(ATF) Brussels-based Euroclear, one of the world’s biggest securities depositories, said this week it has helped create a new asset class in China – the so-called Yulan bond – aimed at linking Chinese issuers seamlessly with global investors.

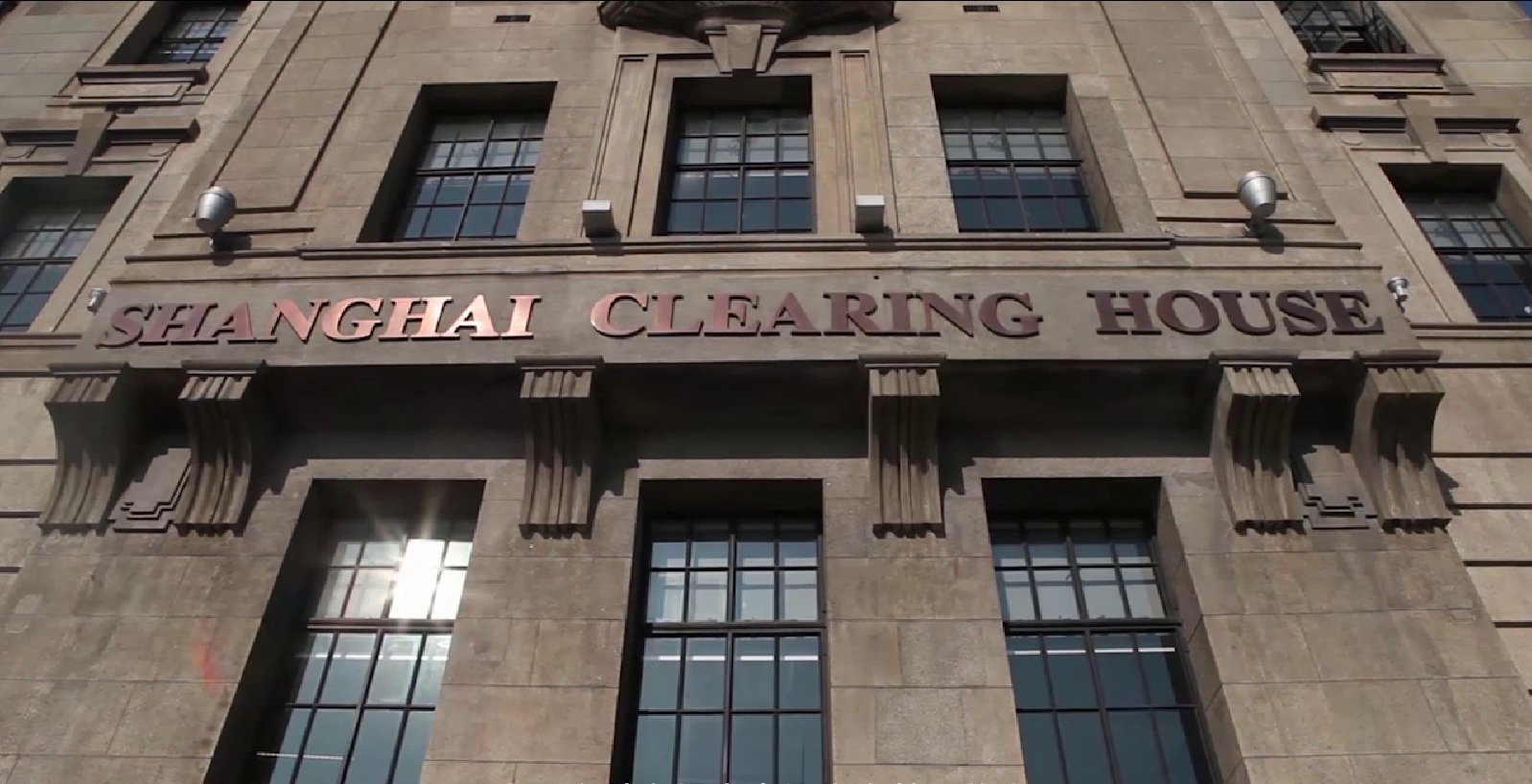

Yulan bonds – named after Shanghai’s city flower, the magnolia, and denominated mainly in US dollars and euros – will be issued through Shanghai Clearing House, a Chinese interbank bond market facility.

The first issuance is expected within months, a Euroclear spokesman said.

International investors in Yulan bonds will settle the securities within Euroclear’s network, freeing them from the need to understand the Chinese settlement system.

Hotel group Jinjiang International and the state-owned industrial park operator Lingang Group both have expressed interest in issuing Yulan bonds, according to the Chinese state-run Xinhua news agency.

Valerie Urbain, CEO of Euroclear Bank, said both Chinese issuers and global investors stood to benefit from the new bonds, which were the culmination of nearly a decade of collaboration between Euroclear and Shanghai Clearing House.

For mid-sized Chinese companies with little experience in global markets, Yulan bonds offer “much wider access to an international investor base, and … a lower cost of borrowing,” Urbain told Reuters in an interview.

Valerie Urbain (Euroclear pic).

China’s latest effort to open up its capital markets comes as outgoing US President Donald Trump ramps up moves to isolate China from the global financial system.

Last week, global index publisher FTSE Russell said it will delete the shares of eight Chinese companies from certain products after a US order restricting their purchase.

Yulan bonds also come amid fresh concerns over the health of China’s corporate bond market following a series of high-profile defaults.

Urbain said these events would not change Euroclear’s role of facilitating cross-border investment between China and international markets.

Investors “have a duty to understand the risk that they are taking, not only from a credit perspective but also from a regulatory perspective,” Urbain said.

Urbain expects interest in Yulan bonds to grow rapidly, but said it was hard to predict the market’s potential size.

730 dollar-denominated bonds this year

Cross-border bond issuance by Chinese companies has been on the rise in the last few years. Chinese companies have issued 730 US dollar-denominated bonds overseas this year with a total issue size of $352.7 billion, up 19% from last year, according to Wind data.

Xie Zhong, chairman of Shanghai Clearing House, said in a statement that both parties will continue to explore new ways to facilitate cross-border investment.

Last September, Euroclear signed a memorandum of understanding with market infrastructure provider China Central Depository & Clearing Co to open a link for easier foreign access to Chinese bonds, aiming to allow the use of yuan-denominated bonds as collateral globally.

Urbain declined to disclose when that link will be launched, saying only that it remains a “work in progress.”

With reporting by Samuel Shen and Andrew Galbraith.