General Motors and Ford Motor are revving up their century old rivalry, this time over which will sell more electric vehicles (EVs) by 2025.

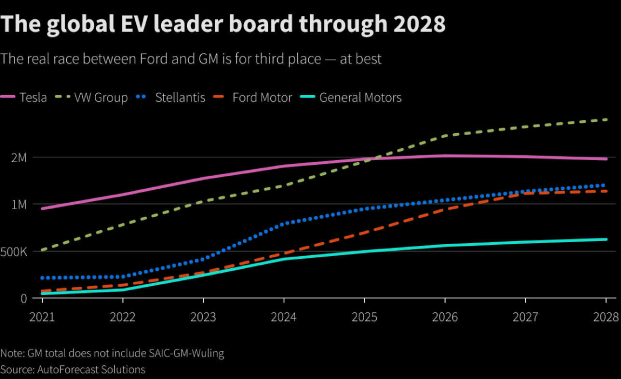

But with Tesla ensconced as the global EV leader and the Volkswagen Group mounting a $100 billion-plus challenge, GM and Ford are racing for third place at best.

As the biggest Detroit carmakers struggle to escape from Tesla’s shadow, the Motown matchup is like two football teams slugging it out using very different playbooks.

GM on Wednesday announced plans to form a joint venture with South Korea’s POSCO to build a battery cathode materials plant in North America by 2024. The deal is part of the automaker’s long-range plan to carefully construct a proprietary, vertically integrated EV machine that it will fully turn on only when costs fall and demand grows in the second half of the 2020s.

“Our goal is EV market leadership,” GM executive vice-president Doug Parks said.

Ford’s EV Strategy

On Friday, Ford will elaborate on its markedly different EV strategy. It plans to quickly launch several higher-volume models such as the Mustang Mach-E and the F-150 Lightning, using modified combustion vehicles.

Ford will follow up in the middle of the decade with a broader portfolio of electric SUVs and trucks, designed from the ground up to run on batteries.

Ford CEO Jim Farley is pressing subordinates to add more EV production capacity, on top of announced plans, including expansion of electric F-150 capacity in Dearborn, Michigan.

Despite their activity, both Detroit automakers are expected to lag well behind EV market leaders Tesla and VW through 2028, according to data provided by AutoForecast Solutions, whose production estimates are widely used across the industry.

The data also shows the Detroit giants must deal with a surprise contender for third place in the global EV race: Stellantis, the European company formed last year by the merger of French automaker PSA and Italian-American automaker Fiat Chrysler.

AFS expects that Tesla’s global output will reach nearly 1.5 million by 2025, with further growth depending on where and how the company expands its production footprint.

Forecasts call for the VW Group to reach 1.45 million EVs in 2025 and climb to 1.9 million in 2028, according to AFS data.

Ford’s global EV production is expected to hit 695,000 in 2025 and 1.14 million in 2028.

GM’s EV range

GM’s EV numbers look much thinner: 494,000 in 2025 and 624,000 in 2028. Those figures do not include production from the SAIC-GM-Wuling joint venture in China, which produces EVs under the Baojun and Wuling brands and in which GM is a minority shareholder.

According to AFS, Stellantis aims to build 948,000 EVs in 2025 and 1.2 million in 2028, which would put the company in third place, ahead of Ford.

Ford’s strategy differs from GM’s in other respects. While both companies plan to build EVs in the United States, Canada, Mexico and China, Ford also will source production in Germany, Turkey and Spain. GM will get electric vehicles from nine plants in 2028, Ford from 12, according to AFS data.

One common element: Both companies will heavily electrify their premium US brands. GM’s Cadillac will offer the Lyriq, Symboliq, Celestiq and Escalade EV, as well as a compact SUV, by 2025. Ford’s Lincoln will counter with electric versions of the Corsair, Aviator and Navigator, along with an electric pickup.

Ted Cannis, head of the Ford Pro business unit, said the company has seen so much early demand for the new F-150 Lightning from fleet and retail customers, “I’m not sure how we can supply” enough vehicles.

- Reuters with additional editing by Kevin Hamlin

ALSO READ:

Ford Charges into Electric Vehicles with $22bn Commitment

GM Invests In Chinese Autonomous Driving Startup Momenta

Ford Parks its Past with SK Innovation Battery Cell Hook-Up