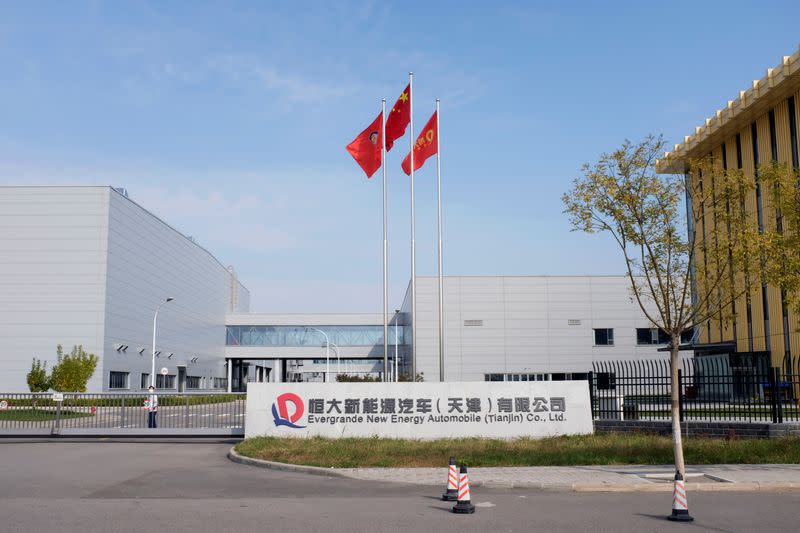

Shareholders in China Evergrande’s EV unit, the New Energy Vehicle Group, have accepted a restructuring proposal to dispose of two subsidiaries, according to a filing with the Hong Kong stock exchange on Friday night.

More than 50% of the votes under the EV company, a unit of embattled property developer China Evergrande, were cast at a Friday general meeting in favour of the proposal raised in late April, the filing said.

The EV unit on April 25 announced the plan to sell two debt-laden companies to another unit under China Evergrande as part of the auto firm’s restructuring.

Also on AF: Ex-ByteDance Executive Says Tech Firm Stole Rivals’ Content

The EV unit was expected to book a $3.6 billion gain from the transfer, while the two companies to be sold held 47 property projects altogether, said a previous stock filing by the EV unit.

The deal would help the EV unit focus on the new energy vehicle segment and could help improve its valuation and eventually “may help to attract investors to Evergrande Auto and raise funds”, said a separate filing by the group company.

China Evergrande said in another filing on Friday that it had received an enforcement notice issued by a court in southern Chinese city of Guangzhou, covering the company, its controlling shareholder Hui Ka Yan and a property development subsidiary.

Hui and Evergrande were requested to fulfil their repurchase obligation worth around 5 billion yuan ($700 million) after a deal dispute, on top of other payment duties including outstanding dividends, liquidated damages and legal fees, the filing said.

- Reuters with additional editing by Sean O’Meara

Read more:

China Evergrande Debt Rejig Will Cost Billions, Could Still Fail

China Evergrande Auditor PwC Quits Over 2021 Audit Disputes

Sale of China Evergrande’s Hong Kong Head Office Fails Again

China Evergrande Halts EV Production Due to Lack of Orders