Asia’s major stock indexes were on the back foot on Tuesday with investor mood flat over the absence of any big signature stimulus announcements out of China’s week-long annual parliament session.

And more signs that the US Fed is in no hurry to U-turn on interest rates anytime soon further demotivated traders while a tech slump in Hong Kong also dragged on indexes across the region.

Japan’s Nikkei share average erased most of its early losses to end flat as investors bought stocks on the dip after the benchmark index slipped from a record high.

Also on AF: AI Could Pass Human Tests This Decade, Says Nvidia Chief

The Nikkei share average edged down 0.03%, or 11.60 points, to close at 40,097.63, narrowing most of its 0.7% loss earlier in the session, while the broader Topix was up 0.50%, or 13.65 points, to 2,719.93.

After five consecutive weeks of gains, the Nikkei breached the 40,000 level for the first time on Monday and has risen nearly 20% so far this year.

Chip-testing equipment maker Advantest slipped 2.64%, weighing the most on the Nikkei, while chip-making equipment maker Tokyo Electron reversed course to end 0.41% higher to become the biggest support for the index.

Chinese stocks steadied while Hong Kong market tumbled, after Beijing set a widely-expected 5% growth target for 2024 at its key annual parliament meeting that many considered underwhelming on policy details and future stimulus steps.

China plans to run a budget deficit of 3% of economic output, down from a revised 3.8% last year. It also plans to issue 1 trillion yuan ($139 billion) in special ultra-long term treasury bonds, which are not included in the budget.

The blue-chip CSI 300 Index rose 0.70%, while the Shanghai Composite Index rose 0.28%, or 8.49 points, to 3,047.79. The Shenzhen Composite Index on China’s second exchange fell 0.59%, or 10.21 points, to 1,718.31.

Chinese enterprises listed in Hong Kong slumped 1.8%, and tech giants tumbled 3.2%. The Hang Seng Index dropped 2.61%, or 433.33 points, to 16,162.64.

Elsewhere across the region, in earlier trade, Sydney, Seoul, Mumbai, Jakarta, Bangkok, Singapore, Manila and Kuala Lumpur were down, while Taipei and Wellington were up. MSCI’s broadest index of Asia-Pacific shares outside Japan lost 1%.

Bitcoin Hits Two-Year High

Meanwhile, alternative assets such as cryptocurrencies and bullion were supported following hawkish comments from Atlanta Fed President Raphael Bostic that there was no urgency to cut interest rates amid risks inflation stays above the central bank’s 2% target.

Bitcoin continued its ascent to a fresh two-year peak of $68,828 that put it within spitting distance of an all-time high.

Odds for a US rate reduction by the Fed’s May meeting declined below 22% from 26% a day earlier, according to CME Group’s FedWatch Tool.

The dollar index, which measures the currency against six major peers, edged up 0.02% to 103.86. It eased 0.07% on Monday, as declines against rivals like the euro and sterling overshadowed gains against the yen.

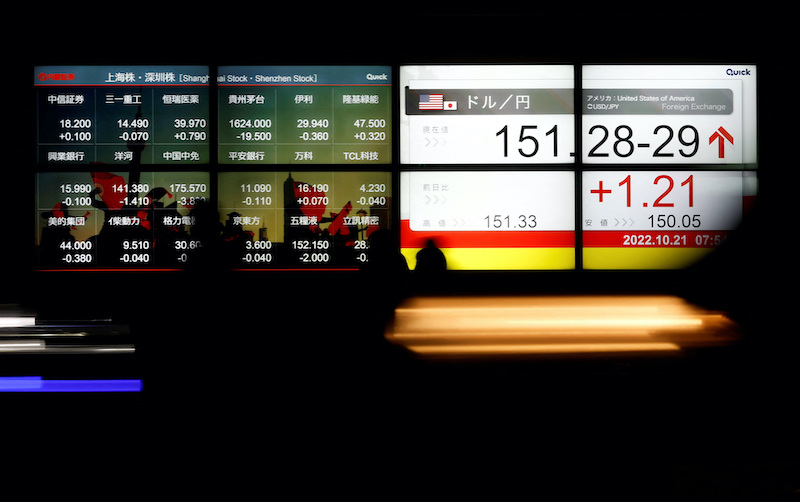

Against the yen, the dollar was steady at 150.49, following Monday’s 0.27% climb. The currency pair tends to be extremely sensitive to moves in long-term US bonds, and benchmark 10-year Treasury yields bounced from nearly three-week lows overnight to sit at 4.21%.

Elsewhere, crude oil continued to tick lower, as demand headwinds counterbalanced a widely expected extension of voluntary output cuts through the middle of the year by the OPEC+ producer group.

Brent futures were off 17 cents to $82.63 a barrel, while US West Texas Intermediate (WTI) eased 25 cents to $78.49 a barrel.

Gold marked a record closing high of $2,114.99 on Monday and continued to hover around that level.

Key figures

Tokyo – Nikkei 225 < DOWN 0.03% at 40,097.63 (close)

Hong Kong – Hang Seng Index < DOWN 2.61% at 16,162.64 (close)

Shanghai – Composite > UP 0.28% at 3,047.79 (close)

London – FTSE 100 < DOWN 0.21% at 7,624.24 (0932 GMT)

New York – Dow < DOWN 0.25% at 38,989.83 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

PM Pledges to Revitalize China’s Economy, Aims at 5% Growth

China Aims for Self Sufficiency in Emerging Tech, AI, Big Data

India Says Big Tech Needs Approval to Release Untested AI Tools

Record-Breaking Nikkei Passes 40,000 Mark, Hang Seng Edges Up