(ATF) Economic events

Financial markets will remain cautious in August, as safe havens gold and US Treasuries made spectacular gains in the previous month, with US senators continuing to grapple with the next coronavirus relief bill.

Gold’s 10% rally in July and the 12-basis point drop in US 10-year Treasuries are pointers to how cautious investors are despite 80% of S&P companies beating their earnings estimates in Q2.

“Growing safe-haven demand, renewed weakness in the USD, falling real yields and buying momentum have all provided a boost to the yellow metal. However, we still believe there is room for more upside to prices,” Warren Patterson, ING Bank’s head of commodities strategy, said.

BCA Research’s Foreign Exchange Strategist, Chester Ntonifor, said the gap in growth between the US and the rest of the world is likely to be larger than usual over the next few quarters because the epidemic has hit the US harder than most other developed economies. This will keep the dollar weak. He also said a technical strategy was in play which sells the dollar when it is trading below it’s 50- and 200-day moving averages.

“Global equities in general, and non-US stocks in particular, tend to perform well when the dollar is weakening. A weaker dollar is particularly beneficial to emerging markets,” he said.

Investors will also cautiously watch Chinese trade data during the week, ahead of the US-China trade talks due to resume later this month.

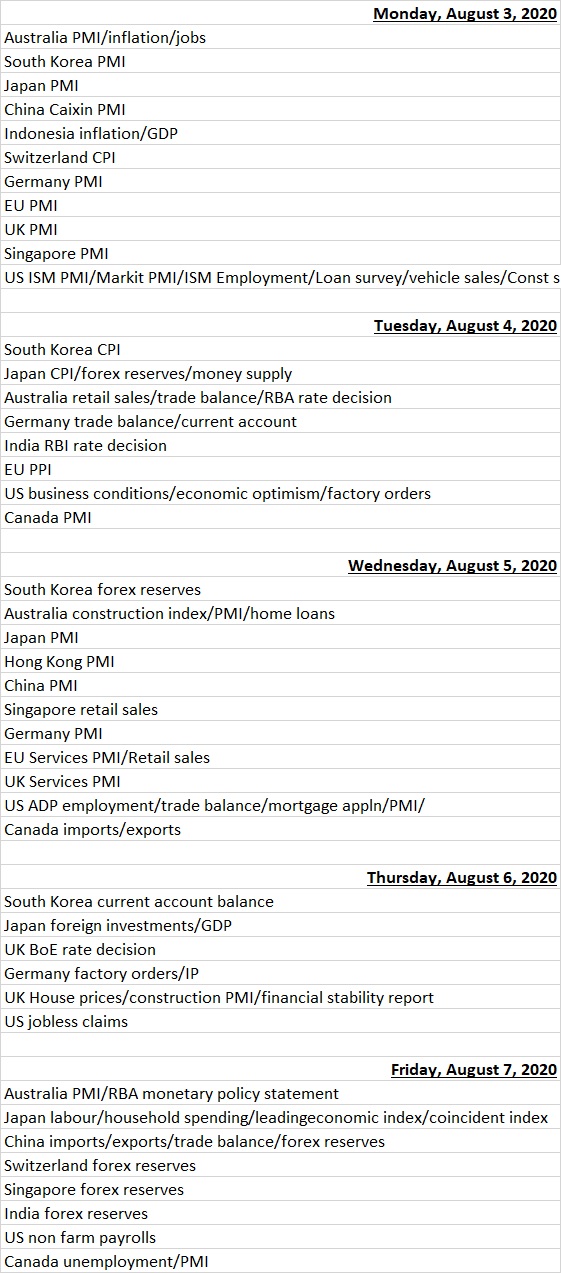

In the coming week, besides the US non-farm payrolls, central bank decisions in UK, Australia, India, Russia and Thailand will be closely watched. GDP statistics for Indonesia and the Philippines, trade data for the US, China, Brazil, Australia, Taiwan, Germany and France, as well as industrial production numbers for Germany, Italy, Spain and Malaysia will also be tracked.

Friday’s non farm payrolls are expected to show a 2.2 million increase, according to a Reuters poll.

Fund flows

Safe havens and asset classes where central banks are acting as buyer of last resort showed healthy inflows in the week to July 28, data from EPFR showed, as the US and European economies realised the rebound that started in mid-2Q 2020 is losing momentum.

Bond Funds took in another $17.2 billion, taking their current inflow streak to 16 weeks. Over 16 weeks, the Global Bond Fund inflows total over $320 billion, almost recovering their record redemptions seen in March of $284 billion. Money market funds took in $5.5 billion during the week.

“The reach for yield continues in the IG space, with investors favouring duration, adding more money into long-term funds,” BofA Securities said in a note.

“The lack of inflation and record low yields across the fixed income market has pushed more and more investors to extend the duration profile of their investments.”

China Bond Funds extended their longest inflow streak since 4Q14, taking in money for the 13th straight week, EPFR said. In July, net inflows into Chinese bonds through Bond Connect, which gives global investors access to the country’s onshore bond market through Hong Kong, totalled a record 75.5 billion yuan ($10.83 billion) in July.

Equity Funds recorded a net redemption of $1.8 billion and would have had a higher net outflow were it not for the over $3 billion that flowed into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates.

“The shock of 2Q20 GDP figures that confirmed the damage done by the Covid-19 pandemic and a focus on developed markets earnings reports and policy milestones contributed to a 23rd outflow from EPFR-tracked Emerging Markets Equity Funds in the past 24 weeks during late July,” EPFR’s director of research Cameron Brandt said.

Although emerging market funds saw another week of outflows, analysts have started reacting positively to rising base metal prices, falling unemployment rates in Korea, Taiwan and India, the US Federal Reserve’s support of dollar liquidity and China’s street beating Q2 GDP expansion.

Economic data calendar

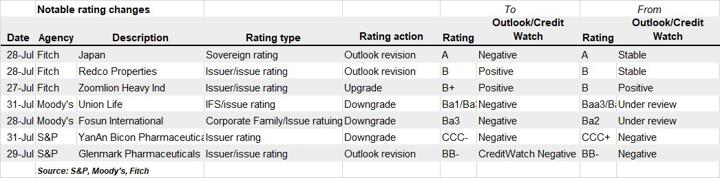

Last week’s rating changes