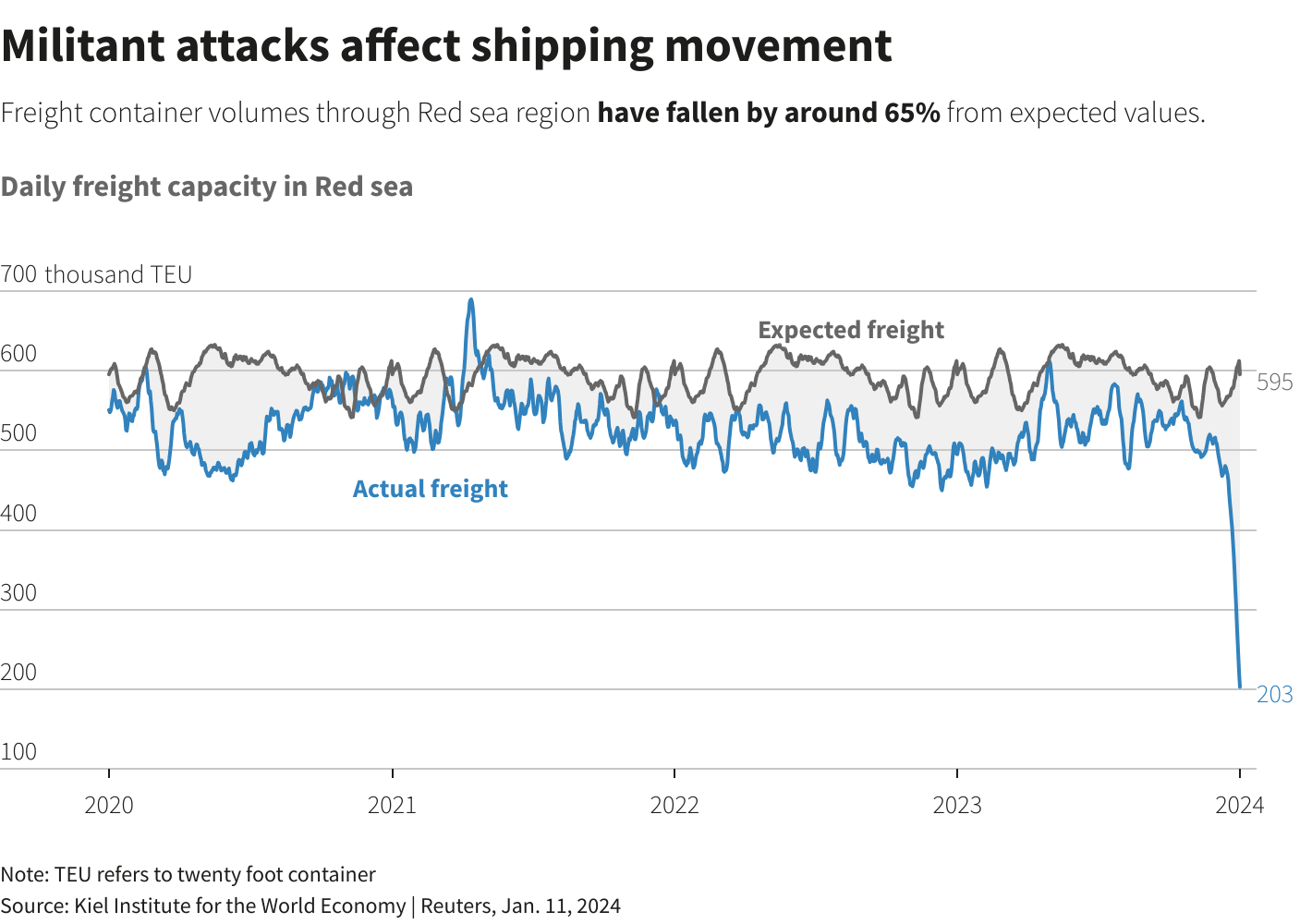

Disruptions in the Red Sea — due to attacks by Iran-backed Houthi militants — look likely to last ‘at least a few months’, according to the chief of Maersk, the world’s largest shipping company.

“For us this will mean longer transit times and probably disruptions of the supply chain for a few months at least – hopefully shorter, but it could also be longer because it’s so unpredictable how this situation is actually developing,” Maersk CEO Vincent Clerc said, speaking to the Reuters Global Markets Forum in Davos.

The situation in the Red Sea has remained volatile despite extensive efforts by a US-led coalition to avert militant attacks on vessels still using the route.

Also on AF: Red Sea Attacks Pose Billions Worth of Risks for China, India

On Tuesday, a Malta-flagged, Greek-owned bulk carrier was struck by a missile while northbound in the Red Sea.

Incidents such those have led Maersk and other large shipping lines to instruct hundreds of commercial vessels to stay clear of the Red Sea. They are now sending vessels on a longer, more expensive route around Africa.

Most recently, Japanese shipping operator Nippon Yusen, also known as NYK Line, instructed its vessels navigating near the Red Sea to wait in safe waters.

The company is also considering route changes, a spokesperson said on Tuesday.

British oil major Shell has also suspended all shipments through the Red Sea indefinitely.

‘Extremely disruptive’ developments

In light of the Red Sea attacks, freight rates have more than doubled since early December, according to maritime consultancy Drewry’s world container index.

Meanwhile, insurance sources say war risk insurance premiums for shipments through the Red Sea are also rising.

Banking executives have said they were worried the crisis might create inflationary pressures that could ultimately delay or reverse interest rate cuts.

“This is extremely disruptive because you have close to 20% of global trade that transits through the Bab al-Mandab Strait. It’s one of the most important arteries of global trade and global supply chains and it’s clogged up right now,” Clerc said.

On Wednesday, Tobias Meyer, the chief of DHL, also said that Red Sea attacks and the resulting diversion of freight could lead to a shortage of shipping containers in Asia in the coming weeks.

Developed economies likely to be worst hit

The Red Sea leads to the Suez Canal waterway, the fastest freight route from Asia to Europe. About 12% of world shipping traffic accesses the Suez Canal via the Red Sea.

Logistics experts expect, therefore, that Red Sea disruptions would hit European consumers the hardest.

The cost of sending a container load of solar modules made in China to Europe has nearly tripled, according to one report.

“The cost of goods into Europe from Asia will be significantly higher,” Yuvraj Narayan, the CFO of Dubai-based logistics company DP World told Reuters at the annual WEF meeting in Davos.

“European consumers will feel the pain … It will hit developed economies more than it will hit developing economies.”

The US and Britain last week began air strikes against Houthi military targets in Yemen in retaliation for attacks on shipping by the Houthis. The US military carried out further strikes this week.

The Houthis, in response, vowed to target US shipping firms, regardless of whether they were heading to Israel or not.

The group has previously said that its attacks on shipping firms are a response to Israel’s ongoing assault on Gaza.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Shipping Chaos Set to be ‘New Normal’ Amid War, Climate Change

Global Trade Shrinks on Red Sea Woes But China Bucks the Trend

Ship Attacks Will Continue, Houthis Vow After US, UK Strikes

Ocean Freight Fees Shoot up After New Red Sea Ship Attacks

Japanese, German Shipping Firms Still Avoiding Suez Canal

Japanese Tanker Attacked Near India by Iranian Drone, US Says

Inflation Worries Mount as Exporters Hunt Ways Around Red Sea

Chinese Car Exports to EU Seen Hit by Red Sea Ship Attacks