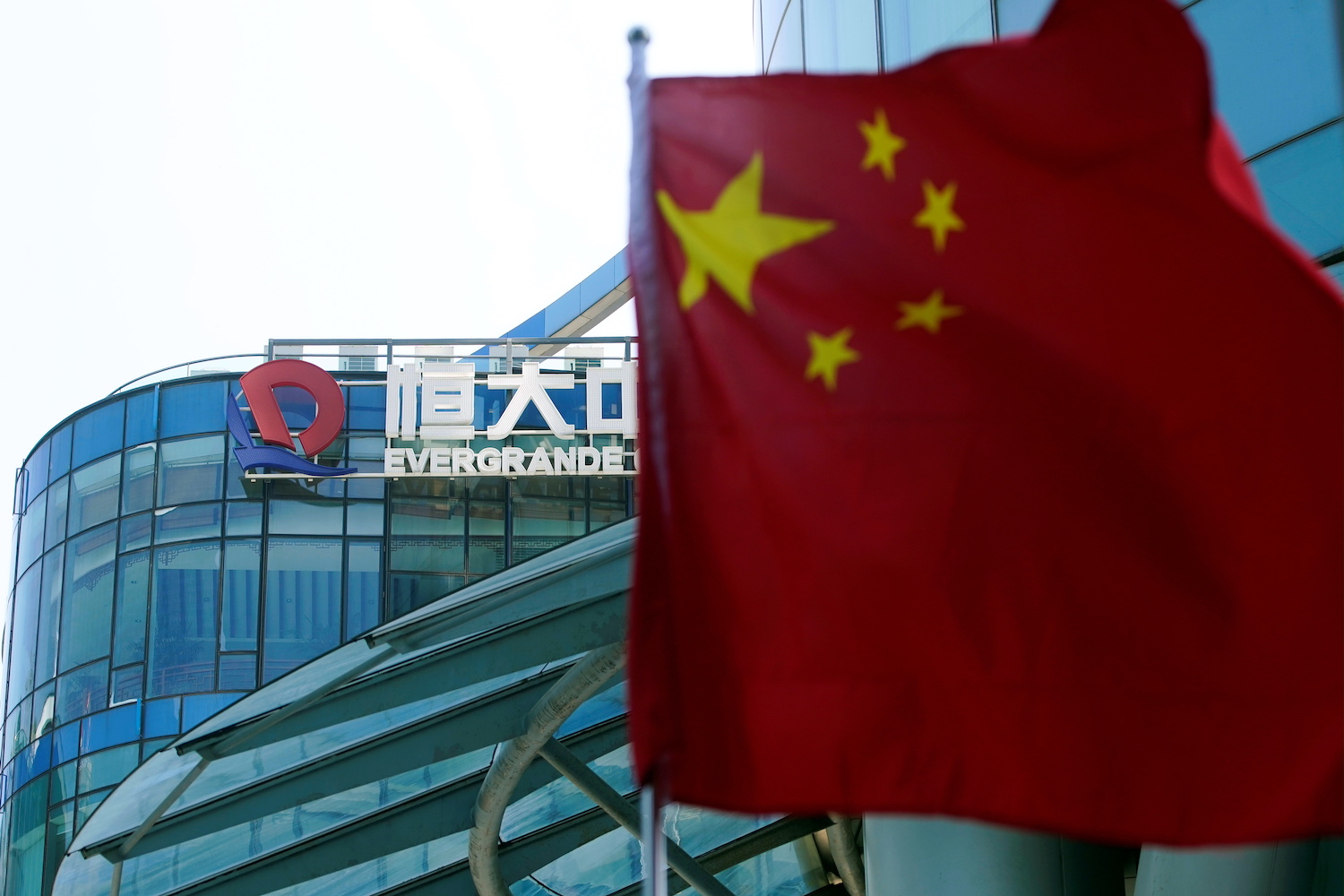

China will allow unsustainable companies such as the Evergrande Group to go to the wall as it attempts to rein in a $27 trillion corporate debt mountain.

That’s according to S&P Global Ratings, which says no private firm is too big to fail as China prioritises reducing financial risks by “destroying the old to make way for the new.”

China’s corporate debt has mostly grown faster than its contribution to GDP for more than a decade and with 31% of the world’s corporate debt pile it only contributes a fifth of global GDP, said Eunice Tan, head of credit research at S&P Asia-Pacific.

That has resulted in a corporate debt-to-GDP leverage ratio that is one of the world’s highest, she said. It stood at 159% as of June this year – much higher than the global average of 101% and almost twice that of Europe, according to S&P’s research.

Hong Kong Exchange Boss Defiant Over China Crackdowns Impact

For comparison, the US and Europe both claim a smaller share of the world’s corporate debt but contribute a larger portion of global GDP, according to data from the Institute of International Finance cited by S&P.

The US has 20% and Europe 27% of the world’s corporate debt, and the two regions contribute 25% and 24% of global GDP, respectively.

Rising Property Defaults

The government will be increasingly more selective about which state-owned enterprises it is prepared to bail out, said Kim Eng Tan, S&P’s senior director of sovereign & international public finance ratings.

Beijing’s inaction over Evergrande – the ailing property developer with over $300 billion of debt – suggests it does not consider any private firm “too big to fail,” he said. As further evidence, S&P points to rising defaults in the property sector, and expects the further tightening of regulations to also impact financial institutions.

“The key is to focus credit on the more productive areas and that’s what the government is doing,” said Terry Chan, S&P Asia-Pacific’s managing director of credit research. ”The government realises that as an economy matures growth is slow. Productivity is the key thing to credit-fuelled growth.”

As China’s GDP growth has slowed significantly, from 14.2% in 2007 to 6.1% in 2019, the country has been attempting to transition to a services-led economy and put more focus on productivity and innovation.

The breadth and speed of changes being implemented recently has increased financial volatility though and could put a strain on growth in an economy that continues to feel the disruptions of the Covid pandemic, he said.

Economists have been downgrading forecasts for China’s growth. Prompted by an energy crisis that has hit China’s huge industrial sector, the Bank of America last week slashed its outlook on China’s GDP growth for next year to just 4%, from 5.3% previously.

- By Iris Hong

Read more:

China Developers Want Maturity Extensions For Offshore Debts

China State Council Offers Tax Relief to Manufacturers