Latest News: Capital Markets

A source said the group made the move partly because of concerns about a backlash in Washington against bankrolling the Chinese government with US capital, the report said.

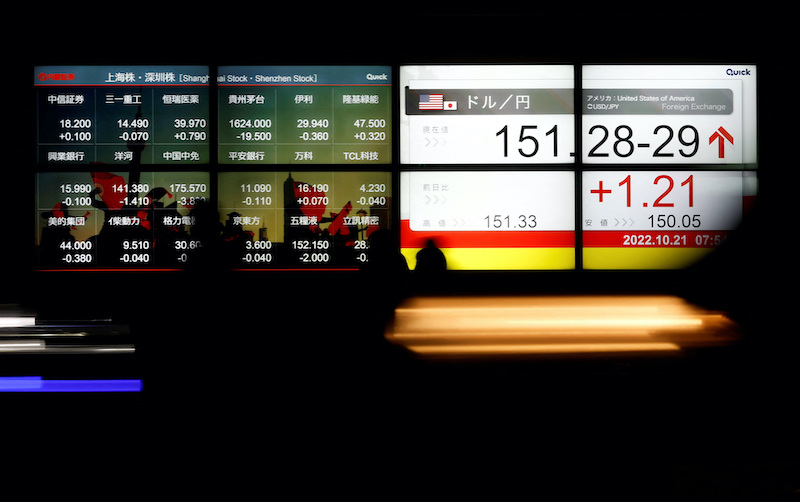

The Institute of International Finance said Chinese bond markets have suffered total outflows of $105 billion over nine months, while Chinese stock portfolios lost $7.6bn in October, the most since March.

Moves by the Politburo caused Hong Kong's Hang Seng Index to soar by over 7% on Friday, while Shanghai's benchmark CSI 300 jumped by 3% and the yuan hit a one-month high

The US Trade Representative's office said the latest talks between Taiwan and officials from six US agencies went well, before they wound up in New York on Wednesday

Chinese takeover would endanger public safety because of China's "deliberate, strategic approach to knowledge discovery and production control", German Economy Minister Robert Habeck said.

Nvidia has confirmed that it is offering the A800, a new advanced chip in China that meets export control rules imposed by the Biden Administration a month ago.

Net selling of Chinese equities by international active funds totalled around $30 billion over the past year

Rumours and news reports have raised hopes for the easing of China's tough Covid curbs and improved relations with the United States

The Hang Seng index fell 3.1% by the close of trading, while on the mainland, the bluechip CSI300 index was down 0.8%

Some 14 auditors have severed ties with Chinese property firms listed in Hong Kong this year, which has raised concern about debt-ridden developers that have failed to publish financial results

Goldman Sachs estimates that $100 billion to $200 billion of foreign holdings could be at risk if global funds significantly cut their allocations of Chinese equities

China stocks sank again on Friday, with CSI 300 Index falling 2.5% and the Hang Seng plunging 3.7% to hit new lows since 2008; most other Asian markets edged down

AF China Bond

- Popular