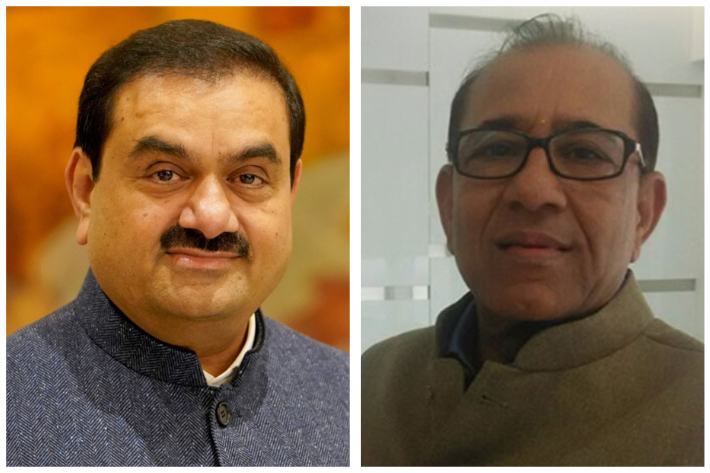

India’s market regulator is investigating Adani Group’s dealings with at least three offshore entities linked to the brother of the conglomerate’s founder for possible violation of ‘related party’ transaction rules.

The three entities allegedly entered into several investment transactions with unlisted units of the conglomerate founded by billionaire Gautam Adani over the last 13 years, two sources with direct knowledge of the matter said.

Vinod Adani, Gautam Adani’s brother, is either a beneficial owner, director or has links with those three offshore entities, the sources said. The added the regulator, the Securities and Exchange Board of India (SEBI), is probing if lack of that disclosure violated ‘related party transaction’ rules.

Also on AF: Adani Seeks More Time to Pay $4bn Debt

Under Indian laws, direct relatives, promoter groups and subsidiaries of listed companies are considered related parties.

A promoter group is defined as an entity that has a large shareholding in a listed company and can influence company policy.

Transactions between such entities have to be disclosed in regulatory and public filings and require shareholder approval above a specified threshold. Violations typically attract monetary fines.

An email to SEBI requesting comment was not answered. And SEBI chairperson Madhabi Puri Buch declined to comment on the Adani investigations at a news conference last week.

‘Disclosure violations’

The probe comes after a report by US short-seller Hindenburg Research alleged improper use of tax havens and stock manipulation by Adani Group, among other things.

Hindenburg alleged that Vinod Adani entities have collectively moved “billions of dollars” into Adani’s publicly listed and private entities, often without required disclosure of the related party nature of the deals.

The Adani Group responded to Hindenburg’s allegations with a 413-page document that said all its transactions entered with entities who qualify as ‘related parties’ under Indian laws and accounting standards have been duly disclosed.

Released on January 24, the Hindenburg report wiped out more than $100 billion in the value of shares in Adani group of companies.

That prompted India’s Supreme Court to ask SEBI in March to investigate the Adani Group for any lapses related to public shareholding, related party rules or regulatory disclosures.

SEBI’s investigation into Adani’s possible ‘related party’ transactions with offshore entities with links to Vinod Adani has not been reported before, although groups such as Forbes have now also focused on the links to Gautam’s brother.

While SEBI investigations are continuing, top regulatory officials were due to give a status report to a court-appointed panel on Sunday, the two sources said.

More transactions under the lens

The three offshore entities with links to Vinod Adani being probed for ‘related party’ transactions are Mauritius-based Krunal Trade and Investments Ltd and Gardenia Trade and Investments Ltd, and Electrogen Infra in Dubai.

There was no response from Krunal, Gardenia and Electrogen Infra to emails requesting comment.

An Adani Group spokesperson said Vinod Adani is a member of the Adani family and is part of the promoter group, but he does not hold any managerial position in any of the listed Adani entities or their subsidiaries.

“This fact, like all other material information required to be reported, has been disclosed to the regulatory authorities in the past and also as and when required,” the spokesperson added, without commenting on the regulatory probe into offshore entities.

Vinod Adani could not be reached for comment. Requests for comment sent to his holding company in Dubai, Adani Global Investment DMCC, were not responded to.

While the sources said that other similar transactions are also under regulatory examination, Reuters could not ascertain the names of other entities and their possible violation of ‘related party’ transaction rules.

SEBI suspects there were “disclosure violations” on some of those transactions, one of the two sources said.

If proven, it could lead to monetary penalties and the matter may be referred to India’s Ministry of Corporate Affairs (MCA) for transactions that are beyond SEBI jurisdiction, the source said.

- Reuters, with additional editing by Vishakha Saxena and Jim Pollard

Also read:

Adani Group Prepays $900m of Share-Backed Financing

Top Indian Court Gets Regulator, Panel to Check on Adani Dealings

Adani Says Has Secured $3bn Loan From Sovereign Wealth Fund

Adani Shares Rally After $1.9-Billion GQG Stock Buy-up

India’s Adani Bids to Reassure Investors as Rout Continues