Analysts are questioning the logic behind China’s plan to build 100 new coal-fired power plants to back up wind and solar capacity, highlighting how existing coal assets remain under-utilised while being costlier than renewables.

China’s move has sparked warnings that the country is likely to end up lumbered with even more loss-making power assets.

“The reality is that China has more coal power capacity than it needs,” said Zhang Shuwei, director at Draworld Energy Research Centre. “It doesn’t make sense to give more incentives for more coal-fired power investments.”

Also on AF: Russia Eyes Gains As Xi-Putin Sign Power-of-Siberia 2 Gas Deal

Just last year, China approved the construction of 106 gigawatts of coal-fired power. That was four times more than in 2021 and the highest amount since 2015, according to research published last month by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM).

It’s also equivalent to about a hundred large coal-fired plants and enough to supply the whole of Britain. At least 50 GW of that capacity began construction in 2022, the report said.

China’s National Development and Reform Commission (NDRC) has also flagged that at least 200 GW of coal capacity is expected to be deployed to support renewable power.

Such a large jump in China’s coal power approvals has sparked fears that there will be backsliding on its climate goals.

It has also raised questions around policies that both intend to reduce the role of the dirtiest of fossil fuels and require more coal-fired power plants to be built.

Old scars drive policies

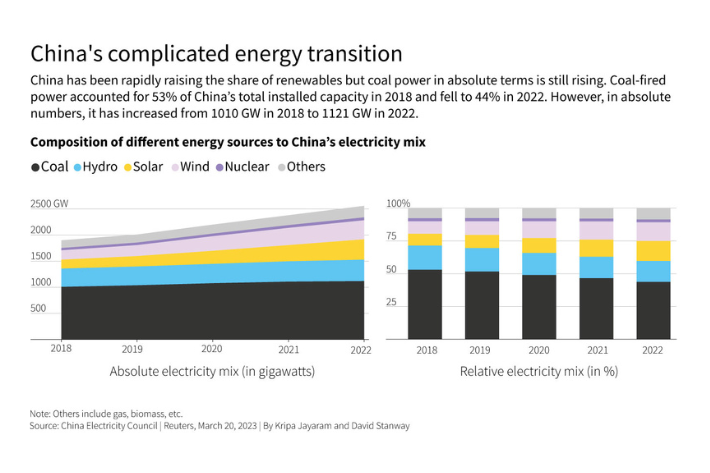

China is the world’s largest and fastest-growing producer of renewable energy.

Renewables are expected to account for a third of all power supplied to China’s grid by 2025, up from 28.8% in 2020.

But the world’s second-biggest economy was scarred by a record drought last year that slashed its hydropower output.

The drought forced factories throughout the southwest to shut down and raising concerns that power shortages could undermine China’s post-Covid economic recovery.

The experience increased Beijing’s determination to not over-depend on the intermittent nature of wind and solar power.

As a result, China remains the only major economy building new coal-powered plants.

Loss-making giants

Coal accounted for 58.4% of China’s total power generation last year and only a small number of older plants are typically retired each year.

According to the China Electricity Council, more than half of the country’s large coal power firms were loss-making in the first half of 2022.

And even though many plants were producing more last year to compensate for the decline in hydropower output, the average utilisation rate inched down to 52.4%.

Analysts note existing coal plants could provide sufficient backup for renewables if they were plugged into a nationwide market, but China’s power sector remains fragmented.

Greed in the mix

China’s plans also highlight how local government interests have impeded the development of an effective nationwide power market that would allow surplus power to be delivered to regions that need it, experts say.

Historically, power plants have been built to support local industry and local GDP growth rather than national power supplies, with provinces reluctant to rely on other provinces for their needs.

Power plants are also not motivated to maximise power output because prices are fixed for residential users while price hikes for business users are limited to 20% of the fixed tariff.

Also on AF: Critical China Factory Hubs Face Greatest Climate Change Risk

The NDRC has been working on capacity payment mechanisms that compensate coal power plants for the decline in earnings as they adjust to their new role as backup suppliers.

The drought-prone southwestern province of Yunnan, which depends on hydropower for most of its electricity, recently set up a capacity market in which coal plants are paid to be available to fulfil supply shortfalls. Other regions are also involved in pilot schemes.

“I think the expectation of these capacity payments is one motivation for coal power groups to pursue new projects despite the fact that power generation from coal is unprofitable at the moment,” said Lauri Myllyvirta, lead analyst at CREA.

It is also unclear who will be paying for the subsidies, said Zhang at Draworld Energy, adding it would be “terrible news” if the costs were to be shouldered by renewable power generators.

Yunnan’s provincial planning agency did not respond to a request for comment.

Instead of building expensive new plants, China could instead encourage existing plants with surplus capacity to deliver electricity to regions that need it the most, said Matt Gray, chief executive of think tank TransitionZero.

“It would be far cheaper… to incentivise provincial trading than incentivising new loss-making coal,” he said.

- Reuters, with additional editing by Vishakha Saxena

Also read:

China Expecting Record Rise in Solar Power Capacity This Year

China Has Big Lead in Critical Emerging Technologies: Study

World’s Biggest Lithium Hub Being Built in Xinjiang – Yicai

China Warns of Export Curb on Polysilicon, Solar Wafers – PV Mag