(ATF) Hong Kong: Asian markets got a dose of reality check; the euphoria over the successful trial data for a coronavirus vaccine cooled as concerns rose about roadblocks ahead of its public release.

“There is no doubt that the Pfizer vaccine news has altered the market’s outlook on the covid pandemic, there is now some light at the end of the tunnel and the equity indices are holding the majority of their gains,” said Fiona Cincotta, market analyst at Gain Capital. “However, the blind euphoria of yesterday has been replaced with a more cautious mood, there are still plenty of questions over the vaccine’s durability and distribution which need answering.”

Japan’s Nikkei 225 index climbed 0.26%, Australia’s S&P ASX 200 advanced 0.66% and Hong Kong’s Hang Seng index added 1.1%. China’s CSI300 eased 0.55% and was the regional underperformer after data showed inflation softening. CPI inflation hit the lowest level in 11 years, falling sharply to 0.5% y-o-y in October from 1.1% tear-on-year in the previous month. PPI deflation remained unchanged at 2.1% in October as weak oil prices continued to drag.

The Asia Eight: Daily must-reads from world’s most dynamic region

“If the CPI reading turns negative in the coming months, combined with continued PPI deflation, real interest rates will likely further rise, and downward pressure on profit growth will intensify,” said Jingyang Chen HSBC Economist, Greater China.

“While a gradual recovery in household consumption and lower base may support an upward trajectory in CPI inflation next year, we think the possibility of CPI deflation in the coming months will likely prevent the People’s Bank of China (PBoC) from tightening its policy stance by year-end.”

Gold jumps

The yuan was set at 6.5897 per dollar by the PBoC, 226 pips firmer than the previous fix of 6.6123 and its strongest level since June 27, 2018. The spot weakened to 6.6128 per dollar but still stronger than the previous day’s trading levels as investors bet on cooling US-China tensions and that Beijing will allow the currency to strengthen.

Gold prices jumped 0.62% to $1,878 per ounce as the US dollar weakened against a basket of currencies to 92.77. US Treasuries came off lows but yields remained elevated as uncertainty swirled around the timing and size of the US stimulus. The 10-year yield was at 94.5 basis points and is 22 basis points higher than a week ago.

“We continue to assume that another fiscal stimulus package will not be forthcoming in coming months. Although we readily acknowledge that the new president and the incoming Congress could legislate further fiscal support, the size and timing of any such package is more or less impossible to forecast at this point,” said Wells Fargo economists in a note.

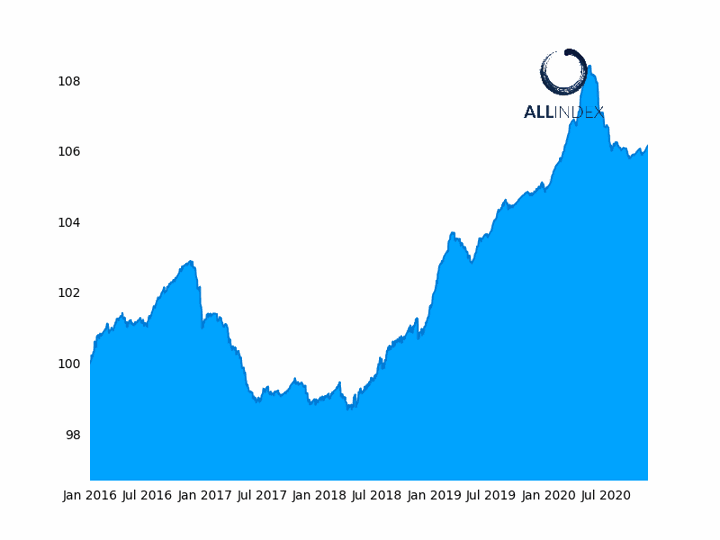

ATF China Bond 50 Index

The benchmark ATF CB50 climbed 0.02%

Also on Asia Times Financial

- Baidu CEO lists eight technologies set to transform human life

- Covid vaccine news boosts corporate bonds as well as stocks

- Vaccine success seen as breakthrough in fight against virus

- India cheers Biden win, but there may be clouds too

- Payment, e-commerce sites come under Beijing competition scrutiny

- Huawei to sell Honor unit to Shenzhen govt and Digital China

Asia Stocks

- Japan’s Nikkei 225 index climbed 0.26%

- Australia’s S&P ASX 200 advanced 0.66%

- Hong Kong’s Hang Seng index added 1.1%

- China’s CSI300 eased 0.55%

- The MSCI Asia Pacific index rose 1.37%%.

Stock of the day

Casino operator Wynn Macau Ltd shares rose as much as 11.2% after the company said in a results announcement it would postpone capital expenditure programmes to preserve cash.