Economic events

Financial markets will monitor central bank and government responses this week to the rapidly deteriorating economic conditions. Last Friday, the US economy reported 20.5 million jobs were lost last month and unemployment rate jumped to 14.7%.

While this was better than analysts’ forecast of 22 million job losses and unemployment rate of 16%, sentiment has been rattled by Treasury Secretary Steven Mnuchin’s comments to Fox News that US unemployment numbers could get worse – and get close to the Great Depression levels of 25%.

“At this point it does not look like May employment data will show improvement or even stability. The incoming data look consistent with the baseline unemployment rate breaching 20% in May, especially if the responses on ’employed but not at work for other reasons’ change,” said Steve Englander, Head of Global G10 FX Research and North America Macro Strategy at Standard Chartered Bank.

“The key for investors would be stabilisation in weekly continuing claims that would point to a balance between job losses and additions.”

Now that the benchmark rates have been slashed to zero, it is unlikely that the Federal Reserve will venture into negative territory. Richmond Federal Reserve president Thomas Barkin said last week that negative interest rates are unsuitable for the United States. Still, the fed funds futures market is pricing in negative US interest rates next year. On Friday, the fed funds futures market forecast the target range for the federal funds, currently at 0 to 0.25%, at about -0.005% in April 2021.

More moves in China

Meanwhile the central bank at the world’s second biggest economy announced on Sunday a slew of measures to offset the damage from the devastating coronavirus pandemic.

The People’s Bank of China said it will keep liquidity supply ample and support small and medium enterprises to ensure employment and to control inflation. The PBoC pledged to deepen reform of the Loan Prime Rate and improve monetary policy transmission. It also said it would maintain credit growth at slightly higher than nominal GDP growth and vowed that there would be more reforms in the foreign exchange market to maintain the yuan’s flexibility and stability.

Among major economic data, the US economy will report retail sales and industrial production data this week. A Reuters poll expects retail sales to fall 10% in April, compared to March’s 8.4% decline. Industrial production is seen tumbling 11.6% after slipping 5.4% in March.

Funds flow

In the week to May 6, equity funds saw outflows of $16.2 billion, while Balanced Funds took in $680 million, Alternative Funds $1.1 billion, Bond Funds $11.3 billion and Money Market Funds $53.5 billion, according to fund flow data compiler EPFR Global.

Within bond funds, Mortgage Backed Bond Funds reversed their outflow streak, High Yield Bond Funds extended their current run of inflows to six weeks taking in $31.4 billion and Inflation Protected Bond Funds took in fresh money for the second time in the past three weeks, EPFR said. High grade funds enjoyed an inflow last week, the fifth in a row and IG ETFs continued to record sizeable inflows. However, the pace has slowed down moderately.

“Fund flows into IG ETFs have staged a V-shaped recovery with last weeks’ inflows offsetting outflows seen in the weeks of the Covid-19 sell-off. With investors showing preference to own ‘eligible’ assets (IG and government bonds) it feels again that the reach for quality yield is back,” BofA Securities analysts said in a note. High yield bond funds saw the sixth straight week of inflows.

Within equity funds, Emerging Markets Equity Funds extended their outflow streak that began in the second week of February.

“Fears that the Covid-19 pandemic has yet to peak in markets such as India and Brazil, slumping demand for many commodities, the depressed outlook for tourism and concerns about the cost of servicing the debt amassed by many EM businesses are among the reasons that investors are pulling back from this asset class,” EPFR said.

Global Emerging Market (EM) debt funds posted another outflow, the ninth over the last 10 weeks and commodity funds recorded a strong inflow, their sixth weekly inflow in a row, BofA Securities analysts said in a note.

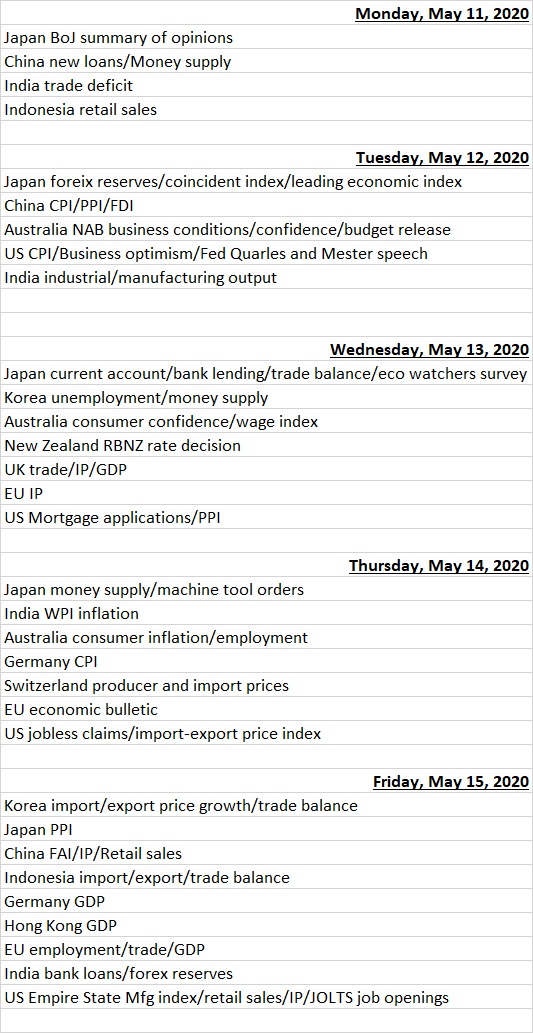

ECONOMIC DATA CALENDAR

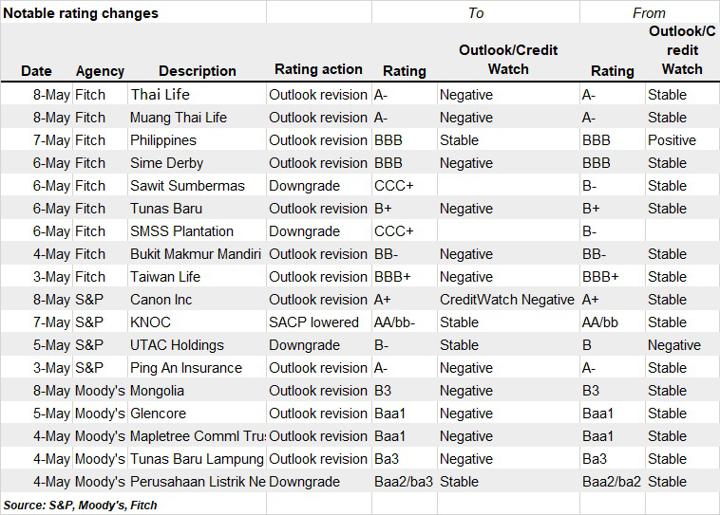

LAST WEEK’S RATINGS CHANGES