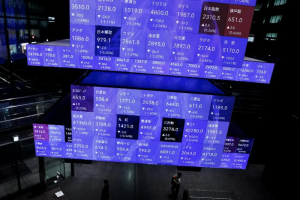

Latest News: Hang Seng Index

Investors reacted to a mixed bag of cues with China’s factory prices slump, Wall Street uncertainty and Beijing’s tech crackdown all playing a part

Asian investors recoiled on Friday as the spectre of another round of central bank tightening cast a shadow across trading floors

Tech-sensitive Hong Kong was in retreat with investors worried about more interest rate rises while the overheating Nikkei continued to cool

China’s services growth slowed last month, dampening the mood on trading floors, while the escalating chip war also weighed

Japan’s benchmark index saw its hot streak end as it fell back from a 33-year high while Hong Kong edged ahead on bets of major state intervention

The promise of significant intervention by Beijing to prop up its struggling economy buoyed investors while a surprise drop in US inflation boosted sentiment too

China’s factory data dip boosted hopes for stimulus in some quarters but investor mood was low amid the threat of more interest rate hikes

Japan’s struggling currency boosted exporter fortunes while poor industrial data continues to come out of China

A report that the US may halt shipments of AI chips made by Nvidia and others to China sent shockwaves through Asia’s markets

Bets on new stimulus from Beijing also lifted investor mood in China and Hong Kong while Japan’s Nikkei gave up some of its recent record-breaking gains

There was an air of uncertainty on trading floors after the cancelled Russian mutiny but no panic as investors took their cues from the US and China

The threat of another round of central bank tightening across the globe deepened growth fears and sent Tokyo and Hong Kong stock indexes backwards

AF China Bond

- Popular