Russia has spent the past seven years building up formidable financial defences, yet in the long run, its economy is unlikely to withstand the onslaught of coordinated sanctions from the West.

Europe and the United States are raining down reprisals after President Vladimir Putin sent tanks into Ukraine, adding to sanctions already pledged in response to his decision to recognise the independence of two breakaway Ukrainian provinces.

“The view Russia will be unaffected is wrong. The negative effects may not be felt upfront but sanctions will hobble Russia’s potential in the longer run,” Christopher Granville, managing director at consultancy TS Lombard and a veteran Russia watcher, said.

Steps by the West include sanctions and asset freezes on more Russian banks and businessmen, a halt to fundraising abroad, the freezing of an $11 billion gas pipeline project to Germany and limiting access to high-tech items such as semiconductors.

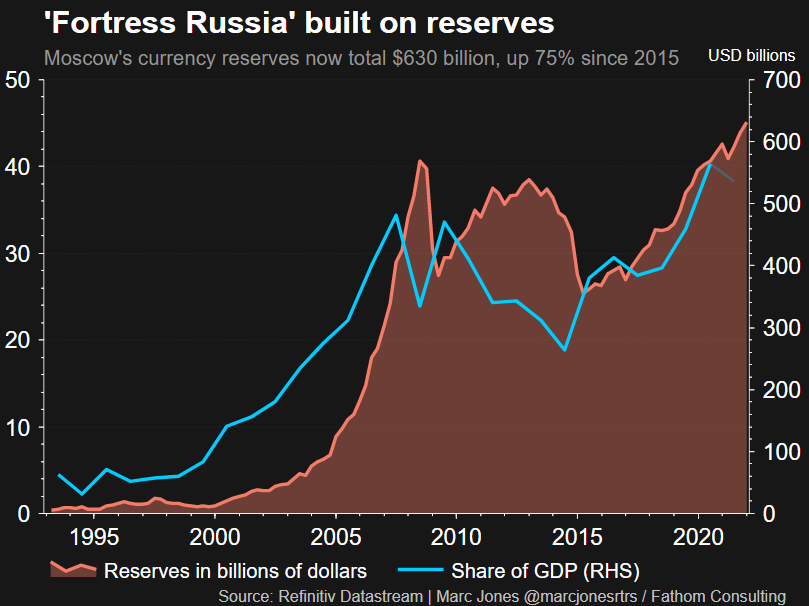

Russia has dismissed the sanctions as counter to the interests of those who imposed them. And they won’t immediately dent an economy with $643 billion in currency reserves and booming oil and gas revenues.

Those metrics have earned Russia the “fortress” economy moniker, alongside a current account surplus of 5% of annual GDP and a 20% debt-to-GDP ratio, among the lowest in the world. Just half of Russian liabilities are in dollars, down from 80% two decades ago.

Those statistics result from years of saving since sanctions imposed after Putin’s 2014 Crimea annexation.

Oil Windfall

According to Granville, surging oil prices will offer Russia an extra 1.5 trillion rouble ($17.2 billion) windfall this year from taxes on energy companies’ profits.

But this kind of autarky has a price – deepening isolation from the world economy, markets and investment, he noted.

“Russia will essentially be treated as a hostile state cut off from global flows, investment and other normal economic interactions that build living standards, incomes, productivity and company profitability.”

Signs of economic vulnerability are already present. Russian household incomes are still below 2014 levels and in 2019, before the Covid-19 pandemic struck, annual economic output was valued at $1.66 trillion, according to the World Bank, far below the $2.2 trillion in 2013.

Sergei Guriev, economics professor at France’s Sciences Po and former European Bank for Reconstruction and Development chief economist, pointed out that Russian nominal per capita GDP, double China’s in 2013, was now behind.

“In 2013 Russia was a high-income country and was actively negotiating OECD accession. Russia is now back to the middle-income status,” he said.

DIMINISHING CLOUT

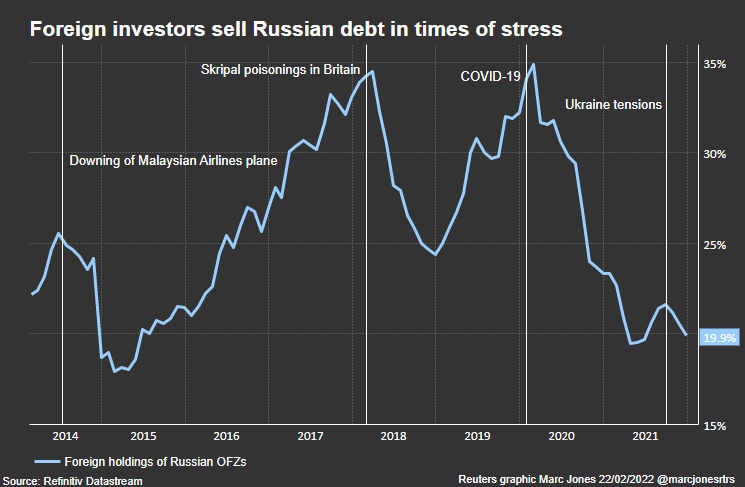

Foreign investors in Russia are a dwindling tribe too. A JPMorgan client survey showed foreign holdings of rouble bonds at the lowest in two decades; equity investment has never returned to pre-Crimea levels in absolute terms, Copley Fund Research estimated.

The premium demanded by investors to hold Russian dollar debt surged on Thursday to over 13 percentage points above US Treasuries, almost triple the emerging markets average.

“Sanctions are going to force Russia to self-finance more and more activity, constraining investment in industry and the military,” said Jeffrey Schott, a trade and sanctions expert at the Peterson Institute for International Economics.

Bigger assaults could include ending Russian access to international payments system SWIFT and an outright ban of investment in Russia.

Losing access to SWIFT would complicate export and import payments, and could even prevent paying bond coupons, triggering technical default. JPMorgan projects sanctions will slice up to 3.5 percentage points from GDP growth in the second half of 2022.

Limited access to foreign capital leaves oil companies reliant on prepayment deals and facing significantly higher cost of capital, the bank added.

The slow erosion in living standards also risks fanning popular discontent, threatening an administration that has already faced sporadic protests. Spillover may be inevitable.

“Autarky is no recipe for progress,” analysts at investment bank Berenberg wrote. “Coping with a heavily armed Russia mired in relative economic decline will remain a key challenge for Europe and the United States for the foreseeable future.”

• Reuters with additional editing by Jim Pollard

ALSO on AF:

Aluminium Prices Hit Record High Over Sanctions Fears

Ukraine Conflict Would Have ‘Uneven’ Asia-Pacific Impact

Russia, China Announce Broad Partnership to Counter US