(ATF) US Federal Reserve officials are committed to bolstering the economy until its recovery is more secure, minutes of its latest policy meeting showed on Wednesday April 7. A cautious approach to removing support helped to contain Treasury yields and supported US equity markets at record highs.

Federal Reserve forecasts project the strongest economic growth in nearly 40 years but “participants agreed that the economy remained far from the longer-run goals and that the path ahead remained highly uncertain,” the minutes from the March 16-17 meeting said.

“Participants noted that it would likely be some time,” before conditions improved enough for the central bank to consider reducing its current level of support.

Some policymakers indicated they thought interest rates might need to increase sooner than anticipated by the bulk of their colleagues, and perhaps as soon as next year, but there was no sense of urgency around that issue in the minutes.

Inflation would pick up, the minutes noted, but likely subside next year. A recent jump in Treasury yields was “generally viewed.. as reflecting the improved economic outlook.”

This calm approach was reflected by the market soon after the Fed minutes were released, as the benchmark 10-year Treasury yield closed the day at 1.67%, well below a recent level closer to 1.80% that had raised concern about bond selling that could start to push yields towards 2%, and possibly prompt a downward shift in equities.

Major US equity indices were barely changed after the Fed minutes were released, with the S&P 500 closing up 0.1% at a new record, and the Nasdaq also rising.

Some Fed officials cited possible financial stability risks flowing from the current policy of maintaining its overnight benchmark lending rate near zero and buying $120 billion in bonds every month – a setting the Fed says is locked in until the economy is well on its way to being healed.

‘Some distance to go’

But even with a “brighter outlook,” Fed governor Lael Brainard said on CNBC that the wounds to the economy remain deep, and the Fed’s new approach is to not act until its employment and inflation goals are secured.

Policymakers expect “considerably better outcomes on growth, and employment and inflation” in the coming months, Brainard said. “But that is an outlook. We are going to have to actually see that in the data,” and with millions of jobs still missing due to the pandemic “we have some distance to go.”

The US economy added nearly a million jobs in March, and that pace may well continue as more activities are considered safe to resume, in turn putting pressure on the Fed to indicate a timeline for tighter monetary policy.

Prices on bonds affected by the Fed’s target interest rate show investors expect the central bank to raise rates sooner than its own projections indicate.

Chicago Fed president Charles Evans, who agrees with the majority of his colleagues that the Fed’s benchmark overnight interest rate will likely need to stay near zero through 2023, said he envisions an uncomfortable period of higher inflation this year. But he insisted the Fed shouldn’t budge until it is sure that prices won’t fall back again below its 2% inflation goal.

“We really have to be patient and be willing to be bolder than most conservative central bankers would choose to be,” he told reporters after an event organised by the University of Nevada.

Speaking separately at a virtual session organized by UBS, Dallas Fed president Robert Kaplan reiterated his longstanding worries that low interest rates and the Fed’s bond purchases could fuel excesses in markets.

Once the pandemic has receded, Kaplan said, the Fed should pare its bond-buying and move toward raising rates in 2022, and he said he may be open to doing both at once.

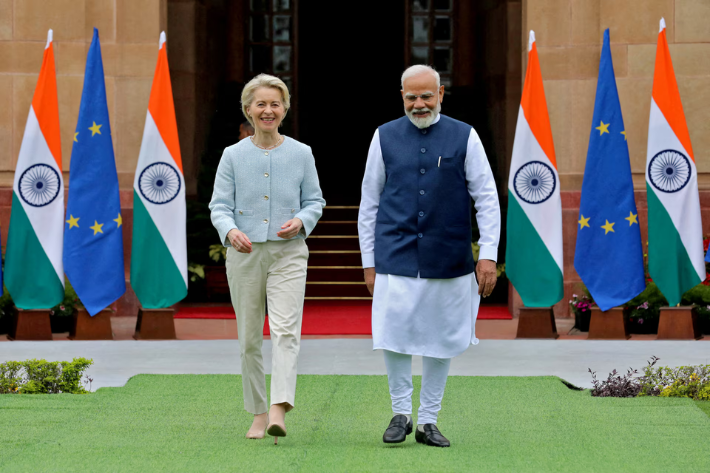

The International Monetary Fund opened its annual spring meeting on Tuesday April 6 with an upgrade in its forecast for 2021 global growth to 6% from a previous prediction of 5.5%. China and India are expected to see the biggest rebound from the effects of the Covid pandemic in 2020, with growth of +8.4% and +12.5%, but it was an upgrade in forecast for US growth that drove the change in the overall global prediction.

Further signs of accelerating growth and potential inflation could prompt another rise in Treasury yields and global interest rates, despite the Fed’s ongoing attempts to calm concerns.