Global equity funds led investment inflows in the week to Feb. 17, as fund investors favoured riskier assets on optimism over the coronavirus vaccine roll-outs and expectations of a massive U.S. stimulus package.

In the week to February 17, investors poured $27.8 billion into various equity funds with Emerging Markets, SRI/ESG and Global Equity Funds all receiving net investments for the sixth, 28th and 35th straight week, according to fund flow tracker EPFR.

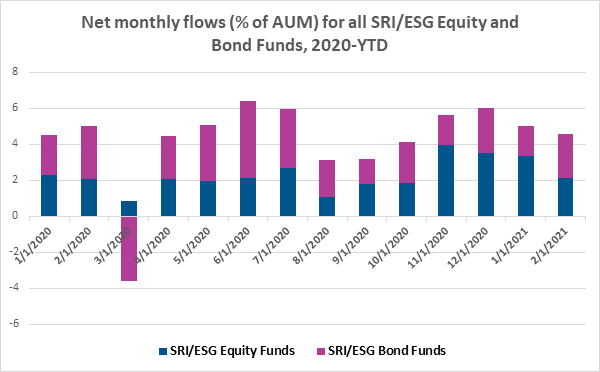

Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates enjoyed another solid week, and SRI/ESG Bond Funds posted their second consecutive weekly inflow record. Source : EPFR

“Emerging Markets Equity Funds recorded their 20th inflow in the past 21 weeks during mid-February, with energy and commodity prices remaining supportive and expectations of more stimulus-fueled developed markets demand for developing markets exports running high,” said Cameron Brandt, Director, Research at EPFR.

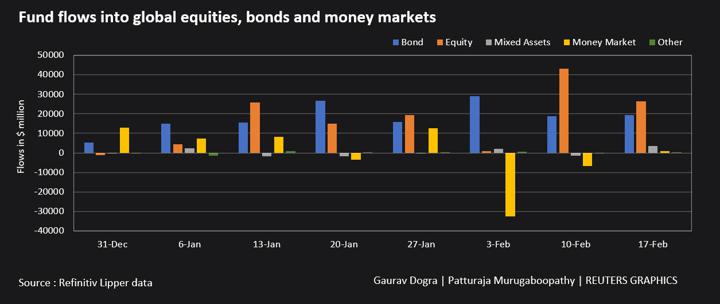

Refinitiv Lipper data showed similar trends with the inflow of $26.5 billion last week marking a tenth straight month of net buying in equity funds

Graphic: Fund flows into global equities, bonds and money markets

Bond Funds attracted a net $12.6 billion in inflows but as the reflation trade powered on flows also reflected concerns about high levels of inflation, with convertible bond funds received their second inflow record in as many weeks, Bank Loan Bond Funds extended their longest run of inflows since 3Q18 and Inflation Protected Bond Funds absorbed fresh money for the 50th time in the past 55 weeks,, EPFR data showed.

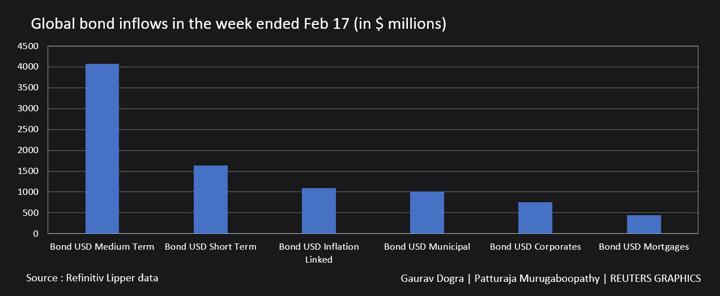

Investors poured some $5.7 billion into funds that invest in U.S. short-term and medium-term bonds, or bonds maturing between 1-5 years, according to Refinitiv Lipper data. Funds investing in inflation-linked bonds, which are structured to provide protection against rising inflation, lured about $1.1 billion.

Conversely, government bond funds recorded a small outflow last week on the back of rising sovereign yields and money market funds extended their streak of outflows to a 6th consecutive week as investors continued to deploy the cash pile accumulated in 2020.

Graphic: Global bond inflows in the week ended Feb 17

Meanwhile, some investors stuck to their holdings in energy funds due to a recent rise in oil prices, driven by a historic freeze in the south of the United States which has hit production. Energy funds saw their lowest investment outflow in 8 weeks in the week ending Feb. 17, but precious metal funds had their second consecutive week of outflows.

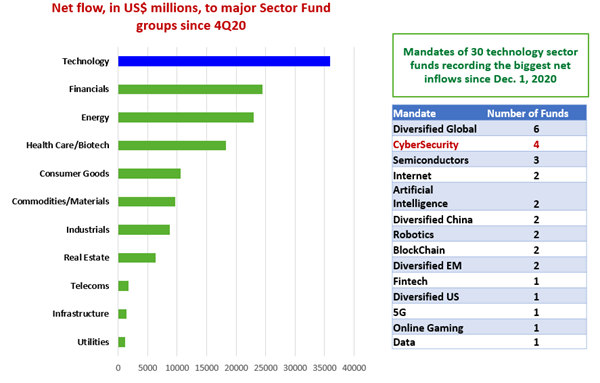

Funds investing in the technology and healthcare sectors led equity inflows. Investors poured $6.98 billion into tech funds, followed by $1.12 billion into healthcare funds during the week, data for 1,170 tech funds and 861 healthcare funds, based on Lipper’s sector classification, showed.

Technology Sector Funds posted their second largest inflow on record as those with diversified global, cybersecurity and semiconductor mandates attracted most of the fresh money.

Graphic: Technology leads other sectors in attracting inflows Source:EPFR

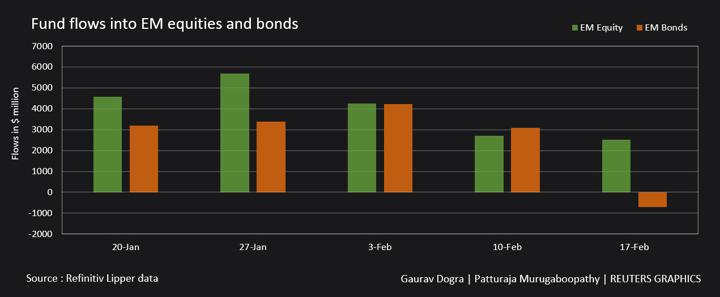

Emerging market equity funds also attracted heavy inflows in the week. Refinitiv data covering 13,812 emerging market equity funds showed inflows worth $2.52 billion.

But emerging market bond funds faced outflows worth $696 million, Refinitiv data for 8,981 emerging market bond funds showed.

Graphic: Fund flows into EM equities and bonds

(With inputs from Thomson Reuters and EPFR)