There was both optimism and scepticism on Thursday after news emerged that multilateral banking agencies and creditors agreed to speed up sovereign debt restructurings.

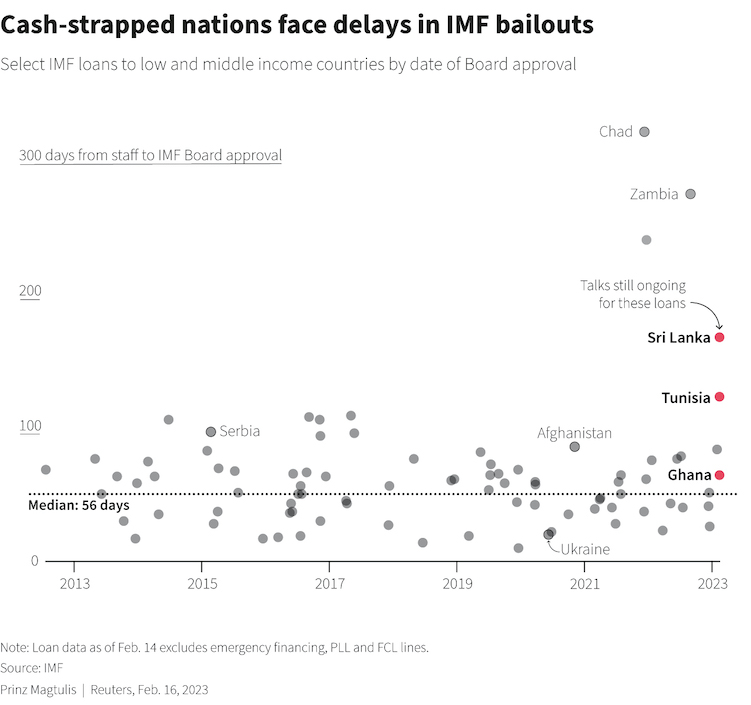

The move, which follows a standoff between major Western-backed lenders like the International Monetary Fund and China, the world’s top bilateral creditor, aims to get bankrupt countries stuck in default in recent years such as Sri Lanka, Zambia and Ghana back on their feet.

The loose framework around sovereign restructurings has seen Beijing seek to influence the traditional rules of engagement in these processes.

The renewed push to overcome the logjams came after a “roundtable” at the IMF Spring Meetings and included pledges from the Fund and World Bank to share assessments of countries’ troubles more quickly, provide more low-interest and grant funding and stricter timeframes on restructurings overall.

The idea is that Beijing will then drop its insistence that the multilateral lenders take losses, or “haircuts”, on the loans they provide or underwrite in crisis-hit countries.

ALSO SEE:

China Seen Dropping Call for Global Banks to Share Debt Losses

IMF says more urgency needed

Beijing has not commented directly on the demand for multilateral lender haircuts, but in remarks published on Friday People’s Bank of China Governor Yi Gang reiterated China’s willingness to implement debt talks under the Common Framework, the platform introduced by leading G20 nations in 2020 to streamline talks with all creditors.

“If the multilateral development banks are now making real commitments to provide fresh grants to distressed countries this is a breakthrough,” said Kevin Gallagher, director of the Boston University Global Development Policy Center.

But he added that as the new plans lacked specific mention of China’s intentions it suggested the “lack of a strong and clear consensus” in Washington.

The IMF’s managing director Kristalina Georgieva has stressed that with around 15% of low income countries already in debt distress and dozens more in danger of falling into it, far more urgency is needed.

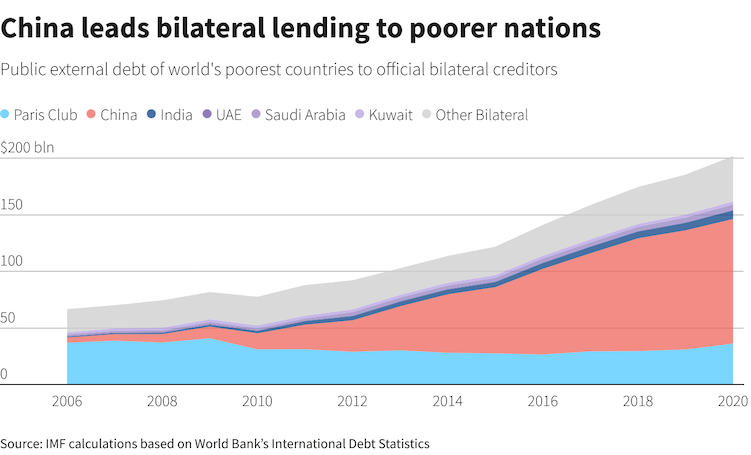

Besides members of the Paris Club of creditor nations such as the United States, France and Japan, cash-strapped nations now have to rework loans with lenders such as India, Saudi Arabia, South Africa and Kuwait – but first and foremost China.

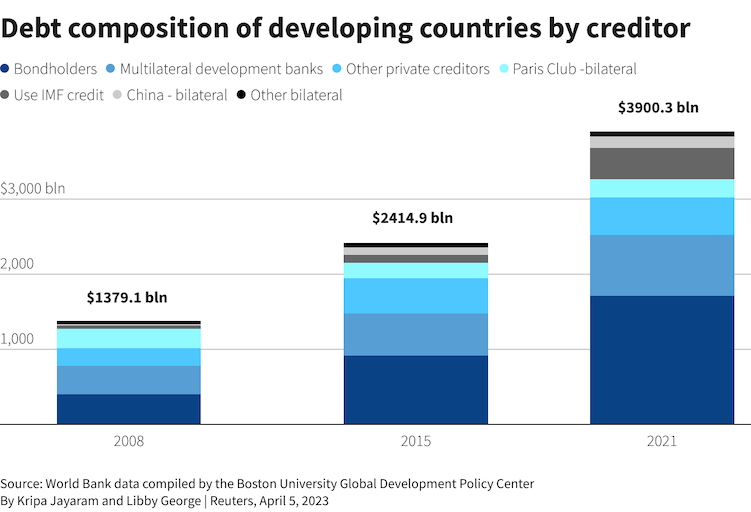

Beijing is now the largest bilateral creditor to developing nations, extending $138 billion in new loans between 2010 and 2021, according to World Bank data, and some estimates put total lending at almost $850 billion.

Headwinds to get worse in 2024

Global headwinds are about to get stronger too. Financially weaker countries with “junk”-grade sovereign credit ratings need to repay or refinance $30 billion worth of government bonds next year between them, compared to just $8.4 billion for the rest of 2023.

The rise in global borrowing costs, though, means that many countries under the greatest stress are now unable to borrow in the international capital markets or, if they can, only at unsustainably high interest rates.

The Chinese debt, meanwhile, is often opaque and muddied by arguments about whether the loans have been given by “official” entities, such as the government in Beijing, or by “private” entities such as Chinese banks.

Authorities in Beijing also prefer to roll over debt payments rather than write them off, and given it is an increasingly dominant creditor, it has little incentive to follow cooperative principles like the ‘Paris Club’ of lenders.

“It would be great to have China on board (with the push to speed up restructurings) but I don’t really have high hopes because there is a lot of geopolitics involved,” Viktor Szabo, an emerging market debt manager at Abrdn in London, said.

Big write-offs needed

Recent research by Boston University estimated that up to $520 billion in debt needs to be written off to help developing nations at greatest risk of default return to a sounder fiscal footing.

But lengthy delays in Zambia, and more recently in Sri Lanka, have elicited widespread criticism of the Common Framework.

Wednesday’s promises by the IMF to provide its assessments more quickly was an admission that the Common Framework was currently failing, Szabo added.

“You have to make it functional. The fact that it’s been in place for three years and there is nothing to really show for it, that is really appalling.”

‘Test of Chinese credibility’

Anna Ashton, director of China research at Eurasia Group, said this week’s developments underscored the benefits for China to give some ground on some of its concerns.

“Being willing to compromise and facilitate debt restructuring right now is likely crucial to China’s continued credibility with the developing world writ large,” Ashton said.

Patrick Curran, senior economist with Tellimer, added that China dropping demands for the big multilateral development banks (MDBs) to swallow losses on their loans could also be “a major breakthrough”.

“There is likely to be broad support for the alternative proposal that MDBs mobilize their resources more aggressively, especially at a time when most low-income countries are locked out of the market,” Curran said.

Germany’s finance minister Christian Lindner on Thursday too said all the talk now needed to be converted into action.

The group that took part in Wednesday’s roundtable plans to meet again in coming weeks to address remaining issues, including how various creditors are treated, principles for cut-off dates and suspending debt payments.

Ultimately, whether the new terms help Zambia, and countries like Sri Lanka, Ghana and Ethiopia that are also in the midst of bailout talks, finalise deals will be the only proof of whether the new terms work.

“China is a difficult partner to talk to but we need China at the table for the solution of debt problems, because otherwise we won’t see any progress,” Lindner said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Seen Dropping Call for Global Banks to Share Debt Losses

Pakistan Kicks Off Talks With IMF on Crucial Funding Package

UN Chief Urges ‘Massive’ Support to Help Pakistan Rebuild

Here’s What Led to Sri Lanka’s Worst Debt Crisis