India’s benchmark indexes posted their longest weekly winning streak in six years on Friday, extending their rally to record highs in a blockbuster December.

Both the NSE Nifty 50 index and BSE Sensex rose about 2.3% in the week, extending gains for the seventh consecutive week.

That was their longest winning run since January 2018.

Also on AF: India Leaps Hong Kong in World’s Top Stock Market List

BSE reported an all India market capitalisation of 363 trillion rupees, or more than $4.37 trillion at close of trade.

The surge in Indian equities follows US Fed Chair Jerome Powell’s acknowledgment of the risks of delaying rate cuts on Wednesday. It bolstered expectations of a 25 basis points (bps) rate cut by March 2024 and fuelled a rally across global stock markets.

“Fed’s newly minted dovishness adds another bullish leg to the market,” said Seshadri Sen and Chinmay Kabra, analysts at Emkay Global.

Higher foreign inflows, hopes of political stability in 2024 and sustained strength in the capital expenditure cycle are expected to contribute further to the strength in domestic equities, they added.

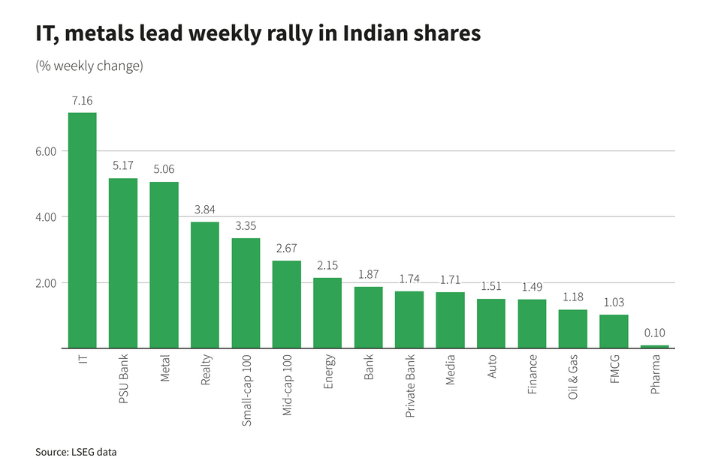

Tech, metals driving rally

India’s IT companies, which draw a significant share of their revenue from the US, jumped 7.16% for the week, logging their best week in 26 months.

Infosys, India’s second-biggest IT company, advanced 5.13% on the day and 5.85% on the week, driven by the easing global rate outlook.

Meanwhile, the metal index climbed 5%, led by an increase in global metal prices as the US dollar came under pressure following the Fed’s dovish commentary on future rate trajectory.

A weak US dollar makes metals cheaper to holders of other currencies.

Earlier in the month energy and financial sector stocks also rallied. The Nifty Energy Index and Banking Index both ended the week at an all-time high as well.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

December Highs Take India’s Market Cap to Record $4.2 Trillion

India to Overtake China to Become Global IPO Leader

India on Track to be World’s No3 Economy by 2030 – Firstpost

China’s Stock Index Near 5-Year Low After Moody’s Outlook Cut

Tata Tech Unit Valued at $6.4bn in Bumper Trading Debut

Growing Interest in Indian Drug Makers Amid ‘China De-Risking’

Buffett Dumps India Payments Giant Paytm at Over $60m Loss