(ATF) India has revealed the names of a dozen state-owned companies it wants to sell stakes in – in a bid to ‘monetise’ and ‘modernise’ state entities, to lower the burden on state coffers and fund development projects.

The NITI Aayog, a government policy think-tank headed by Prime Minister Narendra Modi, released the first list of 12 state-owned companies late last week – also called public sector undertakings (PSUs) – for approval from the Core Group of Secretaries on Divestment (CGD) and the Department of Investment and Public Asset Management (DIPAM).

The list includes banks and insurance companies, telecom towers owned by the loss-making BSNL and MTNL, as well as under-utilised railway assets.

Asset monetisation and privatization were identified as key focus areas in the 2021-22 Budget announced in February to pull the economy out of its pandemic blues, and to bridge the government’s budget gap, which is set to widen to 9.5% of GDP in the current fiscal year.

Modi wants to bring about a complete shift in the economy to make it more efficient, and provide an opportunity for private investments to help the bloated state sector recover and become more efficient. The PM also wants to steer the country closer to his target of making India a $5-trillion economy by 2025.

TEDIOUS PROCESS

In the 2021-22 Budget India’s finance minister had set a bold target to reap some $24 billion during the fiscal year starting on April 1. In the previous year, the government had targeted raising $28.8 billion through divestments but fell short of that goal.

The finance minister asked NITI Aayog to identify state entities that could sell stakes for strategic divestment. The government will also work out an incentive package to nudge states to divest holdings.

Following NITI Aayog’s recommendations, the list will handed to the CGD for scrutiny, then forwarded to the Alternative Mechanism – which comprises the finance minister, the minister for administrative reforms, and the minister for roads, transport and highways – for yet another round pf approvals.

When approved by these ministers, DIPAM will seek in-principal approval from the Cabinet Committee on Economic Affairs and a case-by-case scrutiny based on sectoral trends, administrative feasibility, and investors’ interest.

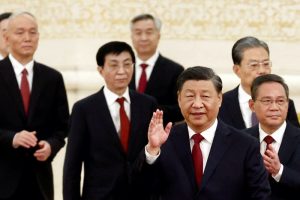

MODI’S AGENDA

According to Modi, his government considers supporting businesses and enterprises a duty, but he has said it is not essential that the state should run and own all agencies.

“The government has no business to be in the business,” Modi said in a comment after the Budget, adding that public sector units should not be run if they were started many years ago and were someone’s pet project.

“Many public sector enterprises are loss-making and several of them need the support of public money. It burdens the economy, (which is why) the government is going ahead with the mantra of ‘monetise and modernise’,” he said.

The private sector should bring in investment, global best practices, top-quality managers, changes in management and modernisation, he said, adding that money generated from stake sales will be put into public welfare schemes in areas like water and sanitation, education and healthcare.

Stakes in over 100 under-utilised state assets, such as those in the oil and gas and power sectors, will be sold in the next round, according to Modi, which would mean $30 billion worth of investment opportunities for private investors.

However, Modi wants to maintain a “bare minimum” state presence in strategic sectors such as atomic energy, space and defence; transport and telecommunications; power, petroleum, coal, and other minerals; and banking, insurance, and financial services.

DEJA VU

But while Modi hopes for a smart post-pandemic economic turnaround to help slim the bloated state sector, many view the latest stake sales with a sense of scepticism and déjà vu.

Previous efforts to sell state assets over the past two decades have faced hurdles such as endless litigation, sometimes by labour unions, and sometimes on account of values put on government assets and the prices at which they were sold.

Modi, though, is upbeat and says his current plan is a “defining moment” for the state sector and a huge opportunity for the private companies. DIPAM has streamlined the sales process, so it is up to private investors to take the opportunity to manage assets like stadiums, pipelines, telecom lines and roads.

The government has already received “multiple expressions of interest” for some of the state assets, reports say.