Foreign direct investment (FDI) into China slowed down to its worst pace in three decades last year, in yet another sign of dwindling global business interest in the world’s second-largest economy.

China’s direct investment liabilities — a measure of net inflow of foreign capital into the country — stood at $33 billion in 2023, data released by the State Administration of Foreign Exchange (SAFE) showed on Sunday.

That was more than 80% lower than the $180.2 billion figure of 2022.

Also on AF: EU Vows to Stem ‘Unfair Competition’ With New China Subsidy Probe

The data marks the second consecutive year of declining FDI into China, Nikkei Asia reported, adding that last year’s numbers were less than 10% of the record amount of foreign inflows, worth $344.1 billion, seen in 2021.

In the July to September quarter of 2023, China recorded its first-ever quarterly deficit in FDI — implying outflows far outweighed the inflows.

However, data from the final quarter indicated some improvement with net inflows worth about $17.5 billion into the country.

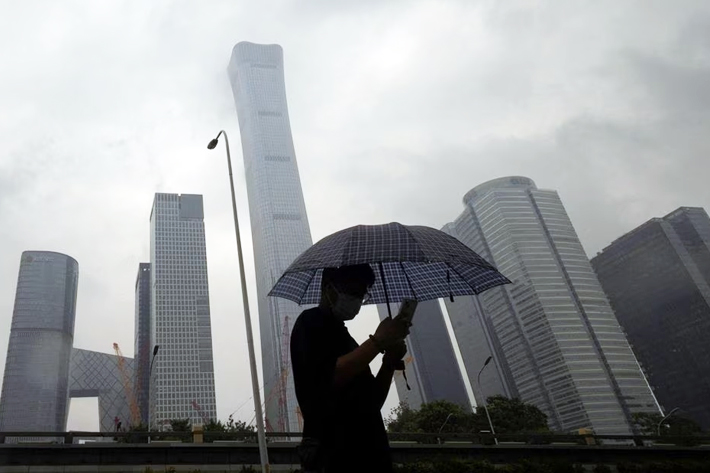

Slumping foreign interest in China comes at a crucial time for the country battling deflationary risks and weak consumer demand.

A faltering post-Covid recovery, coupled with frayed ties with the West and a continuing crisis in the property sector that threatens to spill over into financial services, have been pushing foreign businesses to move out of the country.

View this post on Instagram

A vague but stringent anti-espionage law implemented by the Xi Jinping government last year has also weighed on business sentiment amid increasing raids, fines and exit bans being imposed on foreign firms and their workers.

Frayed geopolitical ties

Sentiment at US firms operating in China sunk to a record low low last year, before slightly recovering in October ahead of a summit between Xi and US President Joe Biden.

Surveys of American and British businesses in China last year also showed that firms had been putting off investments into the country due to geopolitical tensions and regulatory inconsistencies.

The Nikkei report noted, for instance, how increasing American efforts to slow down China’s advances in the semiconductor industry had slowed down chip-related foreign inflows.

While China accounted for 48% of the world’s chip-related foreign direct investment in 2018, that figure fell down to a meagre 1% in 2022, Nikkei said, citing data from the Rhodium Group.

Similarly, in January, US chip designer Teradyne announced it had pulled out $1 billion worth of manufacturing equipment from China.

China’s top leaders, meanwhile, have continued to appeal to the business community to boost investment into the country.

Last month, Chinese Premier Li Qiang told business leaders at Davos that the country’s economy had rebounded and would continue to drive global momentum. He added that the Chinese government will take steps to address concerns of global businesses.

“Choosing investment in the Chinese market is not a risk but an opportunity,” Li said.

- Vishakha Saxena

Also read:

China’s Lunar New Year Spending Up 47%, Beats Pre-Covid Levels

China Sees Biggest Fall in Consumer Prices Since 2009

China’s Deflation And Weak Economy Point to Another Bumpy Year

China’s Property Sector Will Remain Weak For Years: Goldman

US Panel Wants Investment Ban on Critical Tech Sectors in China

Huawei, SMIC Set to Defy US Sanctions With 5nm Chips: FT

China-Western Tensions Reshaping Global Business

Chinese Economy is in Trouble, US Nobel Laureate Says – NYT

Wealthy Families, Private Firms Moving Billions Out of China – NYT