Asia’s major share indexes had a mixed day on Tuesday with property giant China Evergrande’s downfall weighing in some quarters while a Wall Street-led tech boost dictated the mood in others.

As well as the court-ordered liquidation of Evergrande impacting on sentiment, geopolitical tensions lifted oil prices and dented risk appetite ahead of the Federal Reserve’s meeting later in the day.

Japan’s Nikkei share average, though, ended higher, as chip-related shares tracked overnight gains in New York.

Also on AF: US Lawmakers Seek Probe Into China Firms in Ford Battery Plant

The Nikkei share average edged up 0.11%, or 38.92 points, to close at 36,065.86, while the broader Topix was down 0.10%, or 2.55 points, to 2,526.93.

All three major US stock indexes closed higher overnight, with the tech-heavy Nasdaq enjoying the largest percentage gain and the S&P 500 notching a record closing high.

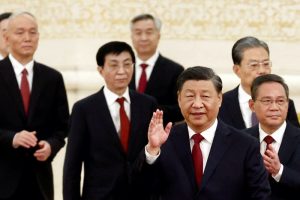

China stocks dropped despite regulators’ measures to boost market confidence, with sentiment remaining fragile after the liquidation of Evergrande gave a fresh blow to Beijing’s shaky real estate market.

China’s blue-chip CSI 300 index was down 1.78%, and the Shanghai Composite Index lost 1.83%, or 52.83 points, to end at 2,830.53. The Shenzhen Composite Index on China’s second exchange fell 2.70%, or 44.28 points, to 1,593.12.

Meanwhile, Hong Kong’s leader confirmed on Tuesday his intention to pass fresh national security laws soon to build on sweeping legislation Beijing imposed on the city in 2020.

Some business people, diplomats and academics are closely watching the developments, saying the prospect of new laws targeting espionage, state secrets and foreign influence, known as Article 23, could have a deep impact on the global financial hub.

Tech giants listed in Hong Kong lost 2.7%, and mainland property developers slumped 3.5%. The Hang Seng Index dropped 2.32%, or 373.79 points, to close at 15,703.45, and the Hang Seng China Enterprises Index lost 2.47%.

Euro Inflation Data Watch

Elsewhere across the region, in earlier trade, Sydney, Singapore, Bangkok and Jakarta were in the green. Seoul, Taipei, Manila and Mumbai were down. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4%.

US Treasury yields remained under pressure in Asian hours, keeping a lid on dollar movement, after the Treasury Department said it would need to borrow less than its previous estimates.

European bourses were set to shrug off the weak sentiment seen in Asia and open much higher, with Eurostoxx 50 futures up 0.43%, German DAX futures 0.40% higher and FTSE futures up 0.54%.

While the Federal Reserve’s policy meeting and Chair Jerome Powell’s commentary will likely be the main event of the week, investors will also watch out for European inflation data, Bank of England policy meetings and the US employment report this week to help gauge the direction markets will take in the months to come.

The Fed in December surprised the market with its dovish tilt, projecting 75 basis points of interest rate cuts in 2024, sparking a blistering year-end risk rally, with traders pricing in easing as early as March.

US Dollar Steady

But since then, a slate of strong economic data, sticky inflation and pushback from central bankers have led markets to significantly dial back their expectations.

Markets now expect 47% chance of a Fed rate cut in March, the CME FedWatch tool showed, down from 88% a month earlier. They currently anticipate 134 bps of cuts in the year, compared with 160 bps of easing a month earlier.

In the currency market, the dollar index, which measures the US currency against six rivals, was steady at 103.51. The yield on 10-year Treasury notes extended its slide and was down 4 basis points to 4.051%.

Investor jitters on rising tensions in Middle East has kept risk sentiment in check and fuelled supply concerns in the oil markets.

The United States vowed to take “all necessary actions” to defend American forces after a drone attack killed three US troops in Jordan. US crude rose 0.6% to $77.24 per barrel and Brent was at $82.78, up 0.46% on the day.

Key figures

Tokyo – Nikkei 225 > UP 0.11% at 36,065.86 (close)

Hong Kong – Hang Seng Index < DOWN 2.32% at 15,703.45 (close)

Shanghai – Composite < DOWN 1.83% at 2,830.53 (close)

London – FTSE 100 > UP 0.60% at 7,678.64 (0934 GMT)

New York – Dow > UP 0.59% at 38,333.45 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Factory Activity Set to Fall Again But at Slower Rate

Hedge Funds Snapped up China Stocks at Rapid Pace – Goldman

Court Orders China Evergrande Liquidation to Pay its $300bn Debts

Hang Seng Lifted by Energy Stocks, Nikkei Gains on Weaker Yen