Latest News: Capital Markets

The group's shares plunged more than 15% on Thursday to an all-time low and the stock has fallen more than 70% this year

Shares in the Paris-based asset management group dropped 2.7% despite its quarterly profit beating estimates

CEO Robert Thomson attributes rise in company's first-quarter profits to the pay TV company and US unit Dow Jones

Company obtained a $360 million grant from the Coalition for Epidemic Preparedness Innovations, the disease research funding group, and its launch customer will be the Global Vaccine Alliance

S&P 500 hits record high after announcement that central bank would reduce Treasury securities purchases by $10 billion a month

Global figure is more than double the scale of the second half of 2020 and 43% higher than the level before the 2019 pandemic

Deputy general manager of China Asset Management had more than 15 years' experience in the securities industry

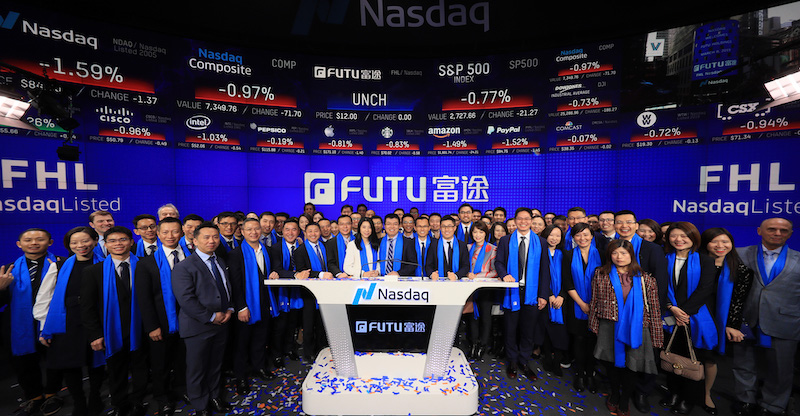

Stock rises as much as 156% from IPO price on investor enthusiasm for fintech company's potential

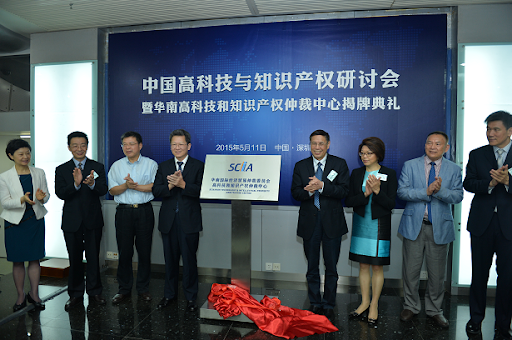

New centre intends to explore a Chinese model of handling capital markets disputes, says Shenzhen's municipal government

India will have a bumper crop of IPOs this month with the largest offering from digital payments and e-commerce company Paytm.

Hong Kong and Shanghai markets got some support after news that troubled property giant China Evergrande had made an overdue interest payment, but other markets were subdued on Friday.

Share fall follows People’s Bank of China official warning that some overseas securities institutions have not obtained domestic licences.

AF China Bond

- Popular