(ATF) The ATF indexes posted a mixed performance on Wednesday, with the flagship China Bond 50 index remaining steady, the ATF ALLINDEX Financial closing positive and climbing 0.02%, and the ATF ALLINDEX Enterprise, Corporates and Local Governments slipping 0.01%, 0.01% and 0.10% respectively.

Financial names led the gains of the day, with the China Bond 50 index recording increases in the debt of China Development Bank (0.29% for a yield of -1.36%), Agricultural Development Bank of China (0.25% for a yield of -1.08%), Export-Import Bank of China (0.23% for a yield of -1.09%), Huishang Bank (0.13% for a yield of -1.34%) and China Citic Bank (0.1% for a yield of -1.08%).

Sinking 1.65%, the bonds issued by The People’s Government of Heilongjiang recorded the greatest losses of the day, weighing on the China Bond 50 and dragging down the ATF ALLINDEX Local Government. Concurrently, the bonds’ yield jumped 9.24%.

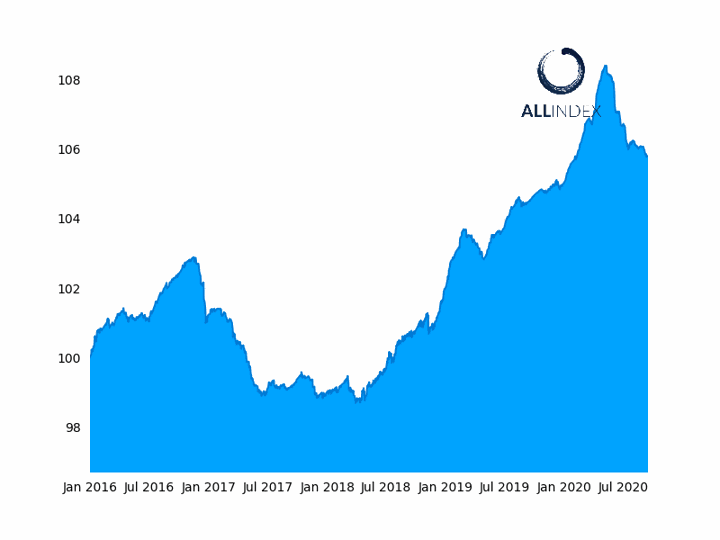

The CB50 Index was unchanged

China Merchants Group, an industrial name, also weighed on the flagship index gauge, with the price of its paper falling 0.51%, leading to a yield increase of 4.6%. The bonds are also constituents of the ATF ALLINDEX Enterprise and led losses in that index, which nonetheless recorded price increases in the bonds of PetroChina (0.05% for a yield of -0.31%), Xi’An Hi-tech (0.02% for a yield of -0.04%), and Datong Coal Mine (0.02% for a yield of +0.01%).

The only significant price moves within the ATF ALLINDEX Financial were posted by Bank of Communications (+0.06% for a yield of -0.68%), China Citic Bank (+0.1% for a yield of -1.08%, as above), China Zheshang Bank (+0.02 for yield of -0.13%), Huishang Bank (0.13% for a yield of -1.34%, as above), and China Merchants Securities (-0.28% for yield of +4.51%).

The prices of Wuxi Construction Development and Jizhong Energy Group bonds, constituents of the ATF ALLINDEX Corporates, rose 0.1% and 0.02% respectively, for yields changes of -0.86% and +0.01%.