Hydrogen could meet 12% of world energy consumption by 2050, according to an International Renewable Energy Agency (IRENA) report on how falling costs of green hydrogen could help a clean energy market emerge.

The report, Geopolitics of the Energy Transformation: The Hydrogen Factor, noted that: “There are still many uncertainties about how the hydrogen market will develop, who will emerge as market leaders, and what the geopolitical implications may be.”

It said hydrogen production – regarded by some as “a missing piece in the clean energy system” – would be more competitive but less lucrative than oil and gas.

“Hydrogen is a conversion, not an extraction business, and has the potential to be produced competitively in many places. This will limit the possibilities of capturing economic rents akin to those generated by fossil fuels,” it said. And, “as the costs of green hydrogen fall, new and diverse participants will enter the market, making hydrogen even more competitive.”

Also on AF: China Targets 200,000 Tonnes of Green Hydrogen a Year

Clean Energy Future

Hydrogen is just one facet of the unprecedented transformation that global energy systems are undergoing because of global warming.

While the cost of renewable energy is falling, the cost of transporting hydrogen is high currently, which means it could regionalise energy trade and energy relations.

But costs were likely to fall sharply with learning and scaling up of needed infrastructure, the report said.

It could make a positive contribution to climate and development efforts if there was international cooperation to ensure the trade had “transparent and credible rules and standards,” and a coherent system that transcends national, regional and sectoral interests.

The hydrogen market had the potential to be decentralised and inclusive, with opportunities for both developed and developing countries, it said.

Green Hydrogen Costs

“Countries with an abundance of low-cost renewable power could become producers of green hydrogen, with commensurate geo-economic and geo-political consequences.”

Green hydrogen could be most economical in locations that have the optimal combination of abundant renewable resources, space for solar or wind farms and access to water, and the ability to export to large demand centres – shipped from the Middle East to Europe, or from Australia to Japan and other parts of Asia, for example.

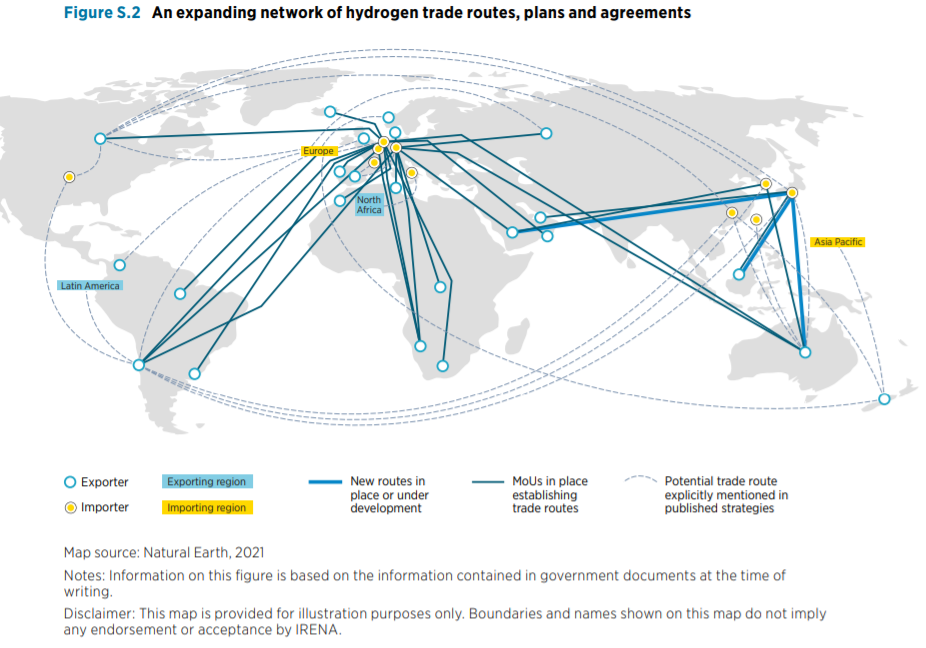

Hydrogen trade and investment would create new patterns of interdependence and bring shifts in bilateral relations, it said.

This appears to have already started, with a growing array of bilateral deals different from the energy ties of the 20th century.

“More than 30 countries and regions have hydrogen strategies that include import or export plans, indicating that cross-border hydrogen trade is set to grow considerably.”

Japan and Germany were hailed as “trailblazers” in the development of hydrogen, while oil and gas exporter countries such as the United Arab Emirates, Australia, Oman and Saudi Arabia had recognised ‘clean hydrogen’ [green hydrogen or blue hydrogen] as a smart way to diversify their economies.

Technically, countries had the potential to produce large amounts of green hydrogen by well over global demand, it said. “Even net energy importers such as Chile, Morocco and Namibia seem poised to become green hydrogen exporters.”

Green hydrogen is projected to start competing with blue hydrogen on cost by the end of the decade, but it could occur sooner in countries such as China “thanks to its low-cost electrolyzers,” the report said, or Brazil and India, which have cheap renewables and relatively high gas prices.

Demand for green hydrogen is expected to take off from 2035, but the report says two thirds will be used locally and just a third exported via adapted gas pipelines or ships in the form of ammonia.

The bulk of investment will be needed for renewable power to generate green hydrogen but it said the market potential is considerable.

Secure Energy Benefits of Green Hydrogen

“Estimates point to a US$50-60 billion market potential for hydrogen electrolyzers and a US$21-25 billion market for fuel cells by the middle of the century.

China, Europe and Japan had a strong headstart in producing and selling electrolyzers. But the market was still nascent and relatively small, and the technology could change, it said.

Countries that get into green hydrogen bolstered energy security in three ways: 1, by reducing import dependence; 2, mitigating price volatility and 3, boosting the flexibility and resilience of the energy system, through diversification.

Another benefit was the clean hydrogen producers market was unlikely to become ‘weaponised’ or run by a cartel – because hydrogen can be produced by many energy sources and in a wide variety of places.

“Even if hydrogen’s use is limited to industrial processes and long-distance transport, its market potential is enormous. A single steel plant using hydrogen fuel rather than fossil fuel to reduce iron would utilise about 300,000 tonnes of hydrogen annually, absorbing the output of 5GW of electrolyzers,” noting that global electrolyzer capacity today is just over 0.3 GW.

But major investment banks said that by 2050, global sales of hydrogen could be worth US$600 billion, and the value chains of green hydrogen could become a US$11.7 trillion investment opportunity over the next 30 years.

• Jim Pollard

ALSO SEE:

Thyssenkrupp Hydrogen Unit Plans to Take on China, Japan Rivals

Woodside, Keppel to Study Hydrogen Supply to Singapore, Japan

Sinopec Starts Building Green Hydrogen Plant in Xinjiang

‘Green hydrogen’ hailed as a way to clean up the steel industry