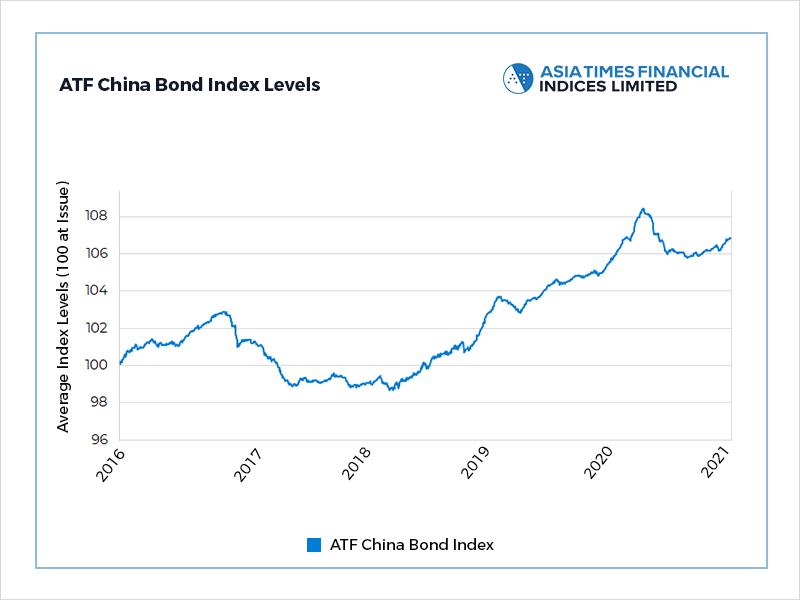

(ATF) The leading gauge of Chinese bonds stalled after authorities urged citizens to stay at home during the Lunar New Year to prevent the spread of new coronavirus clusters.

The warning raised the spectre of more lockdowns a year after the newly emergent Covid-19 virus sparked a two-month shutdown that devestated China’s economy.

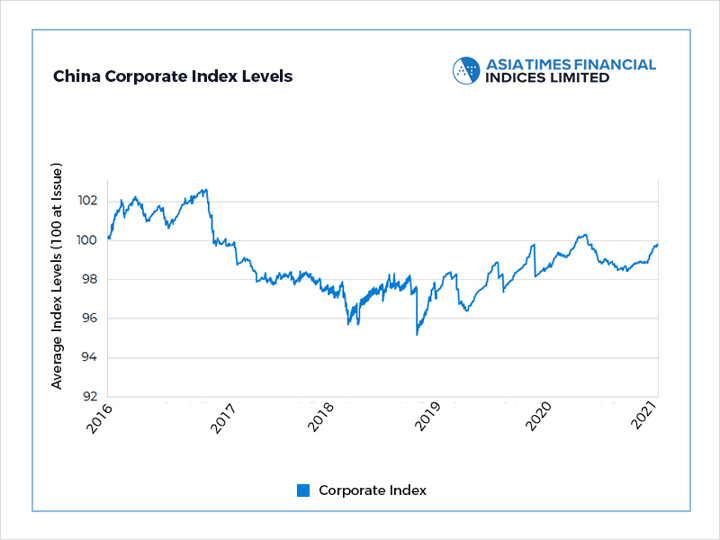

The ATF China Bond 50 Index was unchanged at 106.89. China Merchants Bank was the biggest loser, with the yield on its 3.48% bond climbing 2.51%. All four sub-indexes tracing Corporate, Financial, Enterprise and Local Government securities were little change.

Also on ATF

- Asian stocks on back-foot on Fed, Covid concern

- Hong Kong breaks new ground with $2.5-billion green bond issuance

- Yuan breaking through the ‘red line’

In a broadcast on CCTV News, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council told the nation to stay at home during east Asia’s biggest holiday, which begins in the middle of February.

It requires that people be guided “in a reasonable and orderly manner” to celebrate the New Year “on the spot”.

There are an estimated 277 million migrant workers, who under this ruling will need to stay at their place of work during the holidays.

Investors were also dismayed by comments from central banker Ma Jun, who told the People’s Bank of China Monetary Policy Committee (MPC) that setting a specific gross domestic product (GDP) target for the year is a bad idea in such uncertain economic conditions. Instead it should concentrate on replacing jobs lost in the recession, he said.

China has struggled to cope with a rise in unemployment in the wake of the Covid-19 public health crisis, with confusion over data and many new benefit payments stalled.

China’s official jobless rate came in at 5.2% in December 2020, the same as a year earlier, and better than the February 2020 reading of 6.2%. But the number of situations vacant fell 17% and the number of active jobseekers dropped by 7% in the fourth quarter of 2020.