(ATF) Chinese corporate and local government bonds were little changed Tuesday, even as another coupon payout weighed on a sub-gauge of private-company notes.

Investors remained on the sidelines as Chinese stocks fell on concern the US may impose more sanctions on the nation over human rights abuses. Four officials were put on an EU blacklist for their links to what the US describes as injustices committed in the Muslim-majority Uighur population in the northwestern Xinjiang region.

Washington has said it wouldn’t hesitate to act similarly.

Also on ATF:

- Digital yuan can have ‘controllable anonymity’, PBoC official says

- Baidu’s lukewarm reception on HK debut still raises $3.1 billion

- Biden names top critic of Big Tech to important antitrust position

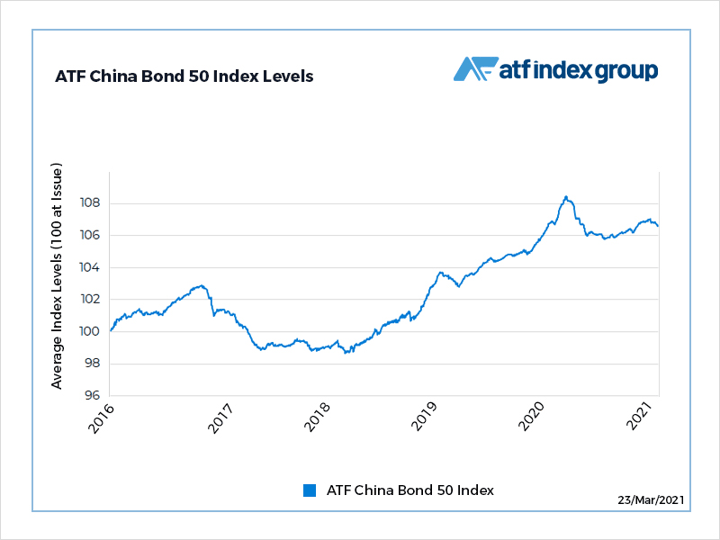

The benchmark ATF China Bonds 50 Index of AAA rated credits climbed 0.01% to 106.61. The Corporates sub-index fell 0.06%, the most in two weeks, after China National Petroleum Corporation made a coupon payment on its 2.99% bond due in March 2025.

The ATF CB50 has fallen 0.33% this month as issuers that had front-loaded their fund-raising plans at the start of past financial years made quarterly and annual coupon payments.

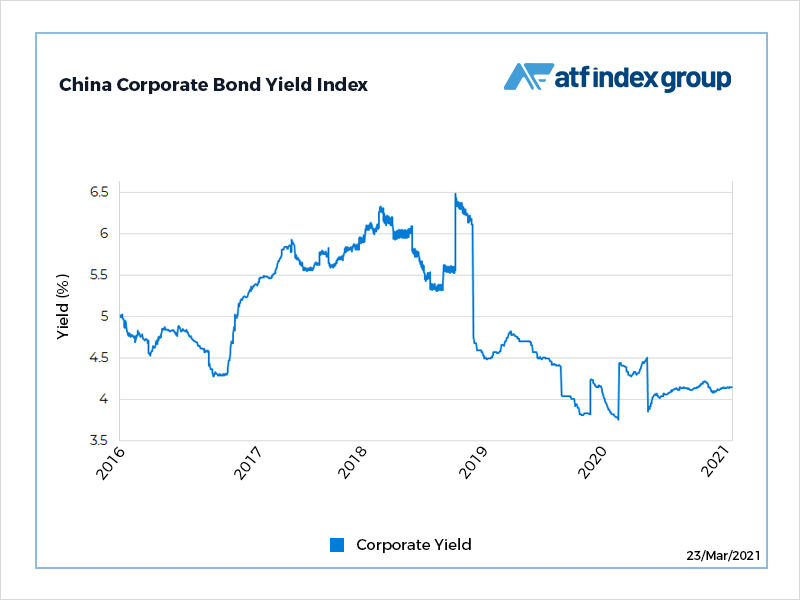

Bonds tend to decline after coupon obligations are met because that reduces the pool of interest the debt will pay out before maturity.

China’s bond markets have also sold off since mid-February on concern that pent-up demand will be unleashed after the pandemic and spur an inflationary spiral.