Latest News: Forex

The talks suspension is a blow for Indian importers of cheap oil and coal from Russia but Moscow was reluctant to hold rupees over the yuan or UAE dirham

The Reserve Bank of Australia, which has drawn criticism in recent weeks, stunned markets on Tuesday by hiking its cash rate by a further 25 basis points

Increasing use of the Chinese currency is expected to slowly create an alternative payment system - one that avoids the risk of US sanctions

Buenos Aires is hoping the move will relieve pressure on the country's dwindling dollar reserves but switch is still a coup for Beijing

Beijing has been pushing hard for the yuan to be used over the US dollar to settle cross-border trades but its use in global finance remains low

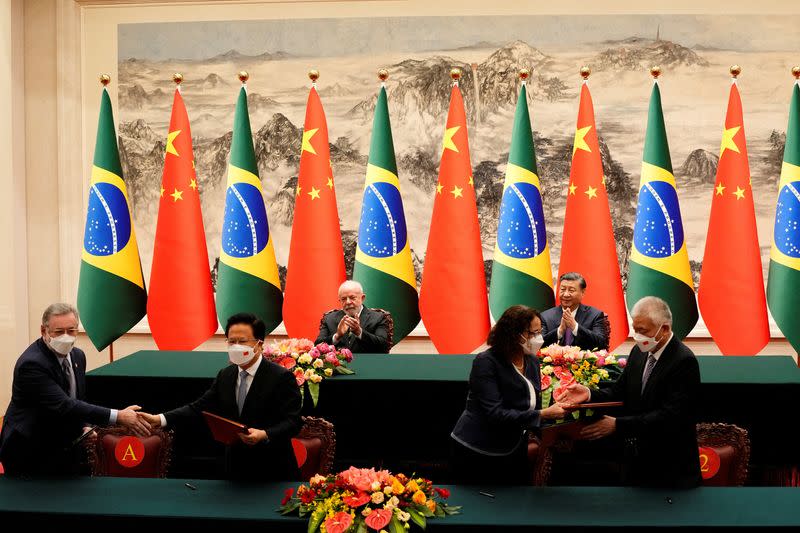

Some 15 agreements were signed during Lula's visit to Beijing, including deals to cooperate on semiconductors, a satellite to monitor the Amazon and cyber security

The Kospi in Korea, the ASX 200 in Australia and the Nikkei in Japan all rose more than 1%; Hong Kong was also up, while Shanghai edged down slightly after more negative data on Tuesday

Russia's central bank has been calling for companies and citizens to move assets into rouble or 'friendly' currencies to avoid the risk of them being blocked or frozen amid sanctions over war in Ukraine

Increasing oil deals between the two countries have already begun to corrode the US dollar’s long-running dominance in energy trade

China's long-term battle to reduce the dollar's dominance in world trade took two steps forward this week, with the first LNG trade in yuan, plus Brazil agreeing to trade via local currencies

China and Brazil have struck a deal to trade in their own currencies instead of the US dollar, the Brazilian government said on Wednesday, in another hit to US economic influence

One of the government officials directly involved in the matter said New Delhi is "not comfortable" with foreign trade settled in yuan but said settlement in "dirham is okay"

AF China Bond

- Popular