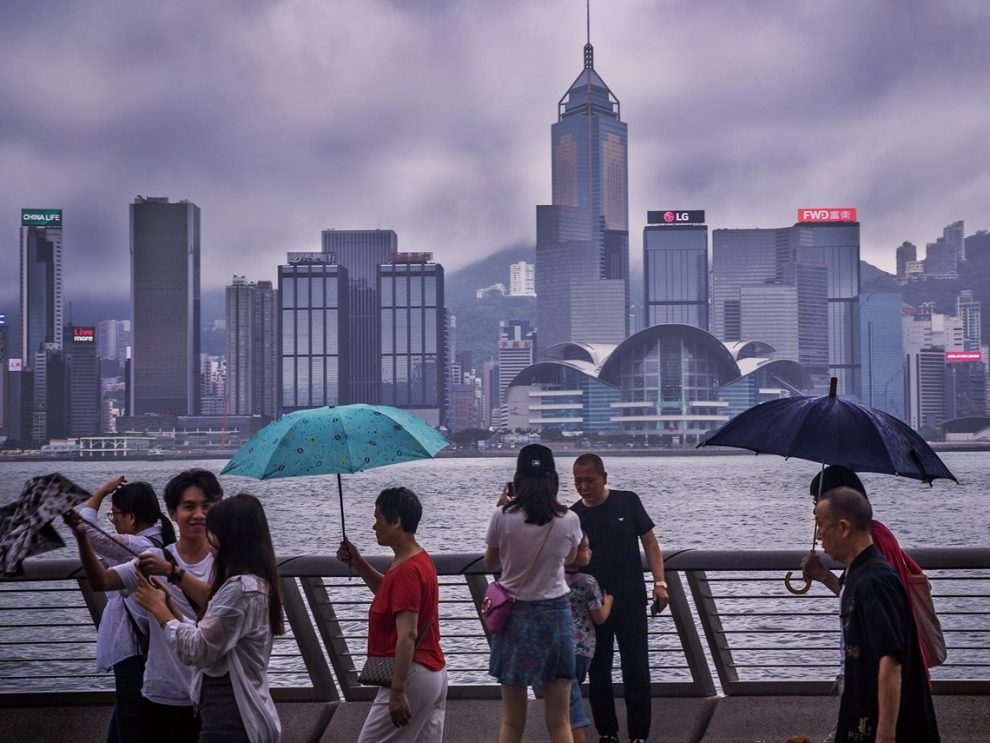

Financial firms in Hong Kong are scrambling to fortify their compliance operations following US sanctions and China’s new national security law, even as the sector pushes to cut costs amid the coronavirus pandemic.

This underscores the growing challenges for firms operating in the Asian financial hub, which was roiled last year by often-violent pro-democracy, anti-China protests and is now in the crosshairs of mounting Sino-US tensions.

International asset managers and Asian banks have stepped up compliance hiring, while some are training existing staff and buying new technology to offset a talent crunch as candidates are unwilling to relocate amid the health crisis and the uncertainty in Hong Kong, bankers, lawyers and headhunters said.

Demand for compliance staff has risen by as much as a third from a few months earlier, two headhunters said.

“In the past three months we’ve had demand from top-tier asset managers looking for regulatory compliance lawyers because they need experts in place when the US and China keep slapping sanctions on each other,” said Olga Yung, regional director at recruiter Michael Page Hong Kong.

Because sanctions are a “niche area”, companies are hiring lawyers with some sanctions expertise and supplementing with external law firms, she said.

‘AN ACTIVE MANDATE’

The United States has imposed sanctions on Hong Kong’s Chief Executive Carrie Lam and 10 other officials for what it says is their role in curtailing political freedoms in the territory.

The sanctions came after Beijing imposed in late June a sweeping security law on Hong Kong, targeting seditious and subversive activities.

A senior banker at an Asian lender in Hong Kong said he gave his compliance team a list of individuals and businesses linked to the sanctioned officials and “the immediate response was to either close all those accounts or hire five more sanction-specialists to do a proper audit”.

The banker, declining to be named because the information was private, said they decided to hire two experts and organise sanctions training for the rest of the team, despite a company-wide attempt to limit spending.

Chinese banks are also hiring.

A headhunter said his firm received “an active mandate” from two of China’s Big Four banks for compliance experts in Hong Kong following the US sanctions, without giving their names.

The penalties levied for breaching sanctions can be large.

Global banks operating in Hong Kong, including HSBC and Standard Chartered, paid billions of dollars in fines in recent years for violating US sanctions on Iran and anti-money laundering rules.

READING TEA LEAVES

It is a Catch-22 situation for financial firms in Hong Kong.

There are worries that firms implementing sanctions could run afoul of the security law. But banks also must guard their access to the US financial system.

The security law and the US legislation are broadly worded and give much discretion to enforcement officers, adding to the uncertainty, lawyers said.

This has pushed up the need for professionals, and means advising on compliance is like “reading tea leaves”, one added.

“The phone is ringing off the hook, and everyone doesn’t only want work done, they want it immediately,” said Benjamin Kostrzewa, an international trade and regulatory lawyer at Hogan Lovells. “It’s hard to even sign the engagement letter before the next client walks into the Zoom room”.

However, meeting the demand is difficult. Until recently there was limited need for specific US sanctions knowledge in Hong Kong’s legal and financial industries.

Recruitment from rival financial hubs has been curtailed because of virus-related curbs and political uncertainty in Hong Kong, say headhunters.

Some companies are using technology to bridge the gap.

A year ago “we were very focused on banks, but now clients are insurers and even casinos and real estate companies”, said Bharath Vellore, APAC managing director at Accuity, which provides financial crime and sanctions lists screening software.

(Reporting by Alun John and Sumeet Chatterjee; Editing by Himani Sarkar)