Economic events

Financial markets are still awaiting progress in the stalled talks between US lawmakers who are negotiating a fresh round of stimulus. The mounting number of unemployed in the US and the rapidly spreading coronavirus, with the infection count in excess of 5.3 million, make such a relief package imperative to the health of the economy.

The postponement of the US-China trade review, reported by Reuters news, will provide temporary relief to markets as relations between the world’s two largest economies remain tense. US officials sought time to allow China to increase purchases of US goods agreed in the deal, to improve the political optics of the review.

The week ahead will see flash PMIs for August from major economies as markets seek new evidence of recovery.

“The worldwide PMI surveys indicated a strengthening of global economic growth during July, but the upturn remained subdued by containment measures,” said Bernard Aw, Principal Economist, IHS Markit who added that it had hinted global growth could slow again after the initial rebound, particularly when recent weeks had seen some restrictions re-introduced.

“An additional concern is that worldwide, jobs continued to be shed, despite widespread government policy support. This has the potential to dampen consumption and frustrate the recovery in the months ahead.”

Also in focus will be rate decisions from China, Indonesia and the Philippine central banks with all of them expected to keep rates unchanged.

“The People’s Bank of China will likely keep policy unchanged with monetary authorities actually tightening via open market operations for most of July and August,” said Nicholas Mapa, ING Bank’s Senior Economist.

He said Indonesia’s central bank will also pause after a recent rate cut to help provide some stability for the Indonesian rupiah.

“The Philippine central bank is also widely expected to keep rates steady after Governor Diokno signalled no rate cuts to come in the next two quarters,” Mapa said.

Fund flow

In the week to ended August 12, US Bond Funds extended their current inflow streak to 19 weeks, equity funds with SRI or ESG mandates posted inflows for the 30th time in the 32 weeks year-to-date but Emerging Markets Equity Funds posted their 25th outflow in the past 26 weeks, fund flow data tracker EPFR said.

“An absence of tourists, a surfeit of hostile Sino-US rhetoric, COVID-19’s unchecked grip on many markets,” were among the reasons that kept the money flowing out of Emerging Markets Equity Funds going into the second half of 3Q20, it said.

“Those tracked by EPFR racked up their 25th outflow in the past 26 weeks as outflows from the three major regional groups more than offset modest flows into the diversified Global Emerging Markets (GEM) Equity Funds.”

Meanwhile, bond funds attracted $13.5 billion of inflows although it was the second lowest since mid-May as primary markets braced for a flood of US paper and investors awaited higher than expected inflation numbers for July.

And although China Equity Funds experienced significant redemptions that were driven by renewed US-China tensions, money continues to roll into China Bond Funds which has logged the highest year to date inflows among all major emerging markets.

Economic data calendar

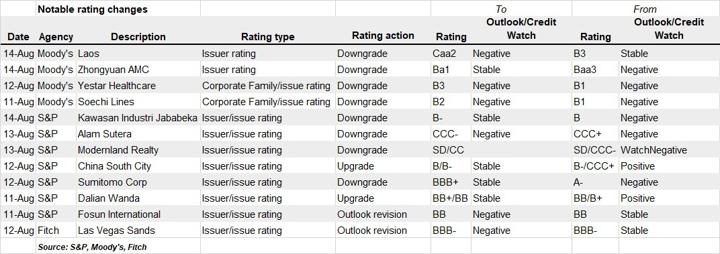

Last week’s rating changes

Also read: Chinese yuan is best major currency bet