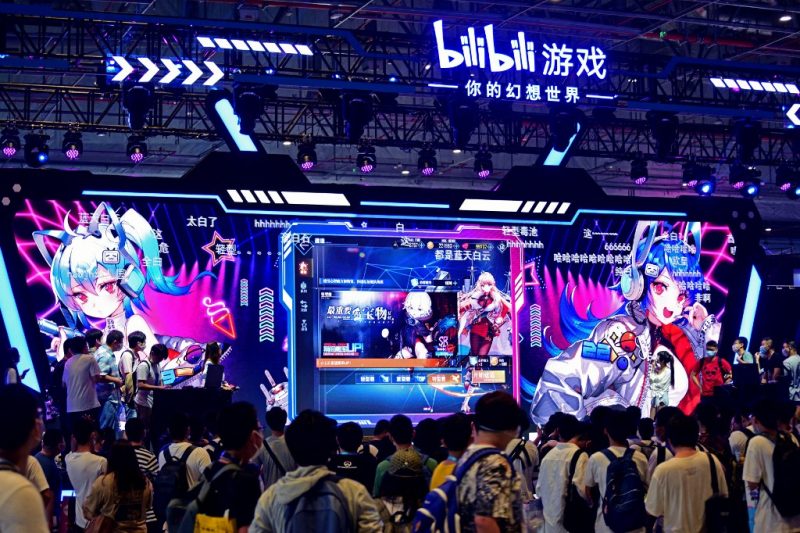

(ATF) Chinese video site Bilibili Inc, which features anime shows and games, has won a nod from regulators for a secondary listing in Hong Kong. The Tencent-backed company is hoping to raise up to $3.2 billion, it said on Wednesday March 17.

Bilibili listed on Nasdaq three years ago and has around 200 million monthly users, most of whom are young people drawn to its broad range of entertainment such as mobile games and live shows.

A wave of Chinese companies have recently turned to Hong Kong for listings, as rising US-China geopolitical tensions have threatened to spill over to Chinese firms listed on Wall Street.

The US House of Representatives passed a bill in December that gives US-listed Chinese companies three years to comply with the US auditing oversight rules. The bill’s passage in June in the US Senate kicked off an exodus of US-listed Chinese companies including NetEase and JD.com for secondary listings in Hong Kong, as an alternative safe haven for raising capital.

Bilibili is likely to be the third US-listed Chinese company to launch a secondary listing in Hong Kong this year, after the $1.1 billion share sale of online car-selling platform Autohome on Monday and the listing of search engine giant Baidu, which is scheduled for next Tuesday, 23 March, and expected to raise $3.1 billion.

The tech firm is selling 25 million shares as part of the offering, at a maximum price of HK$988 ($127.20) per share for the part of the deal reserved for Hong Kong retail investors. The offering initially comprises 750,000 shares for retail investors, with the rest for institutional investors.

Morgan Stanley, Goldman Sachs, JP Morgan, and UBS are joint sponsors for the deal, an information pack document from the company said.

The Chinese video site, 12.4% owned by Tencent, plans to use the funds raised to enrich its content offerings, incentivize its content creators, strengthen AI and big data analytics, and develop more in-house games, the company said.

Raking in revenue of roughly 12 billion yuan ($1.85 billion) last year, Bilibili saw monthly active users (MAU), a key gauge of user loyalty in the internet sector, rise 55% to reach 202 million from a year ago. Some 86% of its users are under the age of 35, it said.

The company said in its fourth quarter earnings conference that it aims for 400 million of MAU by 2023.

Huge popularity among millennials and the Generation Z has yet to guard the company from operating in the red. The document showed that Bilibili suffered a net loss of nearly 3.1 billion yuan ($477 million) last year.

Although the company has yet to make a profit, several analysts are upbeat about its outlook.

“We are impressed by 400m MAU target by 2023, thanks to its ecosystem with high-quality content and engaging communities and penetrating user groups other than those born after 90s. We consider Bilibili one of the key beneficiaries to capture the secular trend in video consumption,” analysts from Jefferies said.

Buy ratings

Bilibili’s revenue guidance for the first quarter (Q1) of this year is between 3.7 billion yuan and 3.8 billion yuan, ahead of analysts’ estimates.

Jefferies expects the company’s online games segment to be stable in Q1 and non-games segments to grow about 120% year-on-year (YoY). For the full year of 2021, they estimate Bilibili’s online games to grow 25% YoY driven by new games releases, and non-games segments to grow at about 80% YoY.

Jefferies has maintained a Buy rating for the Nasdaq-listed company and raised its pricing target to $162 per American depositary share (ADS).

Bilibili went public on the Nasdaq in March 2018 at $11.50 per ADS, raising $483 million. The company’s market cap has grown about nine times over three years, and its shares closed at $113.31 a piece on Tuesday.

The video platform makes money in a number of ways. Mobile games is its largest revenue driver. It also hosts live broadcasts during which users can buy virtual items. Bilibili also makes money from advertising. Rather than Netflix-style shows, Bilibili relies on user-generated content, similar to YouTube.

Analysts from Guotai Junan Securities also have a ‘Buy’ rating for Bilibili. “The company has high potential for commercialization, and its user base is expected to continue the growth momentum,” they said.

From Q1 of 2019 to Q4 of 2020, the number of content creators on Bilibili grew by over 50% year-on-year in each quarter, according to Guotai Junan’s research. Paid members grew stably from 2.5 million in Q1 of 2018 to 17.9 million (or 8.9% of all users) in Q4 of 2020, they said.

With input from AFP

ALSO SEE: