Pandemic widens gender pension gap in Asia and the world

- Causes of gender pension gap mixed, with all systems carrying weaknesses

- Singapore remains top Asian retirement income system, followed by Hong Kong SAR and Malaysia

- Mainland China is most improved system due to significant reform, while new entrant Iceland tops the list

- Index compares 43 retirement income systems, covering two-thirds of world’s population

Mainland China’s retirement system showed the most improvement globally, going from its previous D-grade (47.3) to C (55.1). This is due primarily to higher net replacement rates and improved regulations, particularly efforts around optimizing its birth policies, gradually raising retirement ages and developing its “third pillar” pension system to supplement state-led coverage.

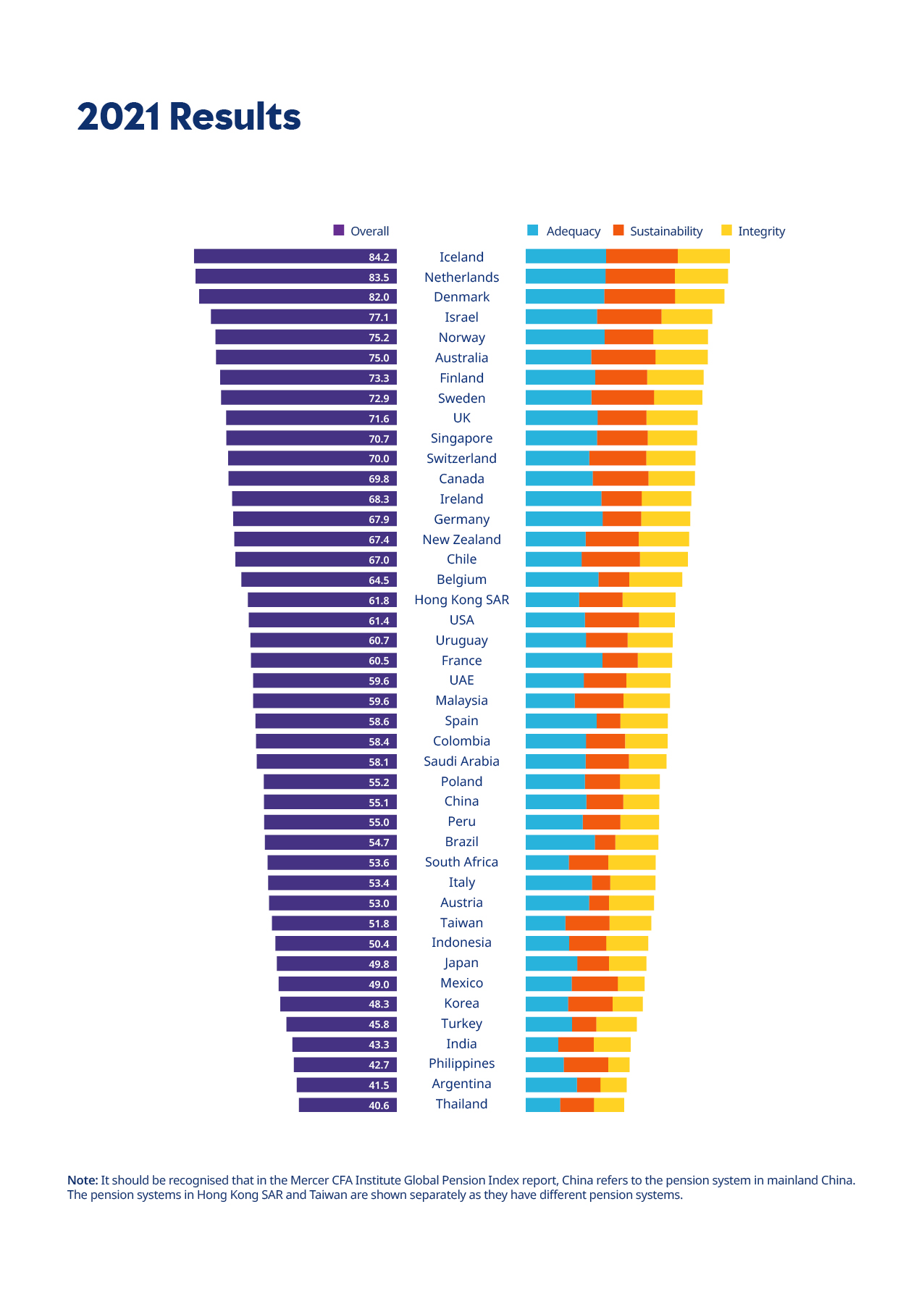

The 13th annual Mercer CFA Institute Global Pension Index (MCGPI)[1] which includes four new systems (Iceland, Taiwan, UAE and Uruguay) this year also saw Singapore’s retirement system retain its top spot in Asia, ranking 10th out of the 43 retirement systems reviewed, followed by Hong Kong SAR and Malaysia as the region’s leaders.

Across Asia, D-grade systems were India (43.3), Japan (49.8), Korea (48.3), Philippines (42.7) and Thailand (40.6), with Thailand having the lowest index value globally. Indonesia, Malaysia and new entrant Taiwan achieved a C-grade (50.4, 59.6, and 51.8 respectively). Hong Kong SAR (61.8) was graded C+ while Singapore achieved a B-grade (70.7).

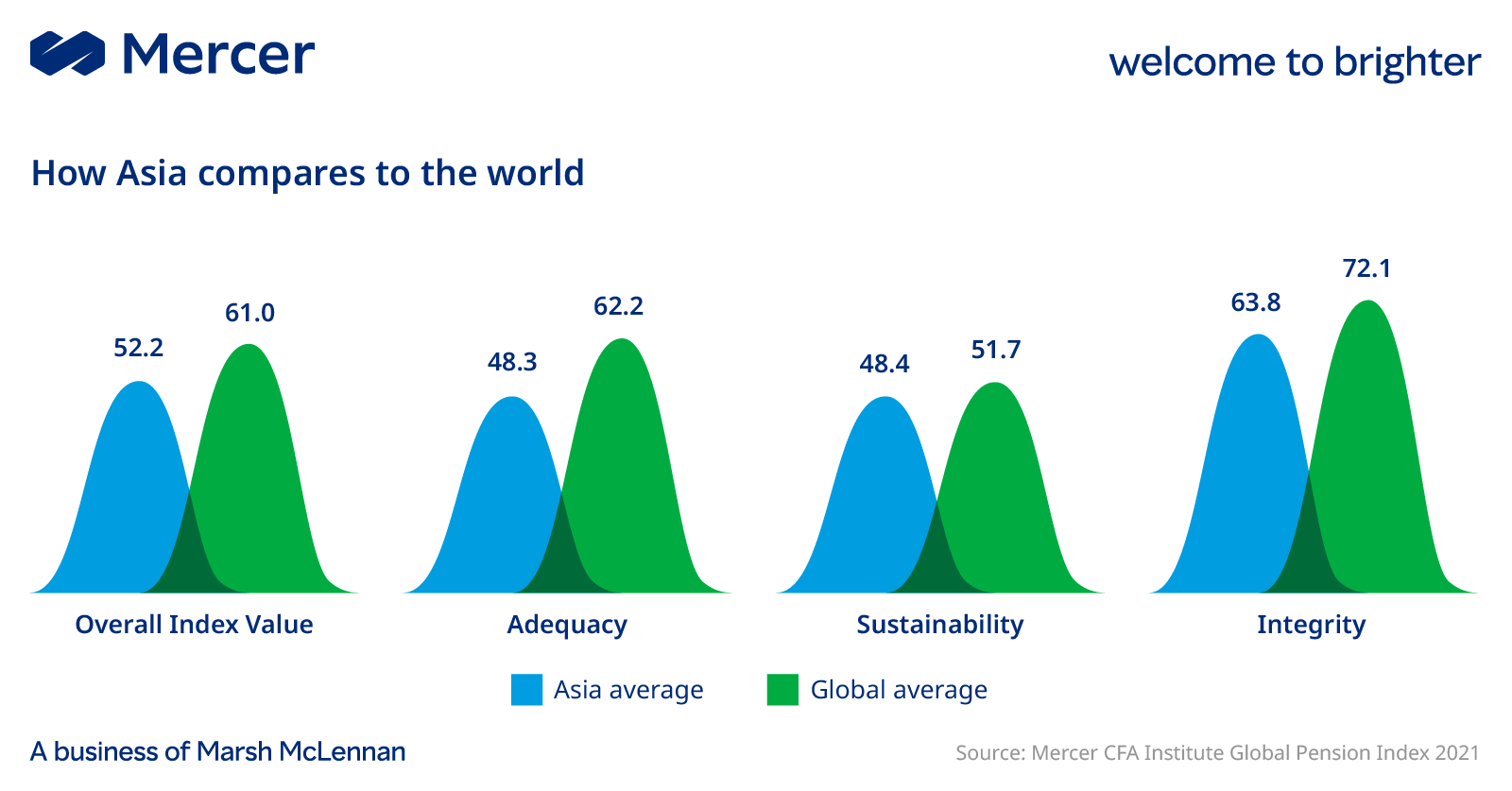

The 2021 Global Pension Index, which measures each retirement system through three sub-indices (sustainability, adequacy and integrity), found that Asia’s retirement systems continue to lag the world’s. Asia’s overall index value average was 52.2, against a global average of 61.

Janet Li, Asia Wealth Business Leader, Mercer said, “Asia’s retirement systems continue to grapple with challenges of providing adequate retirement income and long-term sustainability, particularly in light of ageing populations, longer life expectancies and declining birth rates. The economic impact of the pandemic has exacerbated retirement insecurity with lower pension contributions and higher government debt. It’s critical that governments understand the strengths and weaknesses of their retirement systems and act now. As we’ve seen with Mainland China, their concerted effort to implement policy improvements and grow the base of both individual and corporate participants in the pension system is paying off slowly but surely.”

According to various estimates, by 2050, nearly 1 billion elderly people will live in Asia, of which two-thirds will be in three markets: mainland China, India, and Indonesia. The average life expectancy of 65-year-olds is also set to increase further, and women in most Asian markets can expect to spend an additional 20+ years in retirement by 2050.

Mary Leung, CFA, Head, Advocacy, Asia Pacific, at CFA Institute, said, “While Asia has fared relatively well compared with most other regions during COVID-19, there is no market in Asia that doesn’t need urgent pension reforms. We have been operating in an extremely challenging environment with historically low interest rates and, in some cases, negative yields clearly impacting returns. The gender pension gap presents additional challenges, as women enjoy fewer benefits in their retirement years. Policymakers and industry stakeholders must take collective action to ensure the adequacy and sustainability of retirement benefits.”

Globally, Iceland’s retirement income system (84.2) has been named the world’s best in its debut, closely followed by the Netherlands (83.5) and Denmark (82). For each sub-index, the systems with the highest values were Iceland for adequacy (82.7), Iceland for sustainability (84.6) and Finland for integrity (93.1). The systems with the lowest values across the sub-indices were India for adequacy (33.5), Italy for sustainability (21.3) and the Philippines for integrity (35.0).

Gender differences in pension outcomes

This year’s study also underscored the need for urgent reform to reduce the gender pension gap – an issue inherent in every system.

Across the Organisation for Economic Co-operation and Development (OECD) member countries, the gender pension gap – or difference in retirement income that men and women receive – averages 26%, with the gap ranging from 3% in Estonia to 50% in Japan[2]. The MCGPI’s analysis highlighted that the causes of the gender pension gap are multifold with employment-related, pension design and socio-cultural issues contributing to women being disadvantaged as compared to men when it comes to retirement income.

Across Asia, the pandemic has deepened existing gender disparities in economic participation and opportunity. In Asia Pacific, women’s employment decreased by 3.8% compared to a decline of 2.9% for men. In its 2021 Global Gender Gap report, the World Economic Forum warned that the disparity could further widen as women faced slower reentry into employment, were more likely to bear the burden of housework and childcare and were poorly represented in many “jobs of tomorrow,” such as cloud computing and engineering.

While employment issues are major contributors and are well known – more female part-time workers, periods out of the workforce for caring responsibilities and lower average salaries, for example – the 2021 Global Pension Index found that pension design flaws were aggravating the issue. This includes accrual of pension benefits during parental leave not being mandatory, absence of pension credits while caring for young children or elderly parents in most systems, and the lack of indexation of pensions during retirement, all factors which have a larger impact on women due to longer life expectancy.

Ms Li said, “Closing the gender pension gap needs to be a multi-stakeholder undertaking, from employers playing an active role to ensure gender equity in pay, to individuals taking initiatives in improving their financial literacy. Our study shows that failure to address the gender retirement savings gap will have long-term costs for businesses, particularly in their ability to attract and retain talent, as well as for society. We need to act now and urgently.

“The pension industry can take the lead by removing eligibility restrictions for individuals to join employment-related pension arrangements. This could be expanded to include part-time or informal workers who represent a large population of working women in Asia. Credits for those caring for the young and the old could also be introduced to ensure that individuals who have had to take time out of the formal workforce due to caregiving responsibilities are not left behind.”

2021 Mercer CFA Institute Global Pension Index

| System | Overall Index Value | Sub-Index Values | ||

| Adequacy | Sustainability | Integrity | ||

Argentina (42) |

41.5 |

52.7 |

27.7 |

43.0 |

Australia (6) |

75.0 |

67.4 |

75.7 |

86.3 |

Austria (33) |

53.0 |

65.3 |

23.5 |

74.5 |

Belgium (17) |

64.5 |

74.9 |

36.3 |

87.4 |

Brazil (30) |

54.7 |

71.2 |

24.1 |

71.2 |

Canada (12) |

69.8 |

69.0 |

65.7 |

76.7 |

Chile (16) |

67.0 |

57.6 |

68.8 |

79.3 |

China (28) |

55.1 |

62.6 |

43.5 |

59.4 |

Colombia (25) |

58.4 |

62.0 |

46.2 |

69.8 |

Denmark (3) |

82.0 |

81.1 |

83.5 |

81.4 |

Finland (7) |

73.3 |

71.4 |

61.5 |

93.1 |

France (21) |

60.5 |

79.1 |

41.8 |

56.8 |

Germany (14) |

67.9 |

79.3 |

45.4 |

81.2 |

Hong Kong SAR (18) |

61.8 |

55.1 |

51.1 |

87.7 |

Iceland (1) |

84.2 |

82.7 |

84.6 |

86.0 |

India (40) |

43.3 |

33.5 |

41.8 |

61.0 |

Indonesia (35) |

50.4 |

44.7 |

43.6 |

69.2 |

Ireland (13) |

68.3 |

78.0 |

47.4 |

82.1 |

Israel (4) |

77.1 |

73.6 |

76.1 |

83.9 |

Italy (32) |

53.4 |

68.2 |

21.3 |

74.9 |

Japan (36) |

49.8 |

52.9 |

37.5 |

61.9 |

Korea (38) |

48.3 |

43.4 |

52.7 |

50.0 |

Malaysia (23) |

59.6 |

50.6 |

57.5 |

76.8 |

Mexico (37) |

49.0 |

47.3 |

54.7 |

43.8 |

Netherlands (2) |

83.5 |

82.3 |

81.6 |

87.9 |

New Zealand (15) |

67.4 |

61.8 |

62.5 |

83.2 |

Norway (5) |

75.2 |

81.2 |

57.4 |

90.2 |

Peru (29) |

55.0 |

58.8 |

44.2 |

64.1 |

Philippines (41) |

42.7 |

38.9 |

52.5 |

35.0 |

Poland (27) |

55.2 |

60.9 |

41.3 |

65.6 |

Saudi Arabia (26) |

58.1 |

61.7 |

50.9 |

62.5 |

Singapore (10) |

70.7 |

73.5 |

59.8 |

81.5 |

South Africa (31) |

53.6 |

44.3 |

46.5 |

78.5 |

Spain (24) |

58.6 |

72.9 |

28.1 |

78.3 |

Sweden (8) |

72.9 |

67.8 |

73.7 |

80.0 |

Switzerland (11) |

70.0 |

65.4 |

67.2 |

81.3 |

Taiwan (34) |

51.8 |

40.8 |

51.9 |

69.3 |

Thailand (43) |

40.6 |

35.2 |

40.0 |

50.0 |

Turkey (39) |

45.8 |

47.7 |

28.6 |

66.7 |

UAE (22) |

59.6 |

59.7 |

50.2 |

72.6 |

UK (9) |

71.6 |

73.9 |

59.8 |

84.4 |

Uruguay (20) |

60.7 |

62.1 |

49.2 |

74.4 |

USA (19) |

61.4 |

60.9 |

63.6 |

59.2 |

Average |

61.0 |

62.2 |

51.7 |

72.1 |

[1] The MCGPI is a comprehensive study of global pension systems, accounting for two-thirds (65 per cent) of the world’s population. It benchmarks retirement income systems around the world highlighting some shortcomings in each system and suggests possible areas of reform that would provide more adequate and sustainable retirement benefits

[2] Towards Improved Retirement Savings Outcomes for Women, March 2021, OECD

*The views expressed on Industry Announcements are not necessarily the views of

Asia Financial.

*To contribute press releases, research or commentaries, please send an email to

[email protected]