(ATF) The global default tally in the year to date has struck a decade-high with sectors most vulnerable to the damaging effect of social distancing – such as consumer products, retail, lodging, and oil and gas companies – hit the most, according to S&P Global.

“These sectors carried a large proportion of low ratings prior to the crisis, as evidenced by the sectors leading weakest links tallies before the current crisis began,” S&P analysts Nicole Serino and Sudeep Kesh said in a report.

It defines “weakest links” as issuers rated B- or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch negative.

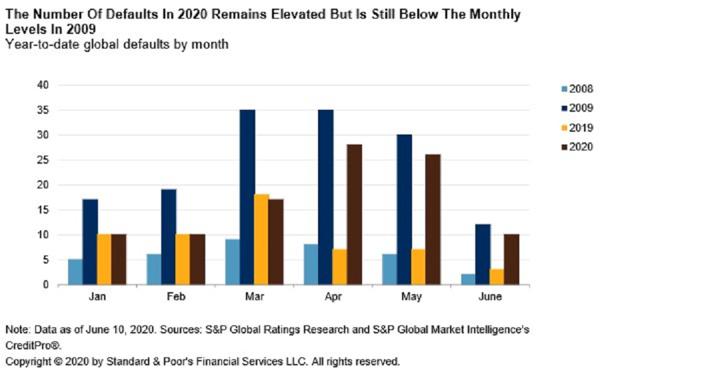

The rating agency said the tally had reached 101 in the year to date, almost twice last year’s tally in the same period. The total defaults in 2019 was 118. The tally for this year has been updated to June 10.

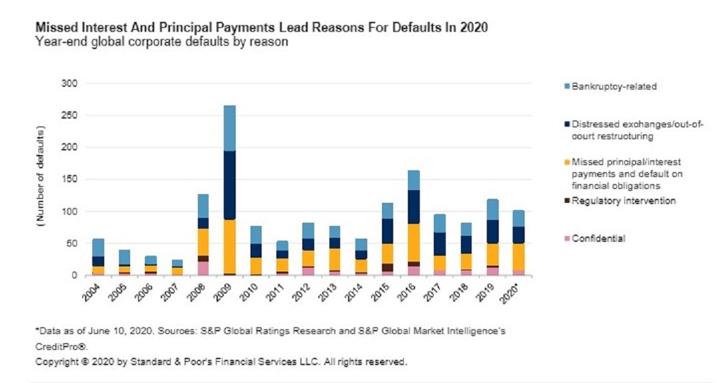

Regionally, the United States led the table with 66 defaults with consumer and media companies the worst hit by sector. Missed interest and principal payments continue to be the leading reason for defaults.

Chinese companies on default list

Among the Asian companies in the default list for this year are Yida China, Qinghai Provincial Investment Group, Tunghsu Group Co Ltd and Yihua Enterprise (Group) Co Ltd from China, plus Geo Energy Resources Ltd From Singapore.

The World Bank said on Monday the coronavirus pandemic had inflicted a “swift and massive shock” that has caused the broadest collapse of the global economy since 1870 despite unprecedented government support.

It expects the global economy to contract by 5.2% this year and said the number of countries suffering economic losses is worse than any recession in 150 years.

“This is a deeply sobering outlook, with the crisis likely to leave long-lasting scars and pose major global challenges,” World Bank Group Vice President for Equitable Growth, Finance and Institutions Ceyla Pazarbasioglu said.

She expected the crisis would drive 70 to 100 million people into extreme poverty – worse than the prior estimate of 60 million, AFP reported.

ALSO SEE: China’s ‘Godfather of capital’ urged to open the books