(ATF) The stock exchanges in Hong Kong, Shanghai, and Shenzhen have reached an agreement to allow stocks on Shanghai Stock Exchange’s Sci-Tech Innovation Board (STAR Market) as well as pre-revenue biotech companies listed in Hong Kong to be eligible for trading via the Stock Connect scheme.

The expansion arrangements are aimed at promoting the continued healthy development of capital markets of Mainland China and Hong Kong, the exchanges said in their respective announcements.

Stock Connect allows international and mainland Chinese investors to trade securities in each other’s markets. It consists of a “southbound” component that allows mainland Chinese investors to invest in stocks on the Hong Kong exchange, as well as a “northbound” component for international investors to invest in the opposite direction.

STAR Market stocks

The three exchanges have agreed that STAR Market-listed shares that are constituent stocks of the SSE 180 and SSE 380 indices, or have H-share counterparts listed in Hong Kong, will be eligible for northbound trading of Stock Connect. Accordingly, their corresponding H-shares will be included in southbound trading of the scheme.

The exchanges expect the inclusion to take place in early 2021 after business and technical preparations are complete.

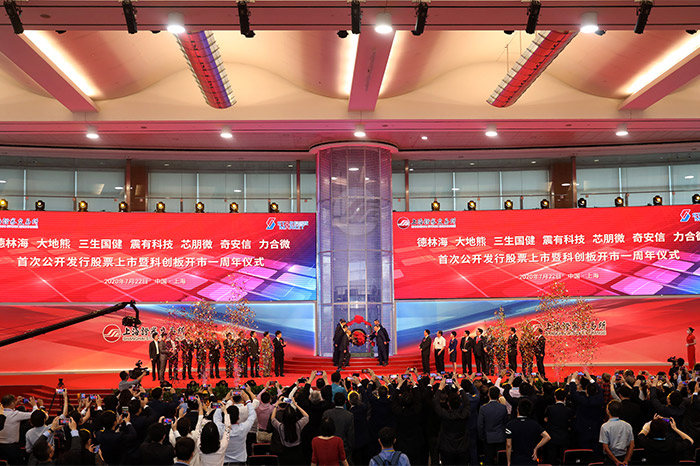

The STAR Market, launched in July last year, is China’s answer to Nasdaq. There are now 197 companies with a combined market cap of 3.11 trillion yuan (US$473 billion) listed on the STAR Market, according to data released by the Shanghai exchange.

The change means international investors will have access to nine STAR Market companies via Stock Connect, according to the research of Northeast Securities.

They are “A+H” dual-listed Haohai Biological Technology and China Railway Signal & Communication Corporation Ltd, Advanced Micro-Fabrication Equipment, which will join the SSE 180 index, and six other companies that will be added to the SSE 380 index, such as Qingdao Haier Biomedical and Raytron Technology.

In a connected arrangement, Shanghai Stock Exchange and index provider China Securities Index announced on the same day that they decided to include STAR Market companies that have been listed for over a year into indices such as CSI 300, SSE 180, SSE 380, and CSI 500, from December 14.

Hong Kong-listed biotechs

The three exchanges have also agreed that shares of pre-revenue biotech companies listed on Hong Kong’s Main Board that are eligible constituent stocks of the Hang Seng Composite Index, or have corresponding A-shares listed in Shanghai or on the Shenzhen exchange, will be included in southbound trading of Stock Connect.

In addition, shares of biotech companies that are H-shares in STAR Market-listed A+H companies will be included in southbound trading of Stock Connect.

The exchanges expect the inclusion to take on 27 December.

International index inclusion

“Inclusion in the Stock Connect scheme is a prerequisite for A-shares to be included in international indices such as those of MSCI and FTSE Russell. Now that the STAR Market stocks are included in Stock Connect, they may be gradually incorporated into international market indices, and that will in turn bring more capital into the STAR Market,” Zhang Xia and Tu Jingqing, analysts from China Merchants Securities, said in a commentary.

As of 28 November, there were 56 companies with longer than one year of listing on the STAR Market, and they account for 3.2% of the total market cap of companies listed on SSE.

After more than 16 months of operation, the STAR Market has become more mature by trimming volatility and now has a turnover rate close to the level of the CSI 300 index, Northeast Securities said. Inclusion of STAR Market stocks in the indices will help the indices to better reflect the entire market’s movements, they added.

“For the investors, the expansion arrangements of Stock Connect will provide them with a larger pool of equities to invest in, enabling them to employ differentiated investment strategies to maximize their returns,” Industrial Securities said.

In the week that ended on Friday 27 November, the northbound leg of Stock Connect had a net inflow of 16.9 billion yuan (US$2.6 billion) and the southbound leg had a net inflow of 12.6 billion yuan ($1.9 billion).

The industries that were most sought after by northbound investors last week were non-banking financial services, electrical equipment, and home electronics, and those sold with largest volumes were food and beverages, construction materials, and computing, according to the research by China Merchants Securities.