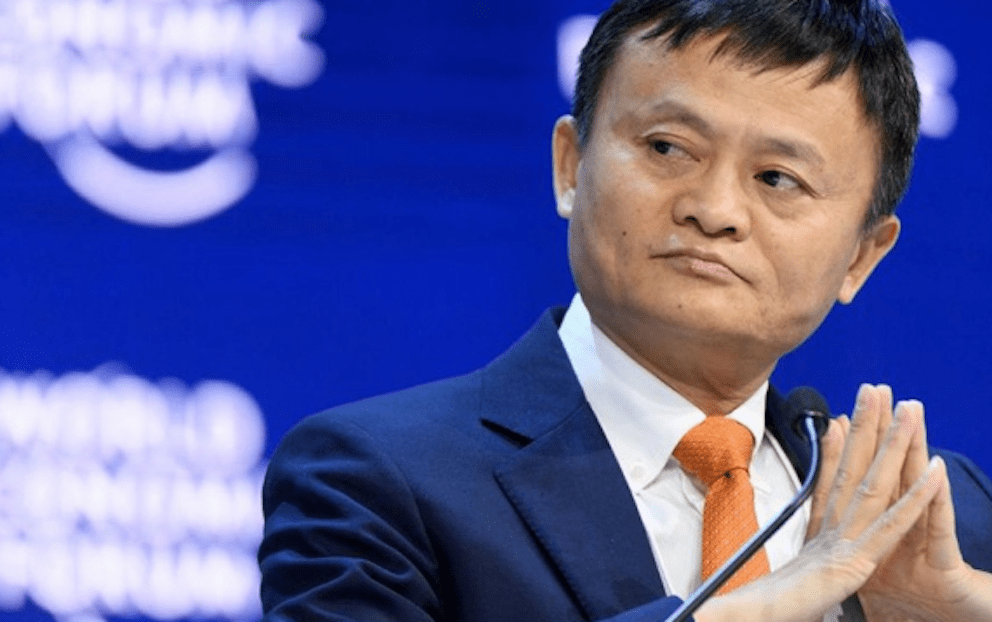

Alibaba co-founder Jack Ma has been on a buying spree of the technology giant’s shares, having snapped up millions worth of its beaten-down stock, media reports say.

Ma bought $50 million worth of Alibaba’s Hong Kong-traded shares in the fourth quarter of 2023, The New York Times and The South China Market Post reported, citing sources with knowledge of the matter.

Ma’s stake in Alibaba has effectively increased from the previously reported 4.3%, making him the company’s largest single shareholder, the SCMP said.

Also on AF: China Markets Bounce on Moves to Reverse 3 Years of Declines

Along with Ma, Alibaba chairman Joe Tsai also upped his holdings in the e-commerce firm.

Tsai purchased about $151 million worth of Alibaba’s US-traded shares in the quarter through his Blue Pool Management family investment, a securities filing showed on Tuesday.

With those share purchases, Ma and Tsai have effectively eclipsed Japan’s SoftBank Group as Alibaba’s largest shareholder, SCMP noted.

Market boost

The disclosures sent Alibaba’s New York and Hong Kong listed shares up by more than 7%. That, in turn, also helped boost a light rebound in Hong Kong’s beaten down share market.

The rally was a welcome relief for Alibaba investors after a tough year that saw the company’s shares on Hang Seng and NYSE slump by more than 38%.

Alibaba’s shares on both indexes have slumped more than 70% from their peaks in October 2020, when the company’s affiliate Ant Group was gearing up to its mega IPO in Shanghai and Hong Kong.

That IPO was, however, thwarted by Chinese regulators after Ma launched a blistering public attack on the country’s financial watchdogs and banks.

Ma, who had stepped down as executive chairman of Alibaba in 2019, said China’s regulatory system was stifling innovation and accused in the country’s banks of operating with a “pawnshop” mentality.

The crackdown that followed from Beijing, engulfed not only Alibaba but much of China’s technology sector.

Ma eventually fled China, only to return in 2023, after a $1.1 billion fine on Ant Group signalled an end to China’s tech crackdown.

Crucial time for Alibaba

The news of Ma’s share buying also comes as a respite for investors unnerved by news in November that the entrepreneur’s family trust was set to sell 10 million American Depository Shares of Alibaba Group Holdings for about $871 million.

Ma increasing his stake at this time is especially crucial given the company’s ongoing overhaul and fierce competition with e-commerce rival Pinduoduo.

The overhaul, believed to be a move to pacify Chinese regulators concerned about one firm becoming a monopolistic mammoth, will see Alibaba split its business into six main units covering e-commerce, media and the cloud.

In November, Alibaba scrapped plans to spin off its cloud business, however, citing uncertainties created by US export curbs on tech used in artificial intelligence applications. The move wiped $20 billion off of the tech giant’s market value.

As part of the overhaul, Ma also gave up control of Ant Group in January last year.

Alibaba had said in December group CEO Eddie Wu would take over as CEO of its domestic e-commerce arm Taobao and Tmall Group, just days after he became the head of the cloud business.

- Vishakha Saxena, with Reuters

Also read:

Jack Ma’s Alipay Reign Officially Over, IPO Back on Track

New Alibaba CEO Wants Focus on AI, ‘Young Employees’ At Helm

Alibaba Stock Slips On Daniel Zhang’s Sudden Cloud Unit Exit

Beijing’s Crackdown Wiped $1.1 Trillion Off Chinese Big Tech

Ant Executives Sever Ties With Alibaba After China Crackdown

In Surprise Share Buyback, Ant Values Firm 75% Below IPO

Ant IPO Unlikely in the Short Term, Chinese State Media Says

Alibaba’s Main Logistics Hub in Europe ‘Suspected Of Spying’