The West will have to choose between cutting China off its supply chains and meeting its climate goals as it faces a highly challenging energy transition, new research has found.

The United States and the European Union have, for years, been sounding the alarm over their dependance on China for critical clean technology, but are still far from building up their own supply chains in time to meet their net zero targets, according to energy research firm Wood Mackenzie.

Furthermore, China’s dominance in green technology — powered by billions of dollars worth of state subsidies — means global economies will have to pay up an additional $6 trillion for their energy transitions without cheap Chinese supplies, the analysis published this month said.

Also on AF: China’s Cheap Solar Panels Killing Europe’s Solar Manufacturers

Wood Mackenzie’s findings come at a time when the US and EU governments have ramped up measures targeting cheap Chinese exports.

Both regions have imposed high tariffs targeting Chinese green tech, like solar panels and wind turbines, and energy infrastructure raw materials like steel and batteries.

Washington and Brussels have also implemented targeted laws to boost the development of clean energy supply chains at home.

But “China’s clean-tech manufacturing capacity expansion has been at the heart of” the global energy transition, Wood Mackenzie noted.

View this post on Instagram

China’s rapid expansion of its renewables sector has brought about “unimaginable scale and cost reduction” for the global clean tech industry, it said.

The report also noted that unlike the past when Chinese products were largely viewed as “mass produced and low quality”, the country is now producing “best-in-class turbines, PV modules and battery cells.”

“Without China at the table, aggressive cost reductions we have become accustomed to are over,” the report said.

China’s massive renewable dominance

The West’s push to break China’s clean-energy supply-chain dominance is driven by a variety of reasons amid a changing geopolitical dynamic.

A key trigger for the West to seek ‘de-risking’ from China, was the Covid-19 pandemic, during which the authoritarian Xi Jinping implemented abrupt, drawn-out shutdowns that ended up upending global supply chains for everything from iPhones to semiconductors.

The subsequent Russian invasion of Ukraine meant US, EU and their allies were no longer buying fuel from Moscow, which further created risks in their energy supply chains.

Washington and Brussels have also been increasingly wary of importing supplies made in China’s Xinjiang region, where human rights organisations have repeatedly alleged serious abuses against the Uyghur community, including forced labour in detention centres.

Xinjiang is among the leading producers of green technology and a dominant supplier of solar panels.

Amid those concerns, however, the reality remains that China remains dominant supplier of green energy infrastructure.

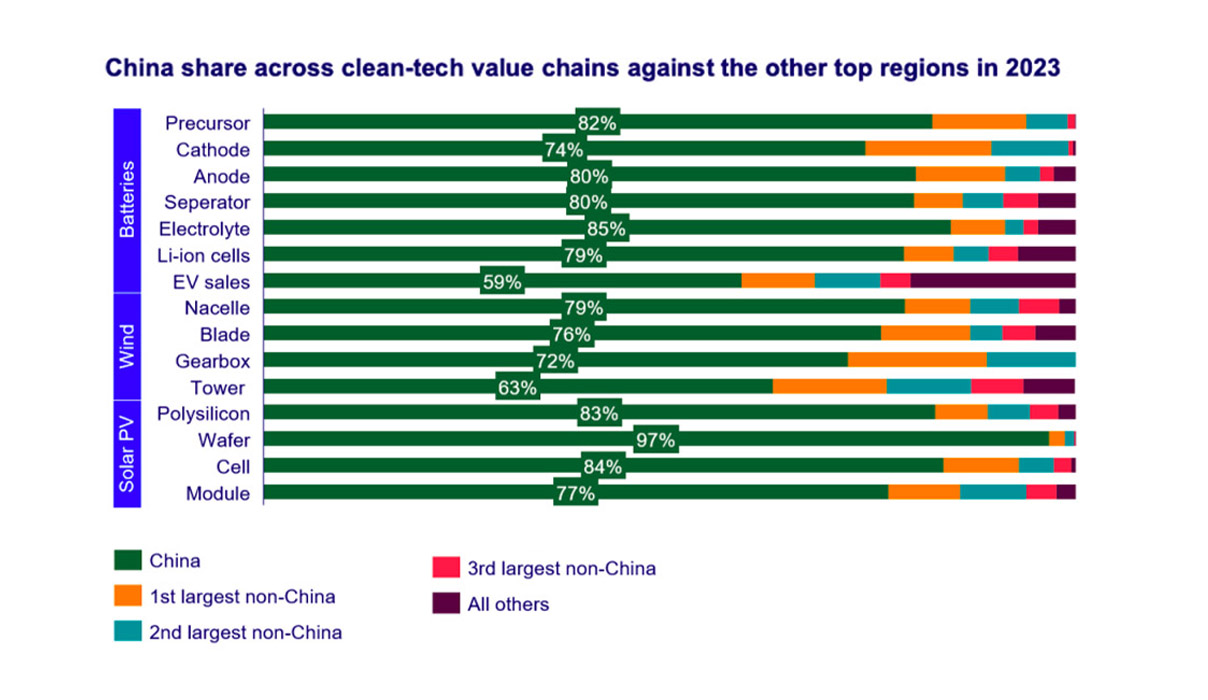

The country already controls more than 80% of solar panel manufacturing, the International Energy Agency said in 2022. And it is on track to account for more than 80% of the global solar manufacturing capacity through to 2026.

China also has a 63% share in global manufacturing capacity and capability for wind towers, Wood Mackenzie noted in its report.

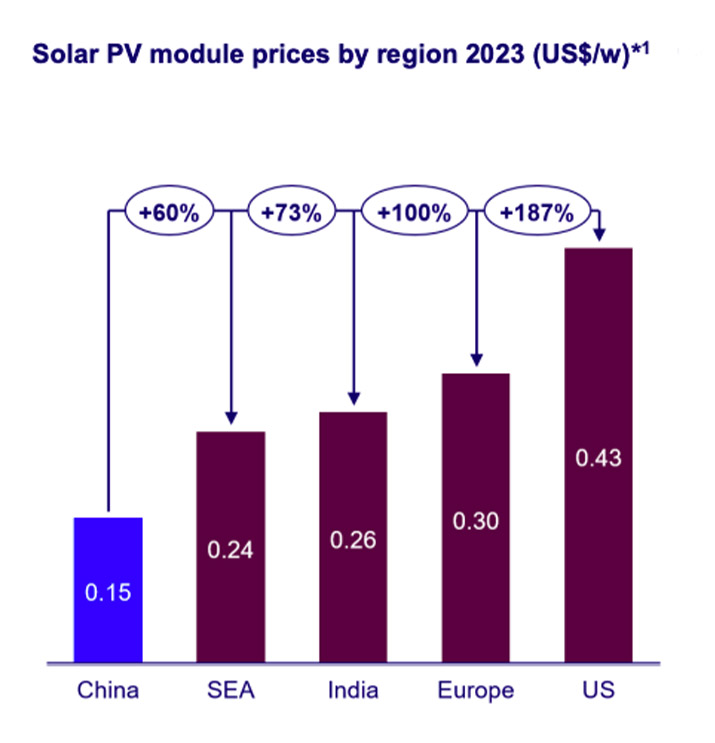

At the same time, Chinese manufacturers are managing to produce and sell these technologies at such low costs that their pricing remains “unapproachable for the major competing markets,” it said.

Chinese manufacturers’ global migration

The report further noted, China’s wind and solar installations in 2023 were estimated to be more than double the US and Europe combined. It valued their capital investment at $140 billion.

But despite this boom at home, Chinese manufacturers are now migrating all over the world, likely out of their own de-risking strategies, amid the increase in policy action targeting China.

Just in Southeast Asia, “investment into manufacturing capability is driven by Chinese manufacturers representing 64% of capacity diversifying outside of China,” Wood Mackenzie noted.

It further noted an unprecedented migration of “R&D investment, manufacturing ability, knowledge, and skill” from east to west.

To build its own clean energy supply chains, the West could, thus, partner with and learn from these diversifying Chinese manufacturers, the Wood Mackenzie report proposed.

“China learned from the west, now the west can learn from the east, specifically in terms of solar and battery technology advancements.”

- Vishakha Saxena

Also read:

China Wind, Solar Capacity Set to Outstrip Coal For First Time

China Moves to Integrate EV Charging to National Power Grids

Xinjiang Goods Ban to Spur Big Drop in US Solar Installations

Raimondo Says Chinese EVs Are a National Security Risk For US, EU

China to Scrutinise Rare Earth Outflows as Exports Rise

China Solar Panel Costs Plunge in 2023, 60% Cheaper Than US

‘Local Protectionism’ Slowing China’s Clean Energy Transition

China Warns of Export Curbs on Polysilicon, Solar Wafers

EU’s Green Tech Reliance on China ‘Worrying’ – Euractiv

EU May Also Probe China Subsidies for Wind Turbines – FT