Economic events

Financial markets will be edgy in the week ahead as tensions between the world’s two biggest economies remain elevated with Washington moving over the weekend to set curbs on China’s biggest chip maker SMIC over security concerns.

The United States imposed restrictions on exports to SMIC stating it could be used for military purposes. We could hear more political rhetoric at the US presidential debate on Tuesday with both candidates expected to mention China besides issues such as the COVID-19 pandemic, the economic crisis, protests in the US, Supreme Court nominations and the conduct of the election.

On the economic front, the week will be dominated by the looming non-farm payrolls on Friday as it is the last print before the elections.

“We forecast nonfarm payroll growth of 800k in September while the Unemployment rate falls to 8.1% from 8.4%,” said BofA Securities in a note. “While the gains are encouraging, we must consider the uneven nature of the recovery. Lower-income and less-educated workers were more adversely impacted by the downturn and are falling behind. Many may soon shift into the ‘long-term’ unemployed, raising the stakes.”

Central bank decisions in India and the Philippines, and PMI releases in major economies will be the other highlights of the week.

“PMI surveys are produced for 14 markets in the Asia Pacific region, though China PMI updates will be particularly watched for clues as to the health of the economic recovery,” said Bernard Aw, Principal Economist at IHS Markit.

“Other key Asian data highlights include industrial output from South Korea, Japan, Vietnam and Thailand.”

The Reserve Bank of India is expected to remain on hold Thursday at a repurchase rate of 4%.

“An inflation-constrained central bank is likely to stand pat in October. Focus will be on the RBI’s updated economic projections, which it may publish after a period of almost eight months” said Rahul Bajoria, Barclays economist.

Bangko Sentral ng Pilipinas is also expected to hold its overnight borrowing rate at 2¼% on Thursday. This follows the central bank’s decision in August to pause the rate-cutting cycle and increase its inflation forecast.

“In our view, the central bank may prefer to monitor the economy a bit longer to assess the growth rebound following the relaxation of community quarantines, as well as the impact from fiscal stimulusafter better than expected PMI data,” said Barclays Bajoria.

Fund flow

Global investors’ growing interest in China was reflected in fund flows in the week to September 23, with China Bond Funds posting their third weekly inflow record since mid-August and China Equity Funds recording the biggest inflows among EM Country and Regional Equity Fund groups.

Capital Economics said in a note that foreign ownership remained small when compared with the overall size of China’s financial markets, with Chinese assets making up a tiny proportion of most non-Chinese investors’ portfolios in relation to its weight in the global economy.

Among the factors supporting flows into China Equity Funds are the Chinese economy’s recovery from its lockdown in the first quarter, the prospect of a less fractious relationship with the US if President Donald Trump is not reelected in November and the growing support from diversified funds with the latest allocations data showing China’s share of the average Global Emerging Markets (GEM) Equity Fund portfolio climbing to a record into September.

“Even if relations between the US and China remain frosty, it seems likely that large inflows will continue for some time as investors in the rest of the world increase their exposure to Chinese markets,” said Jonas Goltermann of Capital Economics in a note.

EPFR data showed that bond funds saw a net inflow of $1 billion in that week with $343 million pulled out of Balanced Funds, $6.8 billion from Money Market Funds and $22.7bn from equity funds.

“A run of inflows that started in late March came to an end for EPFR-tracked US Bond Funds going into the final week of September as investors digested the US Federal Reserve’s tepid outlook for the American economy and took a harder look at the swelling pile of corporate debt,” said Cameron Brandt, director of research at EPFR.

And even if there are expectations of heightened inflows into the world’s second-biggest bond market following the inclusion of China in the World Government Bond Index, there are also worries that yields would rise.

Tim Cheung and Riki Zhang of Informa Global Markets said in a recent note that China’s central bank is showing a general reluctance to boost market liquidity. “This is reinforcing the market perception that the monetary easing cycle is already largely over and borrowing costs will start creeping upward. there is a good chance we will see a significant selloff in October.”

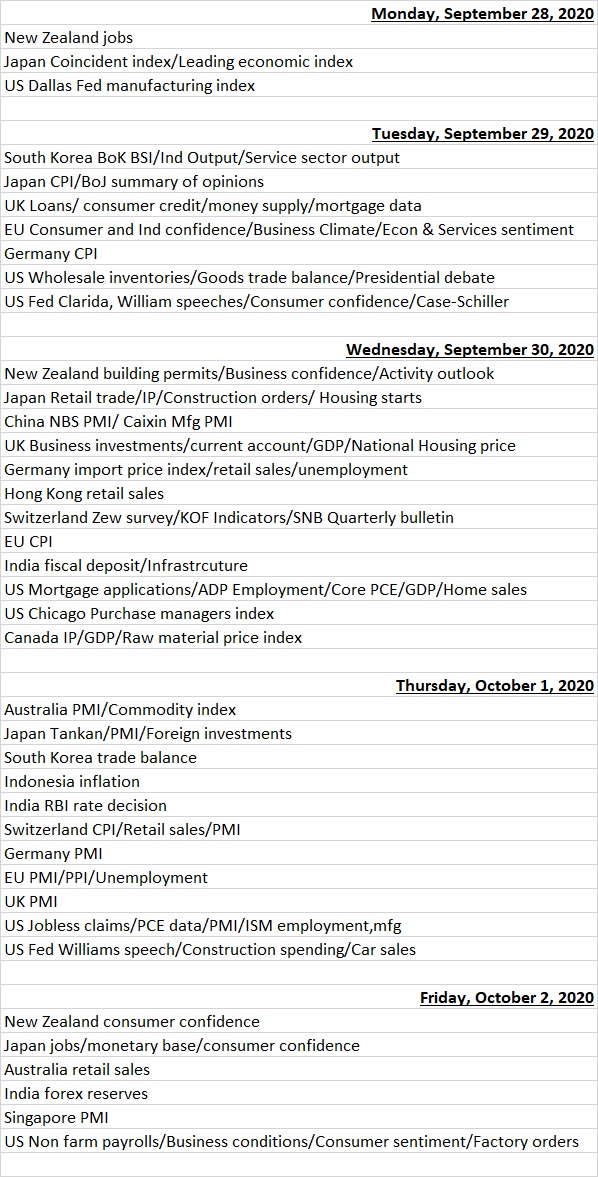

Economic data calendar

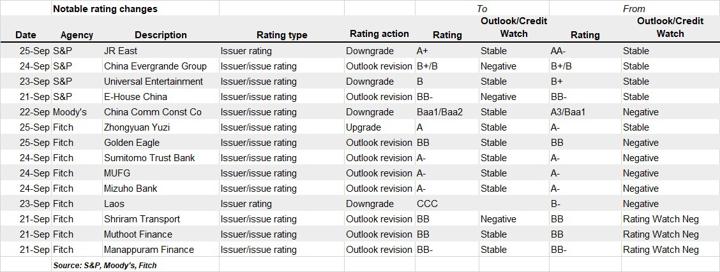

Last week’s ratings changes