Asian shares advanced on Friday, rising to a four-month high, with investor mood lifted by hopes the US Fed will at long last ease up on its rate hikes push.

There was also good news for the markets from central banks in Japan and China, with the Bank of Japan sticking with its ultra-easy policy and the People’s Bank of China poised to roll out more stimulus for its struggling economy.

First to jump on that wave of optimism in Asia was Japan where the Nikkei notched a fresh three-decade high and its 10th consecutive weekly gain.

Also on AF: China Warning on ‘Vicious Competition’ As Blinken Flies to Beijing

That came after the Bank of Japan (BOJ) kept intact its pledge to “patiently” maintain massive stimulus.

As widely expected, the BOJ maintained its -0.1% short-term interest rate target and a 0% cap on the 10-year bond yield set under its yield curve control (YCC) policy.

The Nikkei closed 0.66% higher at 33,706.08, having touched a 33-year high in late trade.

Its weekly gain was 4.5% and the 10-week winning streak that propelled the index 22% higher was the longest in 11 years.

The broader Topix rose 0.28% on Friday and was up 3.4% for the week.

The wider rally has been driven lately by the yen’s weakness, which flatters exporters’ profits, and money flow from foreign investors, who have been impressed by an official drive to improve Japanese corporate governance and balance sheets.

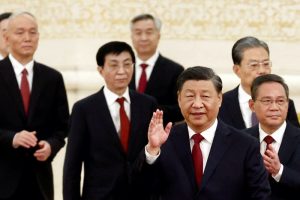

Chinese and Hong Kong stocks rose too, as investor sentiment was lifted on hopes of more stimulus after the People’s Bank of China cut a few key policy rates this week.

China will roll out more stimulus to support a slowing economy, sources involved in policy discussions said, but concerns over debt and capital flight will keep measures targeted at shoring up demand in the consumer and private sectors.

China Treasury Bonds Rumours

Meanwhile, the Wall Street Journal reported that Beijing is considering issuing roughly one trillion yuan ($140.17 billion) of special treasury bonds to help indebted local governments and boost business confidence.

The Shanghai Composite Index rose 0.63%, or 20.36 points, to 3,273.33, while the Shenzhen Composite Index on China’s second exchange advanced 0.99%, or 20.41 points, to 2,083.36.

The Hang Seng Index gained 1.07%, or 211.45 points, to 20,040.37, while the China Enterprises Index added 0.89%.

Elsewhere across the region, in earlier trade, Sydney, Seoul, Singapore and Wellington were ahead but there were losses in Taipei, Manila and Jakarta.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.75% higher and on course for a 2.8% gain in the week, its best weekly performance since January.

But futures indicated European markets were set for a more subdued start, with the Eurostoxx 50 futures up 0.05%, German DAX futures up 0.10% and FTSE futures down 0.03%. E-mini futures for the S&P 500 eased 0.12%.

The S&P 500 and Nasdaq surged on Thursday to close at their highest in 14 months after data showed US retail sales unexpectedly rose in May, while US jobless claims came in higher than expected.

The slew of data helped firm up bets that the Fed would not follow through with more rate hikes as the central bank hinted on Wednesday when it left interest rates unchanged.

Markets are now pricing in a 69% chance of the US central bank raising its interest rate by 25 basis points next month, according to the CME FedWatch tool.

ECB Flags Wages Fears

The European Central Bank on Thursday left the door open to more rate hikes as it flagged risks from rising wages and revised up its inflation projections. The ECB also raised interest rates by 25 bps taking its policy rate to 3.5%, a level not seen since 2001.

The dollar index, which measures the US currency against six major peers, was at 102.22, drifting near a one-month low of 102.08 it touched overnight.

The two-year US Treasury yield, which typically moves in step with interest rate expectations, was up 2.8 basis points at 4.676% in Asian hours.

Oil prices eased, taking a pause from the previous session when futures gained steeply on optimism around higher energy demand from top crude importer China.

US West Texas Intermediate crude eased 0.34% to $70.38 per barrel and Brent was at $75.42, down 0.33% on the day.

Key figures

Tokyo – Nikkei 225 > UP 0.66% at 33,706.08 (close)

Hong Kong – Hang Seng Index > UP 1.07% at 20,040.37 (close)

Shanghai – Composite > UP 0.63% at 3,273.33 (close)

London – FTSE 100 > UP 0.56% at 7,670.75 (0938 GMT)

New York – Dow > UP 1.26% at 34,408.06 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

PBOC Cuts Lending Rate as China’s Economy Slows in May

Trouble in Chinese Factories, Industrial Unrest at 7-Year High

China E-Commerce Giants Face Tariff Hit if US Bill Passed