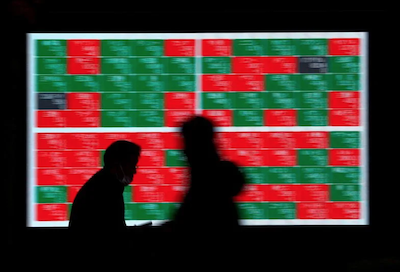

Asian stocks saw a mixed start to the week with investors gauging the impact of Saturday’s assassination attempt on Donald Trump.

The dollar rose and cryptocurrencies leapt as traders shortened the odds on a victory for Trump in November’s US election in the wake of the attempt on his life at a campaign rally in Pennsylvania.

Trading was subdued across the region with Japan’s markets closed for a holiday, but news of the Trump shooting dominated the market mood.

Trump’s broader imposition of tariffs during his 2017-2021 presidency kicked off a trade war with China. As a candidate this year, he has floated tariffs of 60% or higher on all Chinese goods and 10% across-the-board tariffs on goods from all points of origin.

Also on AF: China’s Growth Slows in 2nd Quarter, Downturn Hits Retail Sales

But China stocks still edged up as investors bet on more stimulus after the economy slowed more than expected in the second quarter amid a protracted property downturn and worries about jobs.

Some investors are also betting on a key leadership gathering this week that started on Monday.

The Shanghai Composite Index rose 0.09%, or 2.72 points, to 2,974.01, while the Shenzhen Composite Index on China’s second exchange fell 0.83%, or 13.47 points, to 1,604.01.

The economy grew 4.7% in April-June, official data showed, its slowest since the first quarter of 2023 and missing analysts’ forecast of 5.1% growth in a Reuters poll.

China’s economic growth has been uneven this year, with industrial output outstripping domestic consumption, fanning deflationary risks amid the property downturn and mounting local government debt.

Hong Kong shares fell, however, following the weaker-than-expected data, and on concerns of the higher probability of a Trump election win. The Hang Seng Index dropped 1.52%, or 277.44 points, to 18,015.94.

Tech giants listed in the territory slumped 2.4%, while mainland property developers plunged 2.6%.

Elsewhere across the region, in earlier trade, Seoul, Taipei and Jakarta dropped, while Sydney, Singapore, Mumbai, Manila and Wellington rose.

Crypto Champion Trump

Current odds now indicate that Republicans are twice as likely to win the US election later this year as the Democrats. That sent the dollar rising broadly, which left the euro easing 0.14% to $1.0895, while sterling fell 0.09% to $1.2978.

Cash US Treasuries were untraded in Asia owing to the Japan holiday, but 10-year Treasury futures edged lower, indicating yields will rise when cash trading begins later in the day. Bond yields move inversely to prices.

Crypto prices similarly surged in anticipation of a Trump win, with bitcoin last up 9% at $62,760. Ether jumped more than 7% to $3,336.80.

Trump has presented himself as a champion for cryptocurrency, although he has not offered specifics on his proposed crypto policy.

Under a Trump presidency, market analysts expect a more hawkish trade policy, less regulation and looser climate change regulations.

Investors also expect an extension of corporate and personal tax cuts expiring next year, fuelling concerns about rising budget deficits under Trump.

Elsewhere, the yen reversed some of its gains from late last week and last stood at 157.95 per dollar, though remained not too far from a roughly one-month high of 157.30 hit on Friday.

Tokyo was thought to have intervened in the market to prop up the battered Japanese currency last week in the wake of a cooler-than-expected US inflation report, with Bank of Japan data suggesting that authorities may have spent up to 3.57 trillion yen ($22.4 billion) to do so on Thursday.

Key figures

Tokyo – Nikkei 225 <> CLOSED

Hong Kong – Hang Seng Index < DOWN 1.52% at 18,015.94 (close)

Shanghai – Composite > UP 0.09% at 2,974.01 (close)

London – FTSE 100 < DOWN 0.14% at 8,241.67 (0933 BST)

New York – Dow > UP 0.62% at 40,000.90 (Friday close)

Reuters with additional editing by Sean O’Meara

- Reuters with additional editing by Sean O’Meara

Read more:

China’s New Home Prices Fall at Fastest Pace Since 2015

Conflicting Goals Could Limit Outcomes From China’s Plenum

China’s Exports Surge 8.6% in June, But Imports Drop 2.3%

Creative Ideas Needed to Stem China’s Overcapacity: US Official