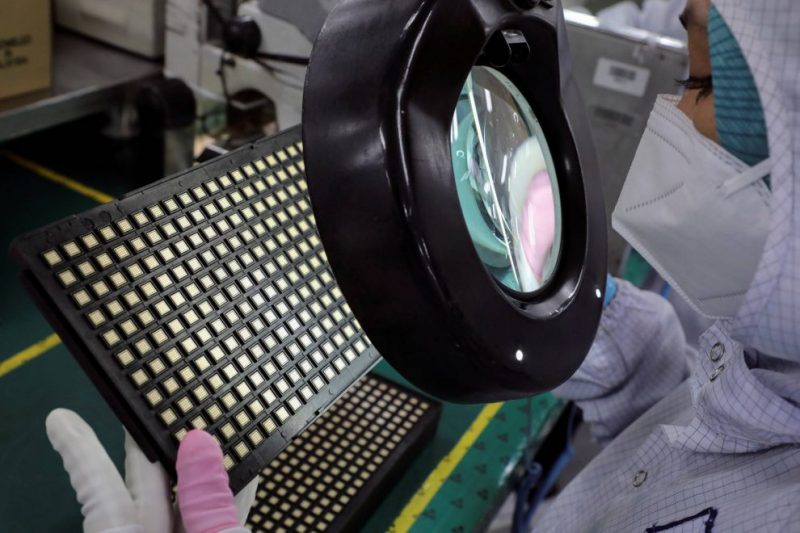

Taiwan electronics suppliers are struggling to make the most of surging demand, including for packing materials, amid supply hurdles.

The comments from a clutch of companies over the past week offer a snapshot of both the opportunities and problems they face: a robust market, especially in automotives and high-end computing, but difficulty in securing inputs, especially from China, where strict Covid-19 lockdowns are in place.

Leading Taiwanese flat-panel maker AU Optronics (AUO) saw its first-quarter net profit drop by more than half from a year earlier.

While AUO supplies displays for top carmakers, such as Tesla, and for high-end notebooks, the materials that threaten to limit its production are at times far more low-tech.

“The less important the material is, the more we lack it. Why? Because their inventory tends to be lowest, so we need large-volume transportation. But right now the biggest challenge is transportation,” chairman Paul Peng told an earnings call.

“So if I tell you what we lack most is cardboard boxes and packaging tape, don’t be surprised.”

China Lockdowns Throttle Transport

Such materials are typically bought from China, where lockdowns have closed factories and throttled transportation.

Joseph Tung, chief financial officer of Taiwanese chip testing and packaging firm ASE Technology Holding, told an earnings call that demand for cellphones and some consumer products seem to be “relatively weaker”.

“But from our standpoint, I think the overall situation still remains very healthy,” he said. “In terms of high-performance computing, in terms of networking and automotive, we still see very, very strong momentum.”

There is a similar message from Powerchip Semiconductor Manufacturing Corp, a supplier of power-management chips.

Company chairman Frank Huang told a shareholder meeting that, although current demand was not as strong as before, the Powerchip Semiconductor’s production capacity was still fully loaded.

“Absolutely, there is not enough supply for auto chips,” added Huang, whose firm provides contract manufacturing services for logic and memory chips for power management, with such customers as MediaTek, Taiwan’s largest designer of chips for mobile phones.

Powerchip is building a new T$278 billion ($9.43 billion) factory in Miaoli, northern Taiwan, that is expected to come online in the fourth quarter.

That same strong demand is also benefiting United Microelectronics Corp, a competitor to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co. United Microelectronics said it was still having problems meeting customer demand even as notebooks and smartphones were showing some weakness.

Delta Electronics, a supplier of power components to such companies as Apple and Tesla, said it was expanding manufacturing “everywhere”, and was particularly bullish on electric vehicles (EVs). It pointed to strong demand from even traditional automakers, such as Ford Motor and General Motors, for their EV offerings.

“There is a big backlog for EVs, for Delta and automakers. The challenge is to balance the materials,” Delta chairman Yancey Hai told an earnings call.

“If you lack the materials, the factories can’t operate. It’s hard for everyone, but I think the future is there.”

- Reuters with additional editing by Jim Pollard

ALSO READ:

Taiwan Exports Seen Rising For 19th Month on Chip Demand

Taiwan To Help US Solve Chips Crisis But Warns Of ‘Unreasonable Demands’

Taiwan tech firms face a demand drop, not Covid-19