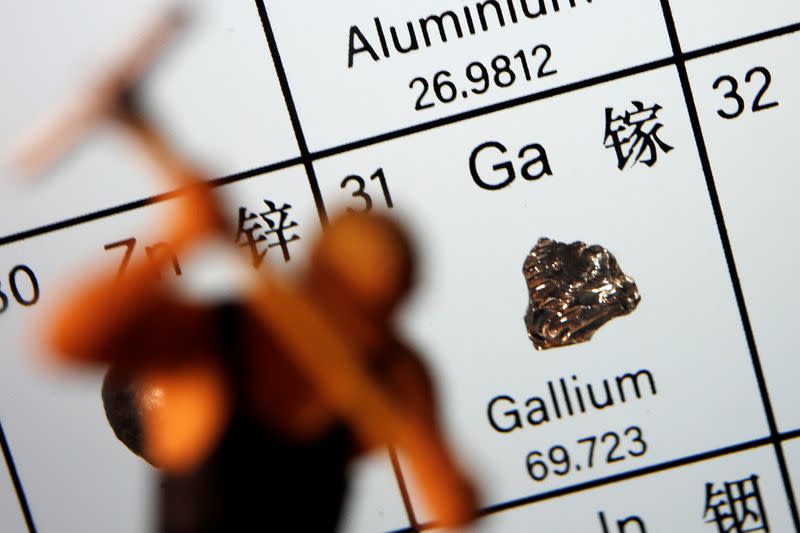

China’s threat to curb exports of gallium has rocked companies that use the soft metal and caused frantic stockpiling of speciality semiconductor wafers made with the product.

But the head of the world’s largest gallium buyer, Freiberger Compound Materials, is not convinced that Beijing will block exports for long.

Freiberger chief executive Michael Harz said he doesn’t believe that China will disrupt gallium trade flows over the next few years, because such a move would quickly damage its own electronics industry.

The CEO said he viewed China’s move as “sabre rattling”, because the world’s leading makers of power amplifiers, which boost radio signals so that smartphones can communicate with cell towers, are based in the United States.

ALSO SEE: China’s Gallium Curbs a Headache for EV Carmakers

‘The industry is on edge’

Freiberger relies almost entirely on Chinese suppliers for its gallium needs to make wafers that go into mobile phone radio signal amplifiers and optical electronics.

Consuming an estimated 10% of global gallium output, the company has found itself at the centre of turmoil following China’s surprise announcement to control exports of gallium and germanium products from August 1.

“My clients are not relaxed about this at all. There’s now a burst of orders being placed to increase inventory levels. The industry is very much on edge,” Harz said.

Chinese gallium companies have driven most rivals elsewhere out of the market by undercutting them on price over the last decade.

Freiberger, with annual sales of 70-80 million euros ($77-$88 million) and a 65% market share in gallium arsenide wafers for smartphone power amplifiers, competes with Japan’s Sumitomo Electric and a number of smaller Chinese manufacturers.

Red LEDs and red light sensors are another major use for gallium arsenide.

The group, which traces its roots to a state-owned electronics factory in the former East Germany, has several months’ worth of gallium in stock because it had long anticipated some form of trade crisis and has little else it can do to react, Harz said.

EV makers unsure what to do

Automakers are also in a dilemma over whether they can continue to rely on a metal which had been seen as a game changer for electric vehicles.

Harz said his Chinese suppliers were providing authorities with data needed to obtain export licences.

They have estimated that deliveries will stop when the export controls take effect on August 1 and resume about a month later when licence requests have been processed, though no reliable information is available.

Freiberger consumes several dozens of tons of gallium per year, making the raw material its largest single cost.

Harz is hoping the Chinese will relent. But until that happens, they will have to live with the uncertainty.

Meanwhile, Umesh Mishra, co-founder at the California-based Transphorm, which is developing chips using gallium nitride, said that, because gallium is produced when processing bauxite to make aluminium, he is confident other countries will step in to replace the China supply.

Alastair Neill, a director at the Critical Minerals Institute, also said that automakers who are in the early stages of designing their next generation of EVs could opt for silicon carbide, even though gallium nitride performs better, rather than risk a fresh supply chain headache.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Metal Curbs, Rare Earths Risks Fuel Hunt For Safe Sources

China Chip Metal Curbs See Germany Urge Faster ‘De-Risking’

Curbs on Chipmaking Metals ‘Just The Beginning’, China Warns

China Move to Block Chipmaking Metals Spurs Supply Fears