Chinese solar overcapacity has led to a steep plunge in new projects to manufacture solar energy materials and components in the first half of the year, while also sparking off a wave of bankruptcies.

The number of new solar manufacturing projects in China fell by more than 75% year-on-year in the first half of the year, according to a mid-year outlook presentation by a key industry lobby.

The China Photovoltaic Industry Association (CPIA) said more than 20 projects in the planning or construction stage had been cancelled or suspended.

Also on AF: China Tightens Focus on Tech Innovation, ‘New Productive Forces’

The cancelled projects represent over 300,000 metric tons of polysilicon capacity, over 15 gigawatts (GW) of silicon wafer capacity, over 60GW of solar cell capacity and over 20 GW of module capacity.

Utilisation rates at cell and module plants stood at around 50-60% on average, according to the figures compiled by CPIA.

At least six firms suspended some operations at domestic factories, while two also suspended production at facilities abroad, the association said.

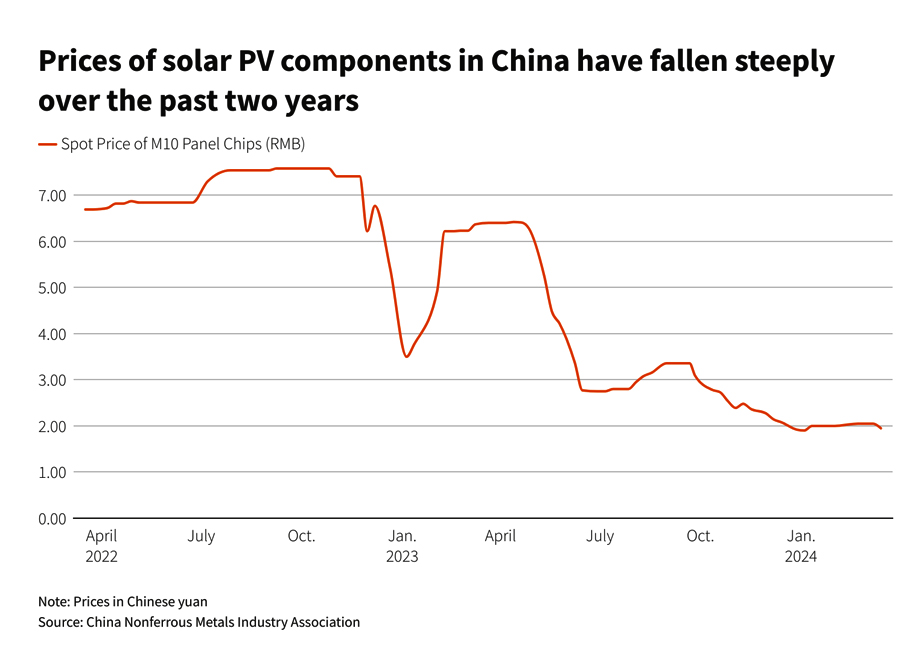

The move to claw back projects comes amid a severe glut in the industry that has decimated prices for China’s finished solar panels.

For many producers, prices have now dropped below cost, squeezing profit margins.

Industry experts say prices are unlikely to see any recovery until at least the end of 2024 or later. Some industry participants believe a paring back of capacity could start to rationalise prices by that point.

Bankruptcies begin

China accounts for 80% of solar module production capacity after years of subsidies that have triggered a collapse in global prices. That has led to pushback from economies like the US and EU where local manufacturers have been forced to shut up shop due to market being flooded by low-cost equipment.

At home too, Chinese solar panel makers have been calling on Beijing to introduce policies to stem the glut and also put an end to “over-investment” in the industry.

Last month, the CPIA warned that prevailing conditions would lead smaller players in the industry to shut down.

That forecast seems to be shaping up with two players in the industry succumbing to their debt woes this month.

This week, Chinese solar module producer Zhejiang Akcome New Energy Technology filed for bankruptcy at one of its subsidiaries, citing an inability to repay its debts.

As of April 30, Zhejiang Akcome Photoelectricity Technology’s assets totalled 2.513 billion yuan ($346.4 million) and debts stood at 1.562 billion yuan, according to the filing.

The decision followed news of financial troubles at parent company Zhejiang Akcome New Energy Technology. Listed as a tier one global PV manufacturer, the company it would suspend production of some modules because of issues with its sales and supply chain.

Meanwhile, earlier this month another solar manufacturer Gansu Jingang Solar began restructuring and initiated a pre-restructuring procedure saying it was unable to repay its maturing debt.

Smaller players are not the only ones hit by overcapacity. Early this year, China’s Longi Green Energy Technology, one of the world’s largest solar panel manufacturers, said it would lay off about 5% of its employees due prevailing challenges in the industry.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

China’s Clean Energy Spending Set to Match US-Europe Combined in 2024

China Solar Panel Costs Plunge in 2023, 60% Cheaper Than US

China Turns on World’s Biggest Solar Farm in Xinjiang

China’s Solar Sector Seen Facing Years of Oversupply, Low Prices

US, EU Can’t Meet Climate Goals Without China’s Cheap Green Tech

EU Can’t Close Borders to Chinese Solar, Energy Chief Says

China’s Cheap Solar Panels Killing Europe’s Solar Manufacturers

China Wind, Solar Capacity Set to Outstrip Coal For First Time

China Solar Firms Paying Price of Global Dominance – FT