Patriotic Chinese investors are betting against recent curbs chip imposed by the US and Japan and reaping large profits as they buy up shares of sanctioned technology firms and state companies.

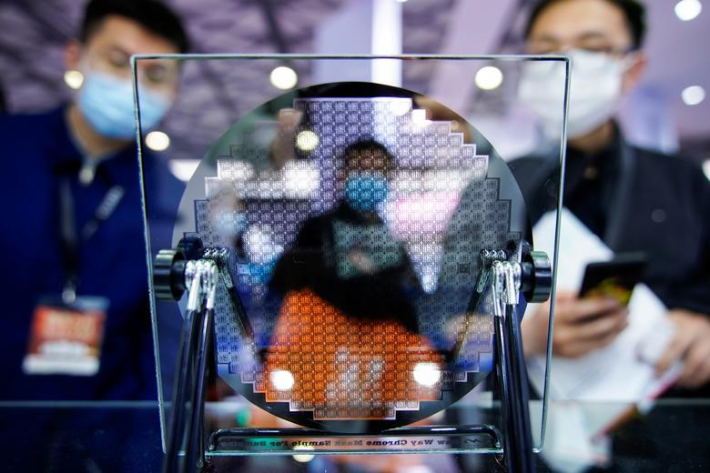

Share prices of leading Chinese makers of semiconductor equipment have jumped since March-end, when Japan said it would join the US chip war against China and restrict exports of 23 types of chipmaking equipment.

“We must choose to stand with our country … and make long-term asset allocation in line with the country’s needs,” Liu Tuoqi, head of investment at Shanghai Zhangying Investment Management, told investors in a roadshow.

Also on AF: China Warns Japan to Reverse its Ban on Chipmaking Gear

Describing the Sino-US conflict as “irreconcilable”, Liu said there was a silver lining in the tech spat. “It forces us to make chips ourselves … the higher the wind and waves, the pricier the fish.”

The sentiment has reflected in stocks of China’s semiconductor companies, with NAURA Technology Group up 14%, Piotech up 45%, and ACM Research Shanghai up 19%.

US politicians’ calls this week to sanction chipmaker Changxin Memory Technologies (CXMT), following Beijing’s ban on US chipmaker Micron Technology, also boosted shares in Chinese memory chipmakers such as ZBIT Semiconductor, up 26% this week, and Montage Technology up 4%.

The nationalistic fervour boosting these select sectors and shares has also been lucrative for investors in an environment of sluggish and uneven domestic growth after China’s economic reopening in January.

China’s benchmark stock indexes rallied in anticipation of a bumper post-pandemic recovery but have erased all gains since.

Focus on state firms

Reflecting the flag-waving fervour, at least eight asset managers have applied to China’s securities regulator to launch the first batch of investment products tracking the CSI Computing Infrastructure Index, seen as the most vulnerable to foreign sanctions, and a vital area in the tech war.

New fund launches will potentially channel money into China’s technology and chipmaking leaders, including ZTE, Unisplendour, Montage and Cambricon Technologies.

It comes as investors are also being subtly nudged – via favourable brokerage reports and mutual fund launches – to invest in state-owned enterprises (SOEs), which Beijing hopes can play a key role in the Sino-US tech war.

“If we want to realize technology replacement in the future, SOEs are the best platform,” Yang Zhenjian, fund manager at Bosera Asset Management, said.

Cutting-edge innovation requires huge and long-term investment, which is beyond the ability of private companies, “but SOEs can do it,” Yang said.

Revaluing state sector

To facilitate SOE fundraising, Chinese regulators have called since late last year for a revaluation of the state sector, boosting shares in companies blacklisted by the US, such as China Mobile, China Telecom and China Unicom.

An index tracking innovative central SOEs has jumped 14% this year.

Yuan Yuwei, hedge fund manager at Water Wisdom Asset Management, said he is bullish on Chinese chip equipment companies, state-owned telecom giants, and indigenous software makers that challenge US rivals in China.

For example, Kingsoft Office, a Microsoft rival that is being adopted widely by Chinese governments and SOEs, has surged nearly 50% this year.

Liu of Zhangying Investment admitted there’s some froth in certain sectors supported by Beijing. For example, China’s chipmaking sector is now trading at 60 times earnings, compared with 16 for the broad market.

But “China needs high valuation in some sectors … Why don’t you put down your wager, while also supporting the country’s development?”

- Reuters, with additional editing by Vishakha Saxena

Also read:

China’s Micron Ban Adds to Asian Chipmakers’ Investment Woes

Money Alone Can’t Rescue China’s Chip Sector, Experts Say

Access to China ‘Essential’ as it Develops Chips: ASML CEO

US Chip Sanctions Have Hardly Impacted China’s AI Capability

US Risks ‘Enormous Damage’ With China Chip War: Nvidia CEO