Latest News: Bonds

The Southeast Asian country aims for a 75% reduction in greenhouse gas emissions by 2030 under its commitment to the Paris Agreement

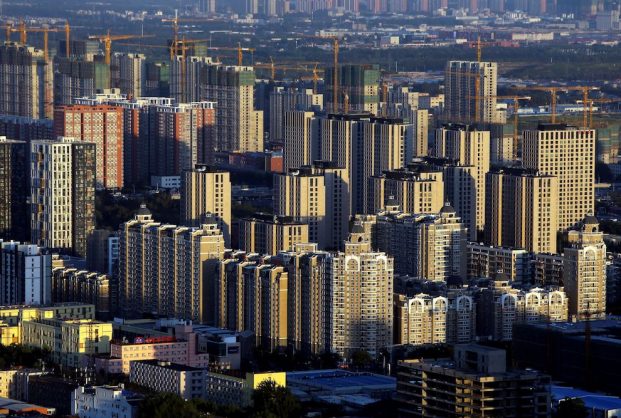

China is now the world’s third-largest green bond market after France and Germany, accounting for about $145 billion of green bonds outstanding

A Zhenro Sept 2024 exchange-traded bond slumped more than 25%, triggering a trading suspension, while onshore bonds issued by units of Logan, R&F, Shimao and Ronshine also fell

Local financial media Cailianshe said Zhenro had denied market speculation it had plans to restructure its dollar bonds

The Chinese developer, with more than $300 billion in liabilities, has been struggling to repay creditors, suppliers, and deliver homes

Central bank expects a large amount of cash to come back into the banking system, while a relatively big amount of treasury bonds will mature this week, replenishing liquidity

Third-quarter earnings figures contrasted with the previous year, which had benefited from high trading activity thanks to a massive injection of cash into capital markets by the Fed.

China's CSI 300 blue-chip share index falls to lowest in 16 months, other Asian stocks decline around 2%, as Fed indicates it may raise US interest rates in March

Evergrande's debt crisis has roiled other developers and global financial markets, contributing to a sharp slump in China's property market

Measures for connecting interbank and exchange bond markets are the latest move to unify China's fragmented $20 trillion bond markets

Domestic and global fund managers are eyeing a buy-up of dollar bonds issued by Chinese developers that were beaten down by Beijing's campaign to cut debt in the sector

Evergrande seeks more financial and legal advisers, while Country Garden surprised with a new issue of $500 million in convertible bonds, after a similar attempt failed last week

AF China Bond

- Popular