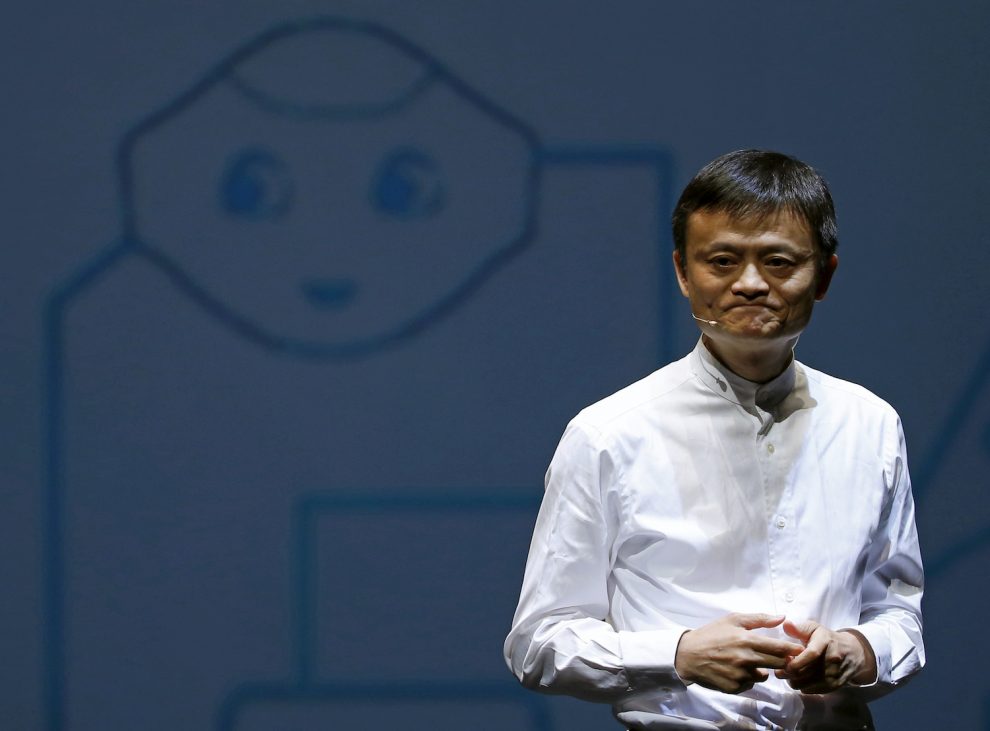

(AF) Chinese regulators want the Alibaba founder to divest control of his biggest company and a new owner that is more aligned to the state, company insiders have alleged. But the tech giant’s Ant Group has denied it is exploring ways to help their founder sell out.

Regulators discussed Ma giving up control of Ant in recent meetings with the company’s executives and suggested that such a move would help end Beijing’s close scrutiny of its business, Reuters has reported, citing two sources with ties to the company and an individual ‘familiar with regulators’ thinking’.

The news comes as no surprise, given the dramas since late last year, following Ma’s infamous speech in Shanghai, in which he criticized country’s oversight of internet banking.

Indeed, the Wall Street Journal has reported that Ma offered to hand over parts of Ant to the government in a meeting with regulators in early November.

Ant has been under severe regulatory pressure to rejig its operations and transform into a financial holding company to help reduce the risks associated with its business.

Officials from the central bank (the People’s Bank of China or PBoC), and the China Banking and Insurance Regulatory Commission (CBIRC) held talks between January and March with Ma and Ant separately, where the possibility of the tycoon’s exit from the company was discussed, according to accounts provided by the sources that spoke to Reuters.

Ant, however, claims this is not true and baseless. “Divestment of Mr Ma’s stake in Ant Group has never been the subject of discussions with anyone,” an Ant spokesman said in a statement.

Reuters said it could not determine if Ant and Ma would sell all or part of his stake, which is worth many billions of dollars. One source alleged that the company hopes it could be sold to existing investors in Ant or its e-commerce affiliate Alibaba Group Holding Ltd without involving any external entity.

‘Complete Exit Sought’

But a second source with company connections said that during discussions with regulators Ma was told he would not be allowed to sell his stake to any entity or individual close to him, and would have to exit completely.

Another option would be to transfer his stake to a Chinese investor affiliated with the state, the source said. Any move would need Beijing’s approval, they said.

The accounts appeared consistent in terms of the timeline for how discussions have evolved in recent months. One company source said Ma met regulators more than once before the Chinese New Year in early February, while another said Ant started working on options for Ma’s possible exit a couple of months ago.

The source familiar with the regulators’ thinking said Ant told officials during a meeting sometime before mid-March that it was working on options. They requested anonymity because of the sensitivity of the situation.

A spokesman for Ant did not provide any comment from Ma, 56, who is now in semi-retirement after stepping down more than a year ago from formal roles with the group he founded. His office did not respond to a request for comment.

The State Council Information Office, PBOC, and CBIRC, also did not respond to requests for comment, Reuters said.

Ma’s exit could help clear the way for Ant to revive plans to go public, sources close to the company said.

Chinese regulators told Ant late last year to fold most of its financial businesses – which include its payments, lending, insurance and wealth management ventures – into a holding company that would be subject to more stringent capital requirements.

Unfair Advantage

Ant runs the world’s biggest digital payments service Alipay and is also a major lender. But China’s state banks had complained that the online tech giant had an unfair advantage because it was subject to less stringent state oversight.

Regulators also viewed it as a financial institution than a tech firm and they were concerned that Ant and other online fintech groups – that often lend cheap money to young people, who can develop bad consumer habits – would threaten the financial stability in a pandemic-stricken economy when its banks are laden with bad loans.

The regulatory clampdown hit full force in November last year when China’s banking and insurance regulator issued new micro-lending rules that led to the suspension of Ant’s $37 billion initial public offering (IPO) two days before the company’s shares were due to start trading.

This led to the imposition of regulations governing online lending and guidelines on the collection of customers’ data.

The regulators intervention came at a time when there was – and still is – concern about trillions of dollars in shadow backing and huge amounts of debt accumulated by companies such as HNA and China Evergrande that could cause significant repercussions and social distress if their companies collapse.

These “debt icebergs”, as some have called them, have been a target of financial chiefs at the central bank who have said one of the country’s key objectives for this year is to deleverage and neutralise debt that has the potential to undermine smooth running of the economy and social stability.

Chen Yulu, deputy governor of the central bank, said in January that Ant was going through a business overhaul according to the regulators’ requirements, while making sure that financial services provided to its customers were not interrupted.

Repercussions of the government clampdown have been severe for more than just the founder of Alibaba and Ant. Ma once commanded a great reverence in China but his standing has taken a blow. He has was the subject of criticism in state media commentaries even before his speech in late October.

But other wealthy business groups in the country’s dynamic tech sector have also been hit.

Alibaba was slapped with a $2.75 billion fine on April 10 after an anti-monopoly probe found it had abused its market dominance to several years. The overhaul ordered by regulators calls for Ant to not only change into a financial holding company, but open its payments app to competitors and other moves that some analysts say are likely to slash its profitability and value.

‘Too Big For Their Britches’

“China still likes to promote its technology firms as global leaders just as long as they don’t get too big for their britches,” Andrew Collier, managing director of Orient Capital Research commented.

While Ma has stepped down from corporate positions, he retains effective control over Ant and significant influence over Alibaba. While he only owns a 10% stake in Ant, he controls the company via related entities, according to Ant’s IPO prospectus.

Hangzhou Yunbo, an investment vehicle for Ma, has control over two other entities that own a combined 50.5% stake of Ant, the prospectus shows. Yunbo can decide all matters related to Ant and exercise the combined voting power of the three entities, the prospectus shows.

Ma holds a 34% equity interest in Yunbo, the prospectus shows.

One of the sources with company ties said there’s “a big chance” Ma would sell his equity interest in Yunbo to exit from Ant, ultimately paving the way for the fintech major to move closer to completing its revamp and reviving its listing.

Reuters could not reach Yunbo for comment. Ant did not provide a comment on behalf of Yunbo.

Jim Pollard with Reuters.

This report was updated to clarify key aspects and meet new style standards.

ALSO SEE:

- Campaign against Jack Ma intensifies

- Ant IPO could get back on track if it follows the law: PBoC chief

- Chinese banks return to popularity after crackdown on fintech firms

- China pushes Ant Group overhaul in latest crackdown on Ma

- Ant Group IPO swept off the table