Asian shares suffered on the final day of trading of the week with a US tech slump and fading confidence in Beijing’s latest stimulus efforts weighing on sentiment.

Market moves were also largely subdued as investors awaited a key reading on US inflation later in the day to gauge the outlook for interest rates.

Japan’s Nikkei share average slumped, erasing its gains for the week, as its chip-sector shares tumbled in line with US peers. The Nikkei lost 1.34% to close at 35,751.07, snapping a two-week winning streak with a 0.59% loss. It had entered the day up 0.76% for the week. The broader Topix was down 1.35%, or 34.27 points, to 2,497.65.

Also on AF: China EV Firms Can Destroy Rivals Without Trade Barriers: Musk

Profit-taking ahead of the weekend exacerbated declines, with some technical indicators still suggesting the rally that took the Nikkei to a 34-year high of 36,984.51 on Tuesday was too fast. The benchmark index sits about 3.2% above its 25-day moving average.

Tuesday’s peak coincided with the Bank of Japan’s decision to leave stimulus settings unchanged but a hawkish tilt by the central bank chief in the post-meeting news conference has weighed on the market over the latter part of the week.

Even so, the Nikkei’s 6.83% climb this year eclipses all its major rivals, including the US S&P 500, which closed at record highs for three consecutive sessions to take its 2024 gains to 2.61%.

Next week sees a pick-up in the Japanese earnings season, with close to 500 companies reporting before a peak in mid-February. In the US too, Apple, Microsoft, Amazon, Alphabet and Meta Platforms all announce financial results.

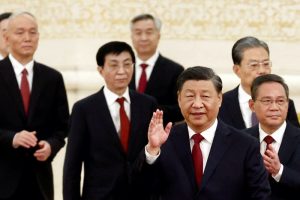

China stocks were mixed, after three sessions of gains following the government’s decision to roll out policy support, while investors locked in profits and cautiously awaited more details on the stimulus plans.

The blue-chip CSI 300 index lost 0.27% but was on track for a 1.5% weekly gain. The Shanghai Composite Index rose 0.14%, or 4.11 points, to 2,910.22, while the Shenzhen Composite Index on China’s second exchange retreated 0.71%, or 11.94 points, to 1,678.04.

Hong Kong Tech Dips

Tech giants listed in Hong Kong retreated 2.7%, after a combined 9% jump in the previous three sessions and gaining nearly 5% this week, its best performance since last July. The Hang Seng Index dropped 1.60%, or 259.73 points, to 15,952.23.

The strong weekly performances were backed by a string of supportive policies by Beijing including a deep cut to bank reserves, policy to ease a liquidity crunch facing troubled property developers, and news report of a 2 trillion yuan ($278.53 billion) rescue package to buy stocks.

Elsewhere across the region, in earlier trade, Wellington, Taipei, Manila and Jakarta were down. There were gains in Singapore and Seoul.

MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.2% but was on track for a weekly gain of about 1.8%.

European Central Bank (ECB) policymakers kept interest rates steady on Thursday, as expected, and reaffirmed their commitment to fighting inflation.

However, four sources hinted that the ECB was open to a change in its rhetoric at the next meeting, paving the way for an interest rate cut possibly in June, if upcoming data confirms inflation has been vanquished.

US Price Index Wait

In the broader market, focus was on the release of the US personal consumption expenditures (PCE) price index later on Friday, with expectations for the so-called core PCE price index – the Federal Reserve’s preferred measure of inflation – to rise 3% on an annual basis.

Data on Thursday showed the US economy grew faster than expected in the fourth quarter amid strong consumer spending, shrugging off dire predictions of a recession in the world’s largest economy.

US Treasury yields slipped in the wake of the report which also showed inflation pressures subsiding further, with the benchmark 10-year yield last at 4.0951%.

The two-year yield, which closely reflects near-term interest rate expectations, eased 3 basis points to 4.2850%.

In currencies, the US dollar drew support from the strong GDP data, pushing sterling down 0.1% to $1.26985. The Aussie dipped 0.02% to $0.6584.

Oil prices eased slightly after ending the previous session with a gain, as tensions in the Red Sea continued to pose a threat to global trade. Brent futures dipped 0.4% to $82.10 a barrel. US crude eased 0.65% to $76.86 per barrel.

Key figures

Tokyo – Nikkei 225 < DOWN 1.34% at 35,751.07 (close)

Hong Kong – Hang Seng Index < DOWN 1.60% at 15,952.23 (close)

Shanghai – Composite > UP 0.14% at 2,910.22 (close)

London – FTSE 100 > UP 1.10% at 7,612.82 (0936 GMT)

New York – Dow > UP 0.64% at 38,049.13 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Evergrande Facing Potential Wind-up Hearing on Monday

Chinese Investors Keen on Banned Crypto, as Stocks Lost Value

Bid to Help China Property Groups Lifts Shares ‘But May Not Work’

Hang Seng Rallies on China Boost, Nikkei U-Turns After Tech Lift