Asian stocks stalled on Wednesday with investors confused about which way to turn with, on the one hand, the threat of more US chip curbs on China weighing on sentiment while, on the other, upbeat data out of the US lifting the mood.

However, Japan’s Nikkei share average surged after four sessions of losses, as technology sector stocks rallied, tracking overnight gains in US peers, boosted by Washington’s threat to their Chinese rivals.

The Nikkei share average surged 2.02%, or 655.66 points, to close at 33,193.99, with tech stocks leading the way.

Also on AF: Tesla to See Record Quarter for China Sales, But Market Share Cut

The benchmark index had slid more than 3% over the previous four sessions, after reaching a 33-year peak last week at 33,772.89.The broader Topix was ahead 1.99%, or 44.79 points, to 2,298.60.

The yen’s slide to its lowest since November against the dollar boosted exporters, with Toyota Motor rising 2.82%.

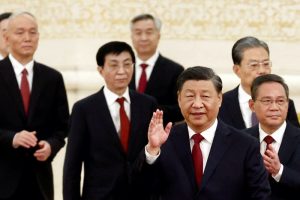

China and Hong Kong stocks fell, after profits at China’s industrial firms declined in May, and on news that the US is weighing up new restrictions on AI chip exports to China.

The country’s industrial outfits saw profits tumble 18.8% year-on-year in the first five months of 2023, data showed on Wednesday, as companies were hit by a squeeze in margins from softening demand amid a stumbling post-Covid economic recovery.

And a Wall Street Journal report said that the United States may stop shipments of AI chips made by Nvidia and others to China.

The Shanghai Composite Index was flat, falling 0.01%, or 0.07 points, to 3,189.38, while the Shenzhen Composite Index on China’s second exchange dropped 0.44%, or 8.95 points, to 2,021.03.

The Hang Seng Index edged up 0.12%, or 23.92 points, to 19,172.05.

Elsewhere across the region, in earlier trade, Sydney, Singapore, Mumbai, Wellington and Taipei all rose but Wellington and Taipei dropped. MSCI’s broadest index of Asia-Pacific shares outside Japan was off 0.2%.

Pressure on Yen Builds

Globally, the picture was mixed too as Eurostoxx 50 futures added 0.3% and FTSE futures 0.2%. S&P 500 futures dipped 0.2%.

Bond yields moved sharply higher in Europe after a bevy of central bankers sounded hawkish on inflation and warned rates would likely have to stay higher for longer.

Markets imply a 90% probability of an ECB rate hike to 3.75% in July and a peak around 4.0%. That underpinned the euro at $1.0950, while keeping it near a 15-year peak of 157.97 yen.

The dollar had hit a near eight-month top of 144.18 yen, before easing back to 143.96 as Japanese officials again protested against the yen’s weakness.

Japan’s top currency diplomat Masato Kanda warned against further falls in the yen, saying authorities would take an appropriate response if moves became excessive.

Markets are wary in case Japan intervenes to buy the yen as it did last October, which knocked the dollar down from a top of 151.94 to as low as 144.50 in a matter of hours.

Yet, a rally in the yen looks unlikely while the Bank of Japan maintains its super-easy monetary policy.

In commodities, gold steadied at $1,915 an ounce, after finding support at the recent three-month low of $1,909.99.

Oil prices edged up after data showed a larger-than-expected draw in US crude and gasoline inventories, but remains uncomfortably close to its lows for the year so far. Brent firmed 33 cents to $72.59 a barrel, while US crude rose 20 cents to $67.90.

Key figures

Tokyo – Nikkei 225 > UP 2.02% at 33,193.99 (close)

Hong Kong – Hang Seng Index > UP 0.12% at 19,172.05 (close)

Shanghai – Composite < DOWN 0.01% at 3,189.38 (close)

London – FTSE 100 > UP 0.45% at 7,495.04 (0934 GMT)

New York – Dow > UP 0.63% at 33,926.74 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Chipmakers Shares Drop on Report of New US Chip Bans to China

China Premier Li Vows to Back Stumbling Economy, Boost Demand

Yield Curve Call Sparks BOJ Policy Doubts as Yen Struggles