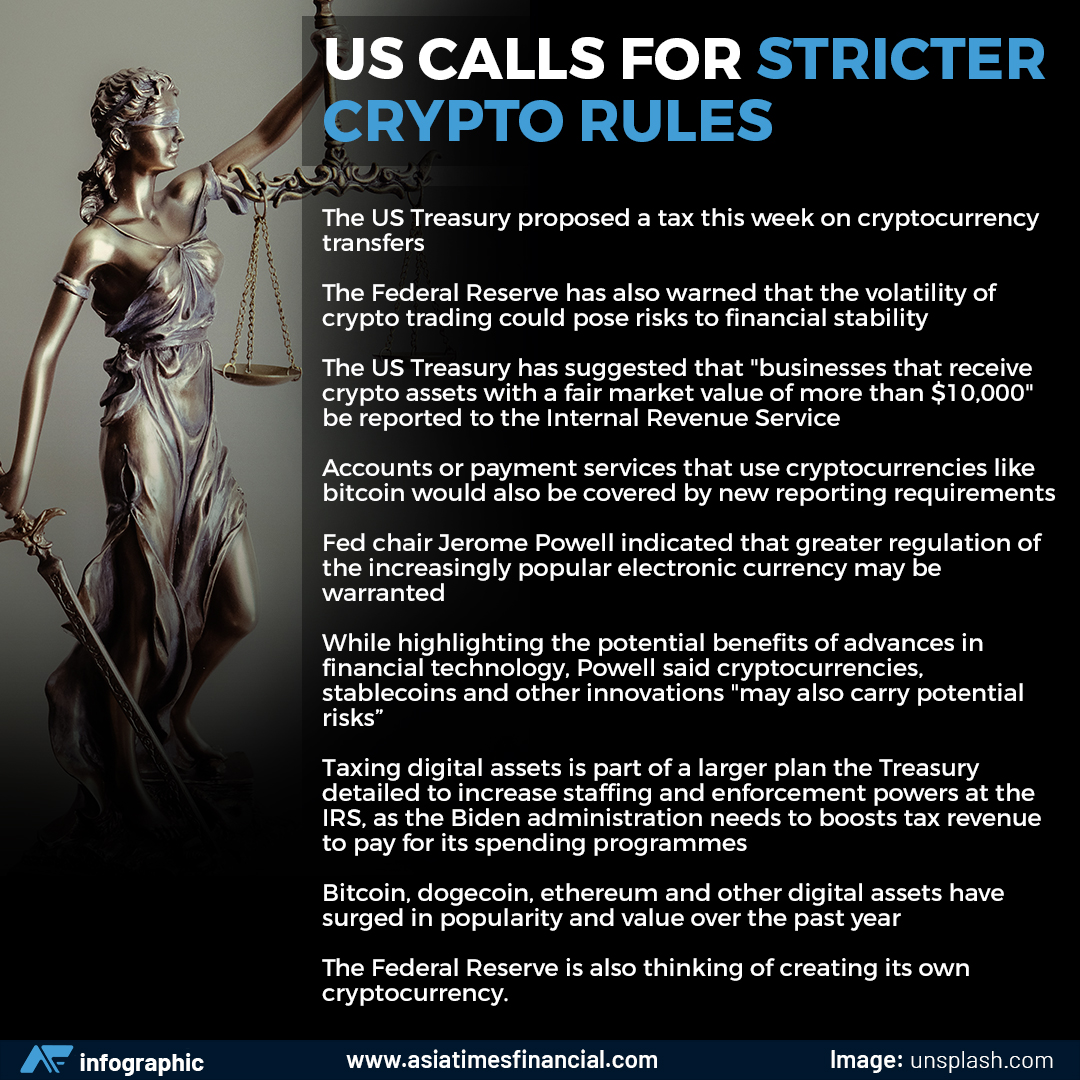

(AF) In a double blow to cryptocurrencies on Thursday, the US Treasury proposed a tax on transfers while the Federal Reserve said the digital phenomenon posed risks to financial stability.

The tax idea is part of a larger revenue-raising effort, with the Treasury calling for “businesses that receive crypto assets with a fair market value of more than $10,000” to be reported to the Internal Revenue Service (IRS) tax authority.

Accounts or payment services that use cryptocurrencies like bitcoin would also be covered by new reporting requirements, Treasury said.

“Despite constituting a relatively small portion of business income today, cryptocurrency transactions are likely to rise in importance in the next decade, especially in the presence of a broad-based financial account reporting regime,” Treasury said in an outline of the proposal.

Meanwhile, Fed chair Jay Powell indicated that greater regulation of the increasingly popular electronic currency may be warranted.

The back-to-back announcements came in a week when bitcoin, the most popular cryptocurrency, took a wild ride, falling as much as 30% on Wednesday after China announced new curbs on the sector, underscoring its volatility.

The two-day bitcoin crash was mostly new holders, according to Meltem Demirors, chief strategy officer at CoinShares.

“Beijing’s crackdown on crypto will be a hard fear to alleviate given that nearly 80% of global cryptocurrencies are powered in China, but crypto loyalists will try,” Edward Moya, strategist at OANDA in New York, said.

“The argument of how FaceBook and Alphabet were still able to succeed despite restrictions from China will be recycled frequently,” he added, saying he expected bitcoin to trade $40,000-$50,000 over the short term.

POTENTIAL RISKS

While highlighting the potential benefits of advances in financial technology, Powell said cryptocurrencies, stablecoins and other innovations “may also carry potential risks to those users and to the broader financial system.”

Taxing digital assets is part of a larger plan the Treasury detailed to increase staffing and enforcement powers at the IRS with the goal of closing the gap between what the government is owed in taxes and what it receives.

The department estimated that gap was nearly $600 billion in 2019 and would grow to nearly $7 trillion over the next decade unless addressed.

Bitcoin, dogecoin, ethereum and other digital assets have surged in popularity and value over the past year, thanks to the economic disruptions of the Covid-19 pandemic and the embrace of some businesses.

The Federal Reserve is thinking of creating its own cryptocurrency, and on Thursday said it would publish a paper this summer discussing its impact on payment systems and the possibility of issuing a US-backed digital asset.

“We think it is important that any potential (central bank digit currency) could serve as a complement to, and not a replacement of, cash and current private-sector digital forms of the dollar, such as deposits at commercial banks,” Powell said in a statement.

With reporting by Agence France-Presse and Reuters

ALSO SEE:

China crypto confusion causes bitcoin volatility, CBDC speculation

Bitcoin plunges on China mining fears and concern about regulation