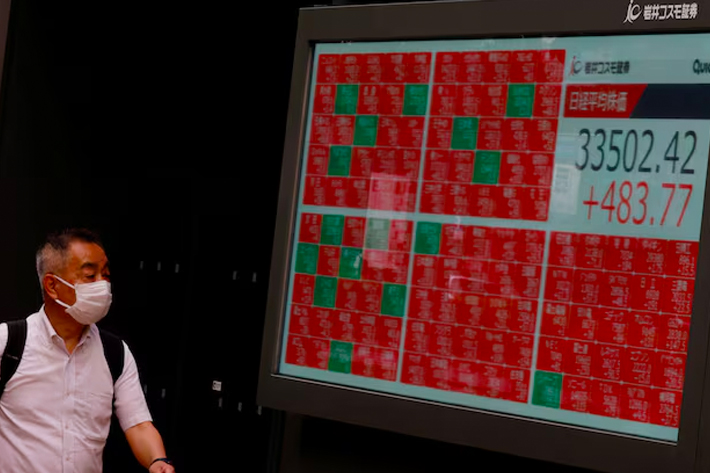

Asia’s major stock indexes posted minor advances on Wednesday but there was an air of uncertainty over trading floors ahead of the US Fed’s interest rate announcement later in the day.

The dollar ceded some of its overnight gains while Asian stocks struggled for momentum as traders weighed the odds of a super-sized Federal Reserve interest rate cut.

Markets have gone from expecting a moderate quarter-percentage-point cut to pricing in a 63% chance the Fed will reduce rates by 50 basis points, up from 14% a week earlier, according to the CME’s FedWatch Tool.

Also on AF: Musk ‘Eroding Tesla EV Sales’, But do Bigger Things Lie Ahead?

Japan’s Nikkei share average rebounded, helped by a softer yen and a recovery in chip-related stocks, although moves were subdued.

The Nikkei share average was up 0.49%, or 176.95 points, to close at 36,380.17, after a two-session slide on a stronger yen, while the broader Topix was ahead 0.38%, or 9.61 points, to 2,565.37.

Automakers, in particular, stood out after investors picked up big names knocked down by the yen’s recent gains. Toyota Motor climbed about 3.3%, Mazda Motor rose 3.6% and Honda Motor gained 2.5%.

Technology stocks also saw some dip-buying, lifting chip-testing equipment maker Advantest up 1.8%.

Among other heavyweights, Uniqlo parent firm Fast Retailing gained 2.4% to give the Nikkei its biggest lift. AI-focused startup investor SoftBank Group finished up 0.3%.

Mainland Chinese stocks traded near their lowest levels in more than five years after a holiday break after a slew of poor economic numbers. But they bounced back later in the day on bets on a US rate cut, which would reduce the interest-rate spread between the two nations.

The CSI 300 Index added 0.37% to 3,164.82. On Friday, it closed at its lowest point since January 24, 2019.

The Shanghai Composite Index rose 0.49%, or 13.19 points, to 2,717.28, while the Shenzhen Composite Index on China’s second exchange edged down 0.17%, or 2.53 points, to 1,473.73.

Mainland markets have yet to catch up to the Hang Seng Index, which rose 1.7% over the first two days of trading this week. Hong Kong’s market was shut for a public holiday and will resume trading on Thursday.

Hezbollah Pagers Attack Fallout

Elsewhere across the region, in earlier trade, Singapore was also up. Sydney, Mumbai, Wellington and Taipei fell, with Manila flat, while Seoul was also closed for a holiday. MSCI’s broadest index of Asia-Pacific shares outside Japan slid 0.27%.

Wall Street finished nearly unchanged on Tuesday, failing to sustain early momentum that pushed the S&P 500 and Dow to record intraday highs.

S&P 500 futures pointed 0.06% higher on Wednesday. Pan-European STOXX 50 futures were weaker though, down 0.19%.

In currency, the dollar dropped 0.67% to 141.365 yen, although that followed a 1.26% surge overnight. The euro added 0.05% to $1.1119. Sterling was steady at $1.3158.

At the same time, two-year US Treasury yields rose slightly to stand at 3.5962%, extending Tuesday’s advance.

Meanwhile, gold struggled to find its feet, slipping 0.1% to $2,567 per ounce after retreating from an all-time high in the previous session.

Crude oil also pulled back after gaining about $1 a barrel on Wednesday amid escalating tensions around the Middle East.

Militant group Hezbollah vowed retaliation against Israel after pagers detonated across Lebanon on Tuesday, killing at least eight people and wounding nearly 3,000 others.

Meanwhile, the UN’s Libya mission said factions did not reach a final agreement in talks aimed at resolving the central bank crisis, which has slashed oil output and exports.

US crude futures declined 49 cents to $70.70 in the latest session, and Brent crude futures lost 47 cents to $73.23.

Key figures

Tokyo – Nikkei 225 > UP 0.49% at 36,380.17 (close)

Hong Kong – Hang Seng Index <> CLOSED

Shanghai – Composite > UP 0.49% at 2,717.28 (close)

London – FTSE 100 < DOWN 0.46% at 8,271.44 (0933 BST)

New York – Dow < DOWN 0.04% at 41,606.18 (close)

- Reuters with additional editing by Sean O’Meara

Read more:

Asian Bonds See Best Month of Net Purchases in Five Years

Hang Seng Gains on Property Bets, Strong Yen Weighs on Nikkei

BIS Warns Central Banks Not to Squander Interest Rate Buffers

Hang Seng Gains as Poor Data Spurs Policy Bets, Nikkei Closed