A major rejig of Alibaba and Ant’s operations was undertaken to reduce financial risks of the online lender, which also faced changes in regard to new anti-monopoly regulations; but PBOC says other platforms must fall in line too

(AF) China’s central bank said on Thursday that anti-monopoly measures applied to e-commerce giant Alibaba’s fintech affiliate Ant Group will also be imposed on other payment service companies.

“Monopolistic behaviour does not only exist in the Ant Group but also in other institutions,” Fan Yifei, vice governor of the People’s Bank of China (PBoC), told a media conference in Beijing. Fan said measures would be revealed “soon”, but did not elaborate.

Fan said the speed of development of China’s payment industry had been rapid over the past few years but at the same time, there were “monopoly and excessive capital expansions during (its) development”.

China pulled the plug on a planned $37-billion listing of Ant Group in November amid growing concerns over banks using third-party technology platforms like Ant for underwriting loans amid fears of rising defaults and a deterioration in asset quality.

Regulators led by the central bank imposed a sweeping restructuring on the fintech giant in April, forcing it to turn itself into a financial holding firm and to cut links of its payments app, Alipay, from its lucrative micro-lending businesses.

The steps taken in Ant’s restructuring include turning the group into a financial holding firm so it will be regulated more like a bank, and folding its two lucrative micro-loan businesses Jiebei and Huabei, into a new consumer finance firm. Regulators also told Ant to tighten its personal data collection, control leverage, and curb liquidity risks.

These are widely expected to slash the firm’s value and profitability.

China’s online payments ecosystem is dominated by Ant’s Alipay and Tencent’s WeChat Pay. Alipay had a 55.6% market share as of the end of the second quarter 2020, while WeChat Pay had a 38.8% market share, according to iResearch.

With reporting from Reuters.

ALSO SEE:

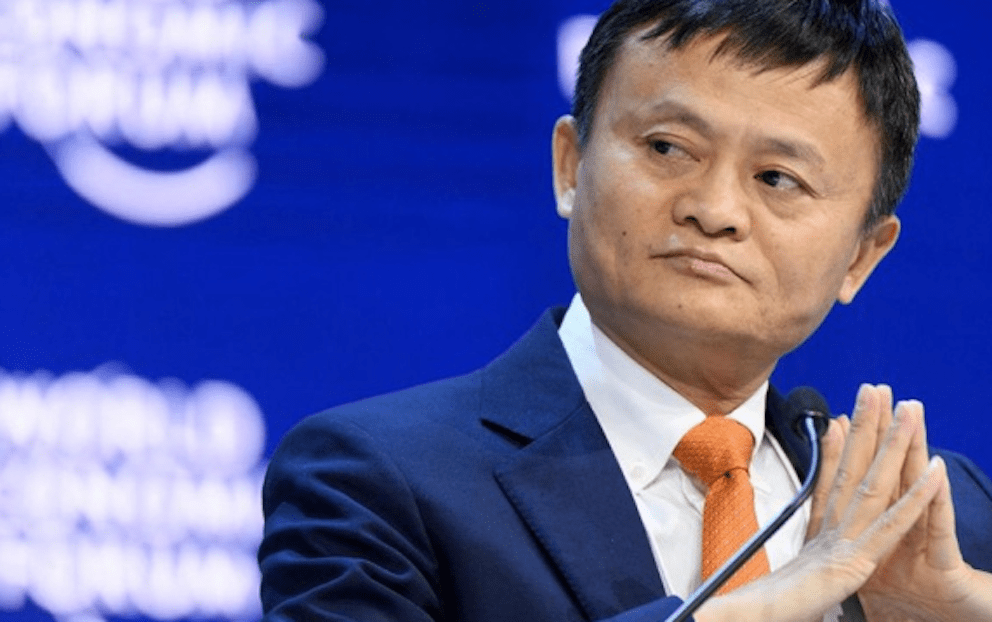

Jack Ma under pressure to sell control of Ant, sources claim