Latest News: Nifty 50

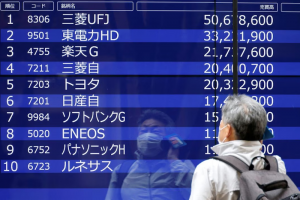

Investors across the region had few reasons to be cheerful on Thursday as China’s downbeat prospects continued to sour the mood on trading floors

The release of home prices data showing the world’s No2 economy is continuing to struggle unnerved investors across Asia

China’s woes continue to cast a shadow over the region’s trading floors with more poor data and threats of a property sector meltdown dampening the mood

Property developer Country Garden’s troubles saw its bonds suspended and shares crash with investors unnerved by the threat of contagion

China’s economy continues to struggle and investors remained unconvinced by Beijing’s latest support measures

China’s move into deflation cast a shadow over trading floors while there was also unease ahead of key US inflation figures due out later in the day

China fell into deflation in July, taking the wind out of investors’ sails, while worries over this week’s US inflation data also dampened the mood

Investors across the region were in cautious mood and reluctant to take risks ahead of the release of key inflation figures from the US and China

Investors were in cautious mood on Monday with eyes on key data announcements from the US and China due this week

Investors reacted after the US sovereign debt downgrade unsettled bond and forex markets while China’s recovery prospects continued to look uncertain

Recent investor optimism was shaken after Fitch cut the US’s rating following the long-running debt ceiling row between Republicans and Democrats

There was optimism on trading floors that the battle with inflation is close to ending but worries over China’s recovery and Beijing’s support plans weighed

AF China Bond

- Popular